PEPE has swung 16.5%, last at $0.0000089, as the top 100 wallets have lifted holdings 3.95% to 303.21T tokens and exchange balances have eased 2.97%. Such accumulation has often preceded rebounds, yet tariff headwinds and a bearish MACD keep $0.00000094 support in view.

The post PEPE Whales Accumulate Amid Market Volatility: Is a 200x Rally Coming? appeared first on Cryptonews. …

Month: July 2025

Bitcoin Cash Futures Jump 24% as Active Addresses Hit Six-Year Low – Risk Ahead?

Bitcoin Cash has shed 7.8% this week, reversing part of June’s 20% surge. Futures open interest has expanded 24% and trading volume has doubled, yet on-chain activity has declined to 2018 levels. With RSI bearish and $400 acting as key support, the rally risks fading unless network usage improves.

The post Bitcoin Cash Futures Jump 24% as Active Addresses Hit Six-Year Low – Risk Ahead? appeared first on Cryptonews. …

Macro Meets Crypto: Predicting Prices with CPI, Fed Rates & BTC Dominance

Macro meets crypto has traced how inflation releases, central bank rate cycles, and internal gauges such as Bitcoin dominance have woven cryptocurrency into the wider economy. Tracking CPI, FOMC decisions, and dominance trends has offered a clear roadmap for positioning through the next 90 days.

The post Macro Meets Crypto: Predicting Prices with CPI, Fed Rates & BTC Dominance appeared first on Cryptonews. …

Elephant kills British and New Zealand tourists in Zambia

The two tourists were trampled to death by a female elephant that was with a calf, police say.

‘I don’t know who to trust anymore’: Druze worry about being left behind in post-war Syria

Recent attacks on the religious minority in Damascus have fuelled growing distrust towards the state.

Kenyan leader to build huge church at presidential office

“The devil might be angry and can do what he wants,” President William Ruto said in response to criticism.

Several killed as flash flooding hits central Texas

Others are missing following “catastrophic flooding” in several areas, authorities say.

Trump to sign sweeping tax and spending bill into law

A signing ceremony at the White House on Friday afternoon will kick off celebrations for 4 July.

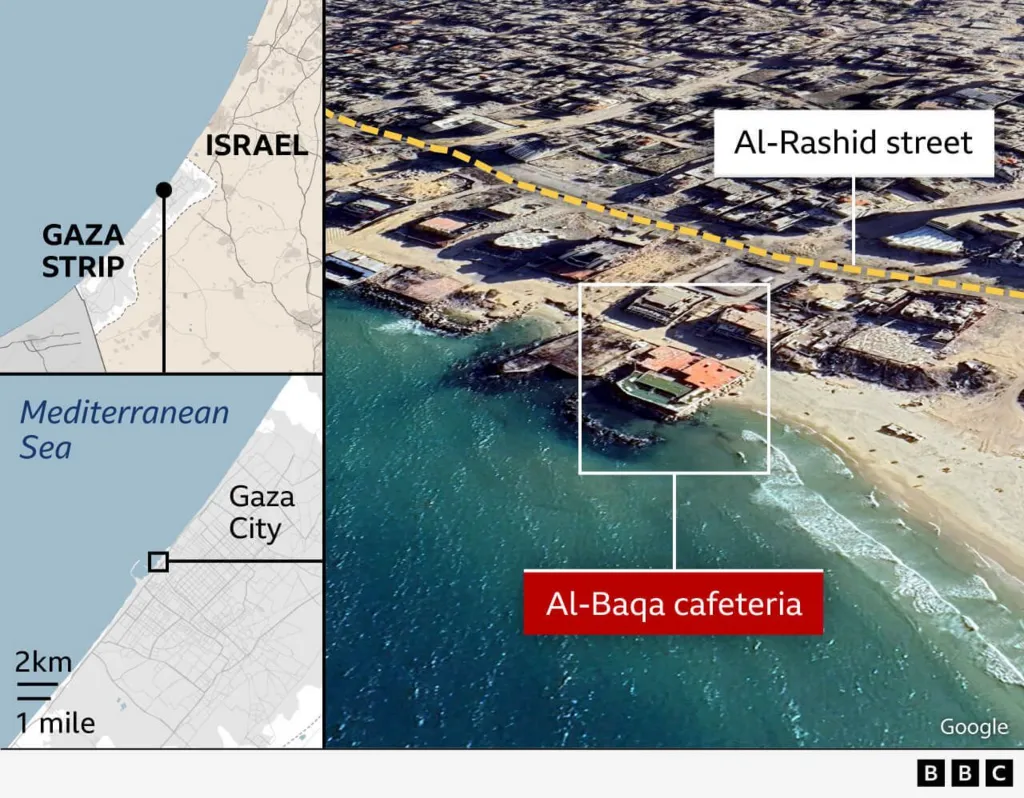

Israel’s strike on bustling Gaza cafe killed a Hamas operative – but dozens more people were killed

The attack raises more questions over whether Israel’s use of force is proportionate, as required by international law.

Hamas says it is consulting other Palestinian groups on Gaza ceasefire plan

The US president says he expects to know soon whether Hamas has agreed to a proposal for a 60-day truce.