Exchange-traded fund provider 21Shares is pushing further into the tokenized finance sector, filing with U.S. regulators for a spot ETF that tracks the native token of Ondo Finance.

Key Takeaways:

- 21Shares has filed for a spot ETF that would directly hold ONDO.

- Ondo is building out institutional-focused tokenization infrastructure.

- Tokenized real-world assets are on the rise, with $25B now on-chain.

According to a preliminary prospectus submitted to the Securities and Exchange Commission on Tuesday, the proposed “21Shares Ondo Trust” will hold ONDO tokens directly and follow the CME CF Ondo Finance-Dollar Reference Rate.

Coinbase will act as custodian of the tokens. The fund is designed to be a passive investment vehicle, with no leverage or active speculation. Shares can be created or redeemed in cash or in-kind.

ONDO Powers Layer-1 Blockchain Built for Institutional Finance and RWAs

ONDO is the utility token powering Ondo Chain, a layer-1 proof-of-stake blockchain purpose-built for institutional finance and tokenized real-world assets (RWAs).

With a current market cap of $3.5 billion and a circulating supply of 3.1 billion tokens, ONDO is priced at $1.12, down 48% from its December peak of $2.14, per CoinGecko.

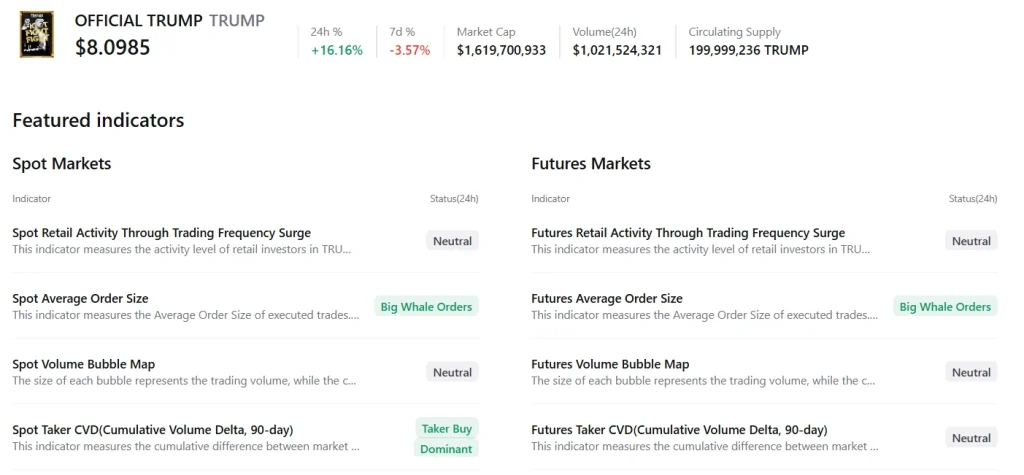

Among the token’s notable backers is World Liberty Financial, the Trump-affiliated DeFi platform.

The group purchased $250,000 worth of ONDO in December and currently holds 342,000 tokens, valued at around $383,000, per Nansen data.

Still, ONDO accounts for just 0.2% of the platform’s $208 million portfolio, which leans heavily on stablecoins, wrapped Ether, and Bitcoin.

21Shares’ ETF filing follows a busy month for Ondo Finance. Earlier in July, the protocol acquired SEC-registered broker-dealer Oasis Pro to advance its tokenized securities strategy.

The move, made in collaboration with Pantera Capital, is seen as a bid to bridge traditional finance with blockchain infrastructure.

Oasis Pro, which operates as an Alternative Trading System and SEC-registered transfer agent, has been a FINRA member since 2020.

Ondo’s broader vision was laid out in February with the launch of Ondo Chain, its dedicated blockchain designed to cater to Wall Street firms and institutional-grade tokenization.

The filing comes amid a surge in tokenized real-world asset activity. On-chain RWA value has jumped 58% this year to nearly $25 billion, according to RWA.xyz.

Ethereum currently dominates the space, with 55% of RWA tokenization activity, largely in private credit and U.S. Treasurys.

95% Approval Chance for Spot Solana, XRP ETFS

As reported, Bloomberg’s senior ETF analysts have assigned a 95% chance that the SEC will approve spot ETFs for Solana, XRP, and Litecoin this year, raising their previous odds from 90% amid growing optimism for institutional crypto products.

They also expect a crypto index ETF tracking multiple assets could gain approval as early as this week, signaling broader access to altcoins for traditional investors.

Beyond ETFs, institutional Bitcoin demand is spreading into corporate treasuries.

As reported, Singapore-headquartered edtech firm Genius Group has doubled its Bitcoin holdings to 200 BTC after acquiring 20 BTC last week, part of a wider strategy to build a 10,000-BTC treasury.

Public companies are increasingly adding altcoins like Ether (ETH), Solana’s SOL, and XRP to their treasury strategies, according to a report from Animoca Brands Research.

Michael Saylor’s Strategy popularized this model by holding over 600,000 Bitcoins as a hedge against inflation and currency devaluation.