Altcoin season feels distant today, even with small pockets of strength developing against the wider mood of extreme fear.

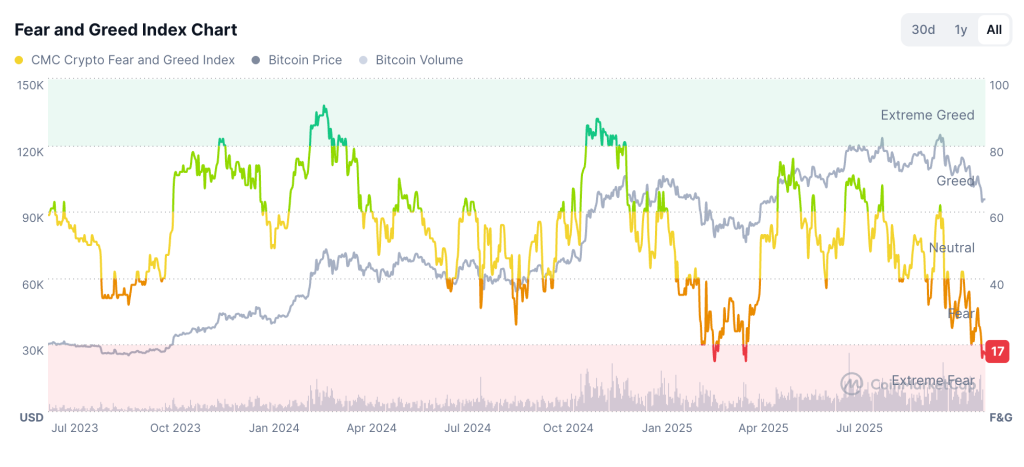

The Crypto Fear and Greed Index sits at 17, only slightly above this year’s lowest of 15, and the market continues to react to the same pressures that have dominated the past week, including spot ETF outflows, reduced risk tolerance, and slower participation from long-term holders who have been taking profits during Bitcoin’s pullback from levels above six figures.

Crypto Fear and Greed Index (Source: CoinMarketCap)

Bitcoin trades around $94,000 and remains the anchor for overall sentiment, since many desks are using it to gauge how much liquidity remains in the system. The combination of risk reduction, macro caution, and position trimming has constrained rotation across mid-cap and small-cap tokens, and that restraint shapes today’s environment more than any single move in isolation.

History shows that when sentiment drops into deep fear, traders tend to prioritize liquidity, stable turnover, and clear usage over speculation, and the current pattern fits that profile.

Within this setting, Uniswap, Ethena, and Immutable stand out mainly because they are rising in a market that is otherwise heavy. Their moves offer a narrow window into how capital behaves when conditions are tight and how some assets can still climb when the wider market is constrained by risk aversion.

Uniswap Holds Up Through Steady Protocol Usage

Uniswap’s UNI is currently trading near $7.89, up by about 5% in 24 hours, with liquidity and volume remaining steady relative to earlier sessions.

Swaps continue to route through the protocol at a rate that supports consistent demand, and governance discussions around the Unification roadmap keep attention on its long-term structure without depending on short-term narratives. UNI’s move today fits the pattern of a token supported by ongoing usage rather than sudden shifts in sentiment.

Ethena Benefits From Stabilizing Yield Structures

Ethena’s ENA is now trading around $0.272, up by roughly 3% in 24 hours, after several weeks shaped by adjustments to its synthetic dollar strategy and a more measured approach to leverage.

Funding and open interest data point to a calmer backdrop for the protocol, and today’s rise appears linked to this stabilization rather than to new developments. ENA continues to function as a reference point for how much appetite remains for structured yield during a cautious period.

Immutable Gains on Steady Gaming Pipeline Activity

Immutable’s IMX is near $0.383, up about 2.5% in 24 hours, supported by progress within its gaming pipeline and continued interest from builders working on upcoming releases.

The project’s earlier partnerships and tooling updates maintain attention even during weak sentiment days, and the increase in turnover from last week’s levels suggests that traders remain engaged with ecosystems anchored by active development rather than short-lived signs.

Extreme Fear Shapes the Altcoin Season Outlook

The market’s current posture is shaped far more by the environment than by the handful of tokens showing strength. With fear near its lowest point of the year and Bitcoin drifting around the $94,000 level, rotation remains muted because liquidity is being preserved rather than deployed.

Conditions have tightened across leverage, funding, and derivatives activity, and that combination reduces the likelihood of broad rallies even when some tokens show resilience.

This period of extreme fear shows how the market behaves when sentiment compresses and how emphasis shifts toward projects with clear usage or defined roadmaps. Movements in Uniswap, Ethena, and Immutable show that activity does not disappear entirely during these phases; yet, the lack of participation across most altcoins indicates that the altcoin season remains distant until liquidity and conviction return.