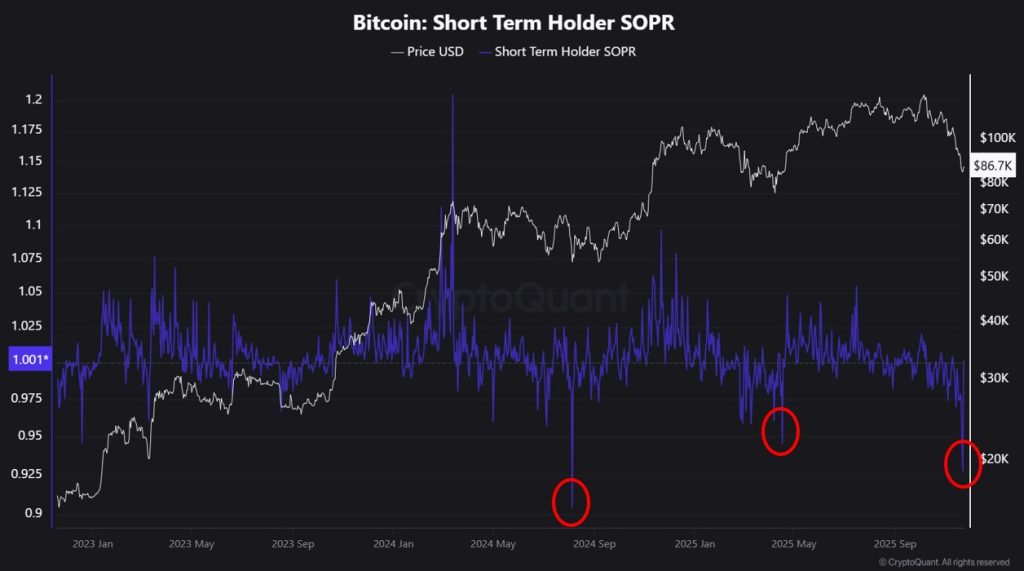

Bitcoin’s recent volatility has triggered short-term holder capitulation, flipping market sentiment from positive to negative as selling pressure intensified across leveraged positions.

CryptoQuant analysis reveals familiar patterns from previous bull cycle corrections.

However, the market now stands at a critical crossroads where the next move could determine whether this marks a temporary setback or the beginning of a prolonged downturn.

While short-term technical signals suggest an imminent rebound, analysts warn that a break of the $80,000 support level would significantly increase the likelihood of a much tougher period.

The current price action can be interpreted in two ways:

- Represents the bottom of a correction within the ongoing bull cycle.

- The end of the decline lies far ahead if a bear market has truly begun.

Critical Support Level Holds Key to Market Direction

Technical indicators point toward diverging scenarios based on Bitcoin’s ability to hold key price thresholds.

CryptoQuant’s combined long- and short-term SOPR analysis shows that while a short-term rebound appears highly likely, failure to maintain the $80,000 level would open the door to extended weakness.

However, analysts note that a drop exceeding 70% from the all-time high, characteristic of previous bear cycles, appears unlikely this time around.

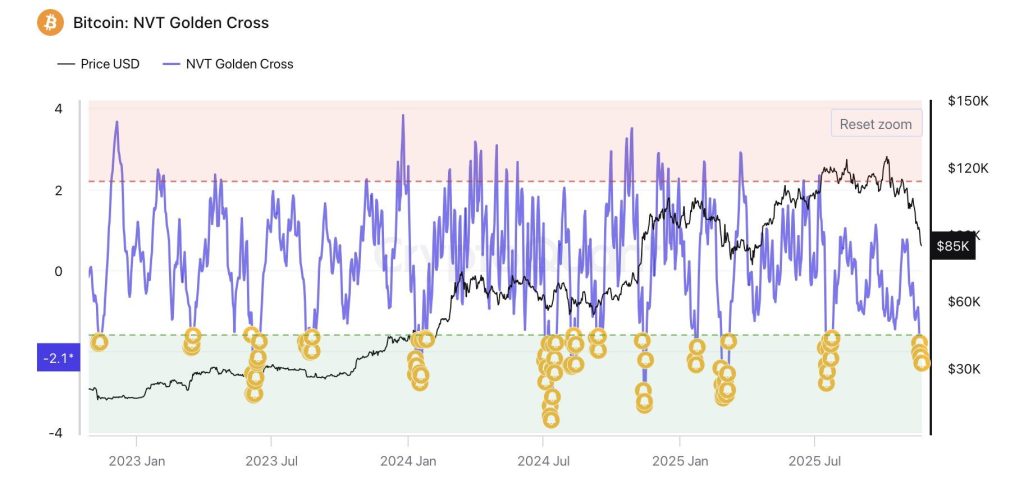

Meanwhile, on-chain metrics suggest potential undervaluation at current levels.

The BTC NVT Golden Cross indicator fell below -1.6, historically indicating that Bitcoin’s market cap is undervalued relative to its on-chain activity and is likely to revert toward its mean.

This technical signal has previously identified favorable entry points for long positions, though analysts caution against using leverage in the current volatile environment.

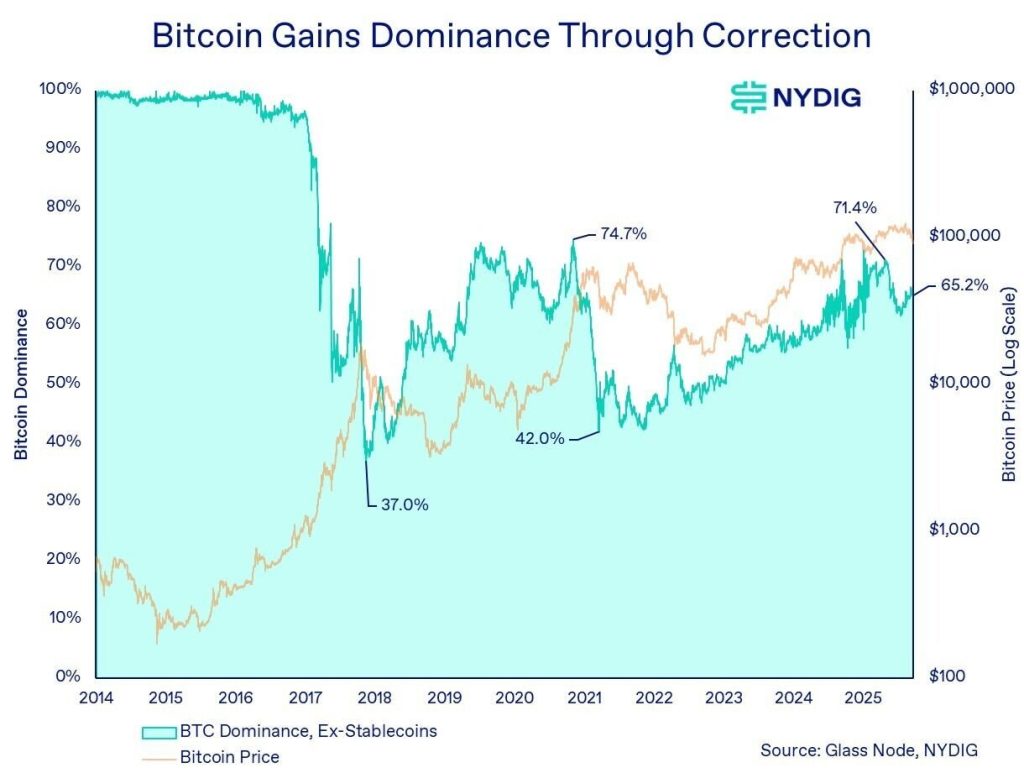

Bitcoin dominance surged above 60% in early November before stabilizing around 59% as capital consolidated into BTC during broader market drawdowns, according to NYDIG.

The weekend showed the second-strongest recovery in four months following a difficult week of selling pressure.

Index Classification Fears Amplify October Crash

Notably, new analysis reveals that MSCI’s October 10 consultation on potentially excluding companies holding over 50% of assets in Bitcoin from global indexes contributed to the dramatic market crash that liquidated $19 billion in 24 hours.

The proposal puts Bitcoin-heavy firms like MicroStrategy at risk of forced selling by index funds tracking MSCI benchmarks, creating structural uncertainty that hits an already fragile market dealing with Trump tariffs, weak Nasdaq performance, and heavy leverage.

Michael Saylor responded directly to MSCI concerns, clarifying that MicroStrategy operates as a publicly traded company with $500 million in ongoing software revenue and Bitcoin-backed credit products, not as a passive fund or holding company.

Saylor highlighted five new digital credit instruments totaling $7.7 billion in notional value issued this year, positioning the company as an active innovator rather than merely a treasury operator.

JPMorgan amplified bearish sentiment days after the initial crash with a report emphasizing MSCI risks.

However, the bank’s timing drew criticism from traders familiar with its historical pattern of publishing bearish notes during market weakness.

MSCI’s final decision is scheduled for January 15, 2026, with any policy changes taking effect the following month.

While some analysts argue the October crash resulted primarily from tariff announcements and derivatives liquidations rather than index classification fears, the consultation created additional structural uncertainty that may persist through the decision date.

Long-Term Bulls Dismiss Four-Year Cycle Concerns

Despite recent weakness, prominent analysts maintain bullish long-term outlooks.

PlanB reiterated his 2019 forecast projecting Bitcoin’s market cap reaching $10 trillion, equivalent to $500,000 per coin, by 2028 following the current halving cycle.

His model previously predicted that the 2020-2024 period would take Bitcoin from a $100 billion market cap to $1 trillion, and it materialized as forecast.

However, technical analysts note Bitcoin closed its second consecutive weekly candle below the 50-week EMA, a pattern that preceded 50% drawdowns in both 2018 and 2022.

Critics of the four-year cycle theory argue that this framework may no longer apply as Bitcoin matures and institutional adoption accelerates.

Analyst Ted Pillows suggested the cycle could be “dead,” while others maintain that Bitcoin’s fundamental adoption trajectory remains unchanged regardless of short-term volatility or index classification debates.

Recovery above $90,000 and eventual breakout past $100,000 would likely trigger significant FOMO among traders who sold, expecting deeper lows around $75,000.