Maelstrom Fund CIO Arthur Hayes has warned that Bitcoin may fall back to $100,000 amid a wave of macroeconomic headwinds, revealing that he has already trimmed his crypto holdings in anticipation.

Key Takeaways:

- Arthur Hayes warns Bitcoin could drop to $100K due to weak job data and slowing credit growth.

- He has already sold over $13 million in crypto and shifted most of his holdings into USDC.

- His outlook contrasts with growing market optimism that traditional Bitcoin cycles are fading.

In a post on X, Hayes responded to on-chain data from Lookonchain showing that he had recently sold off $8.32 million worth of ETH, $4.62 million in Ethena (ENA), and $414,700 of the meme token Pepe (PEPE).

The address tied to Hayes now holds $28.3 million in tokens, with $22.95 million sitting in USDC, according to Arkham Intelligence.

Arthur Hayes Flags Weak Jobs Data and Sluggish Credit as Bitcoin Red Flags

Hayes cited weak U.S. job data and sluggish credit growth in major economies as red flags.

The July Non-Farm Payrolls report showed just 73,000 new jobs, far below expectations, and stoked renewed fears of tariffs and slowing nominal GDP growth.

These factors, Hayes argued, could weigh on risk assets like Bitcoin and Ether, potentially pushing them toward the $100,000 and $3,000 levels, respectively.

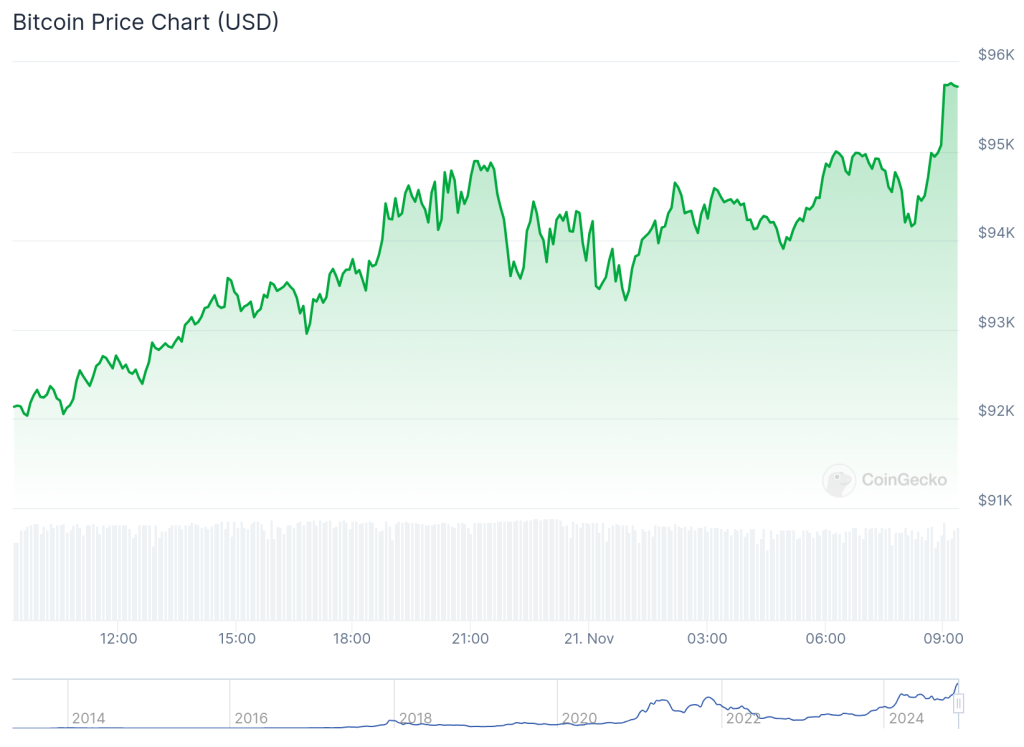

Bitcoin has already slipped more than 7% from its all-time high of $123,000 set on July 14, while Ether is down over 12% since briefly crossing $3,900 at the end of July.

A drop to $100,000 would mark an 18.7% correction from the peak.

Hayes’ caution contrasts with a growing narrative that Bitcoin’s worst pullbacks may be behind it.

Bloomberg’s Eric Balchunas recently highlighted the asset’s reduced volatility since BlackRock’s ETF filing in mid-2023.

Blockware Solutions’ Mitchell Askew echoed that sentiment, saying the era of “parabolic bull markets and devastating bear markets” may be over.

“Bitcoin cycles, as we know them, are dead,” Eli Nagar, CEO of Bitcoin mining pool Braiins Mining, wrote on X.

“You can’t compare this phase to the ones that came before. Not in scale. Not in structure. Not in what’s at stake,” he added.

Crypto Bull Market Holds, But Momentum Shows Signs of Strain

Bitcoin is trading near $113,000 amid slowing price action, sparking debate over whether the current bull market is peaking or simply consolidating.

Ethereum, by contrast, surged over 50% in July and is holding above $3,450, driven largely by ETF inflows and strong institutional demand.

Despite headline gains, the Altcoin Season Index remains low at 36, indicating that capital is concentrated in Bitcoin and Ethereum, with little movement across mid-cap tokens.

Analysts say broader altcoin participation is typically needed to confirm a full market cycle. Bitcoin dominance remains above 60%, limiting the rally’s depth.

Institutional activity continues to support the market. Corporate treasuries have allocated over $86 billion to crypto in 2025, and JPMorgan estimates more than $60 billion in new capital has entered the space this year.

Ethereum has been a major beneficiary, with high daily trading volumes and growing interest from large investors.