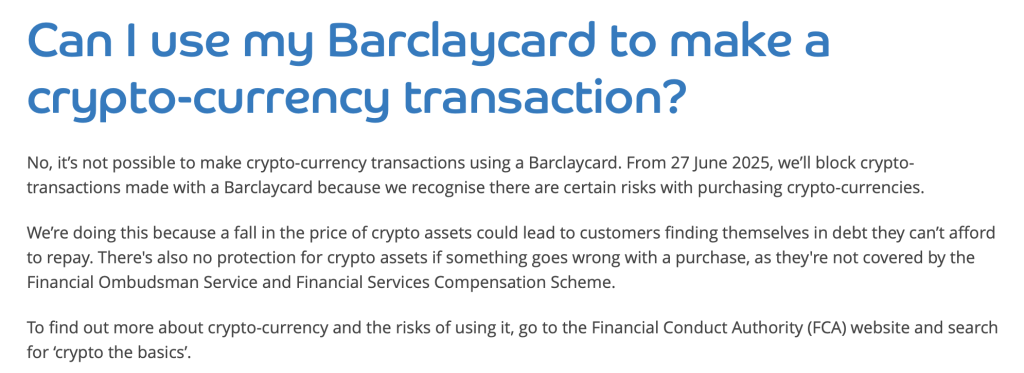

Barclays Bank, one of the UK’s largest and most established financial institutions, announced that it will block all cryptocurrency-related transactions made using its bank cards, including Barclaycard credit cards, starting 27 June 2025.

The decision comes during growing concerns about the financial risks posed by the highly volatile nature of digital currencies.

Bank Cites Lack of Consumer Protections

In a statement posted to its website, Barclays explains the rationale behind the move. “From 27 June 2025, we’ll block crypto-transactions made with a Barclaycard because we recognise there are certain risks with purchasing crypto-currencies,” the bank said.

“A fall in the price of crypto assets could lead to customers finding themselves in debt they can’t afford to repay.”

The bank also points out the lack of regulatory protections associated with crypto purchases. Because digital currencies are not covered by the Financial Ombudsman Service or the Financial Services Compensation Scheme, customers have limited recourse if something goes wrong with a transaction.

This absence of safeguards, combined with price volatility, poses a huge risk for consumers who may use credit to invest in or purchase crypto assets.

Financial Institutions Distance Themselves from Crypto

Barclays’ decision aligns with a cautious stance increasingly adopted by traditional financial institutions and regulators worldwide. While cryptocurrency adoption has grown, so too have concerns about scams, price manipulation, and consumer harm.

In the UK, the Financial Conduct Authority (FCA) has repeatedly warned consumers about the dangers of investing in unregulated crypto markets.

In its notice, Barclays directed customers to the FCA’s website for more information, encouraging them to search for “crypto the basics” to understand the risks involved.

This move by Barclays follows similar steps taken by other UK banks in recent years, as they seek to limit consumer exposure to speculative digital assets. It also signals a broader trend of traditional financial institutions drawing clearer boundaries around the use of credit and banking services for cryptocurrency activities.

While some crypto advocates may see such restrictions as heavy-handed, Barclays maintains that the decision is in the best interest of its customers’ financial well-being.

UK Wants Banks to Have Less Exposure to Crypto

Earlier this month, the Bank of England (BOE) said it is considering a proposal that would restrict UK banks’ exposure to crypto by 2026.

Speaking at the Risk Live Europe event in London on Wednesday, the central bank executive director, David Bailey, noted that the UK’s upcoming rules would be more on the “restrictive end.” He specified that banks would be encouraged to keep a low crypto exposure.

“There are also examples where it might be more appropriate to start more towards the restrictive end of the spectrum,” he said. “The prudential treatment of banks’ exposures to cryptoassets, and specifically those with features associated with heightened price volatility and where investors could lose the entirety of their investment, is an example in this space.”