The Royal Government of Bhutan transferred $23.73 million worth of Bitcoin to the Binance exchange within hours of Bitcoin reaching a new all-time high above $112,000, continuing the nation’s strategic pattern of selling during price peaks.

Arkham Intelligence data shows that the government moved 213 BTC across multiple transactions, with the largest single transfer, worth $23.18 million, occurring just two hours before the market close.

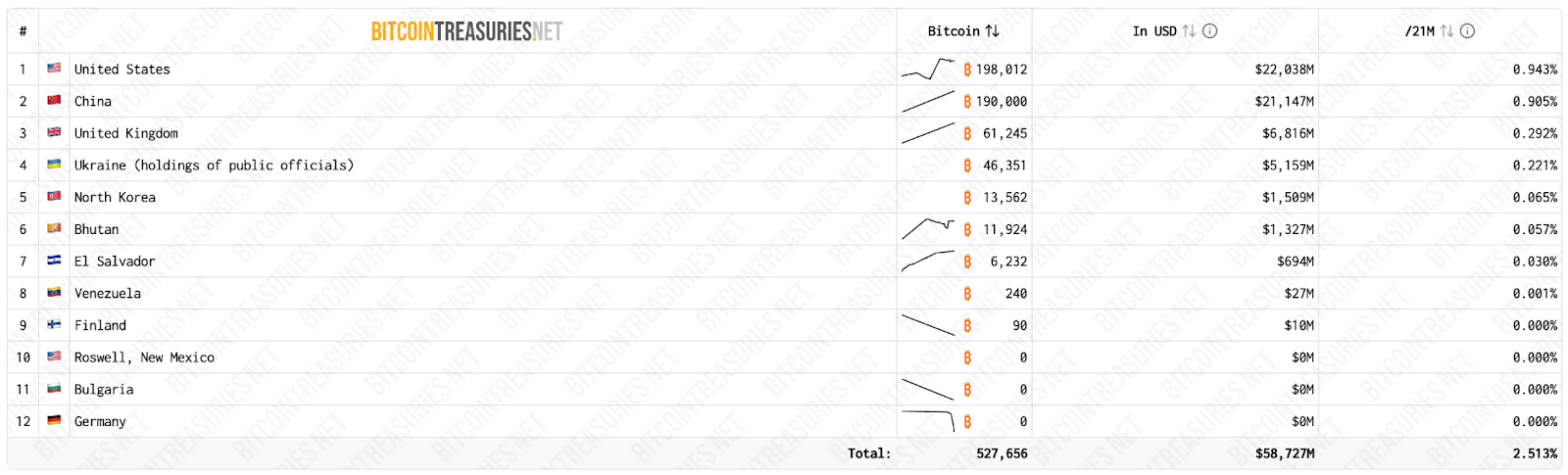

The latest sales bring Bhutan’s remaining Bitcoin holdings to 11,711 BTC worth $1.3 billion, maintaining its position as the sixth-largest government Bitcoin holder globally.

The timing coincides with Bitcoin’s breakthrough above previous resistance levels, suggesting strategic market analysis drives the nation’s trading decisions rather than random liquidation events.

Bhutan has consistently demonstrated superior market timing compared to other sovereign Bitcoin holders, particularly in contrast with Germany’s costly liquidation strategy.

The German government’s decision to sell 49,858 BTC at $53,000 per coin in July resulted in an estimated $2.015 billion opportunity loss, as those holdings would now be worth $4.57 billion at current prices.

The Himalayan kingdom’s approach differs significantly from El Salvador’s buy-and-hold strategy, with President Nayib Bukele pledging never to sell Bitcoin reserves.

El Salvador currently holds 6,233 BTC, worth approximately $693 million, while Bhutan maintains nearly double the holdings, despite periodically making strategic sales during favorable market conditions.

Hydro-Powered Mining Empire Funds Strategic Trading Operations

Bhutan’s Bitcoin accumulation strategy centers on sustainable mining operations powered by abundant hydroelectric resources from Himalayan rivers.

The country began mining Bitcoin in April 2019 when prices traded around $5,000, building reserves through energy-efficient operations that account for over 25% of the nation’s GDP.

Druk Holdings and Investments, Bhutan’s sovereign investment arm, has mined 13,011 BTC since its inception, while also diversifying into Ethereum, BNB, and Polygon holdings.

The investment vehicle oversees the country’s flagship airline, hydroelectric plants, and various industrial operations beyond cryptocurrency activities.

Partnership with Singaporean mining giant Bitdeer expanded Bhutan’s capacity through a 600-megawatt facility in Gedu, positioning the nation among the world’s largest sustainable Bitcoin mining operations.

The country’s largest facility operates on the site of a failed $1 billion Education City project, utilizing existing infrastructure for cryptocurrency production.

Satellite imagery confirms mining operations began construction in December 2021, with facilities concealed behind mountainous terrain but identifiable through transformer installations and power line networks.

The strategic location provides both energy access and operational security for the government’s digital asset accumulation efforts.

Recent initiatives include the world’s first national-level crypto tourism payment system, partnering with Binance Pay and DK Bank to enable cryptocurrency payments across over 100 local merchants.

The system supports over 100 cryptocurrencies, enabling transactions for everything from airline tickets to roadside fruit purchases.

Smart Money Strategy Outperforms Buy-and-Hold Approaches

Bhutan’s calculated selling approach has generated superior returns compared to passive holding strategies employed by other nations.

Over the past two months, the government sold 1,696 BTC at an average price of $81,999, capitalizing on price appreciation while maintaining substantial long-term positions.

The latest transactions include 208.56 BTC ($23.18 million) and smaller amounts totaling $273,000 and $238,000, executed during optimal market conditions.

Additional transfers show sophisticated portfolio management with USDT movements between Binance and Kraken exchanges for operational liquidity.

More recently, Gelephu Mindfulness City, Bhutan’s Special Administration Region, announced the inclusion of Bitcoin, Ethereum, and BNB in its official strategic reserves, becoming one of the first jurisdictions to formally recognize digital assets in government portfolios.

The autonomous city aims to serve as an economic corridor linking South Asia to Southeast Asia.

Similarly, Matrixport became the first licensed crypto firm to expand operations in the Mindfulness City, which operates under separate regulatory frameworks designed to attract blockchain businesses.

Bhutan’s portfolio currently totals $1.303 billion, including Ethereum holdings, which represent approximately 43% of the nation’s GDP of $3 billion.

The country is executing a tactical sales strategy during peaks, which has generated substantial wealth for the small Himalayan kingdom while avoiding the opportunity costs experienced by less sophisticated government sellers.