Binance is exploring strategic options to re-enter the United States market following President Donald Trump’s pardon of founder Changpeng Zhao, with the exchange considering consolidating its separate US affiliate into its global operations or having its main platform serve American investors directly, Bloomberg reported.

The pardon, issued Wednesday after Zhao pleaded guilty in 2023 to failing to maintain adequate anti-money laundering controls, has sparked intense debate over conflicts of interest given Binance’s recent $2 billion deal involving Trump’s family crypto firm World Liberty Financial.

Hours after receiving the pardon mid-flight, Zhao announced his renewed ambitions for the world’s largest crypto exchange, saying he would “do everything we can to help make America the Capital of Crypto and advance web3 worldwide.”

BNB, the native token of Binance’s blockchain network, surged 8% on Thursday following news of the pardon.

Pardon Clears Path for Binance Expansion

The presidential pardon carries sweeping legal implications that could fundamentally change Zhao’s involvement with Binance and its subsidiaries.

According to Bloomberg, Jonathan Groth, a partner at DGIM Law, confirmed that the clemency allows Zhao to re-engage with Binance ventures, removing barriers that had sidelined the billionaire founder since his November 2023 guilty plea..

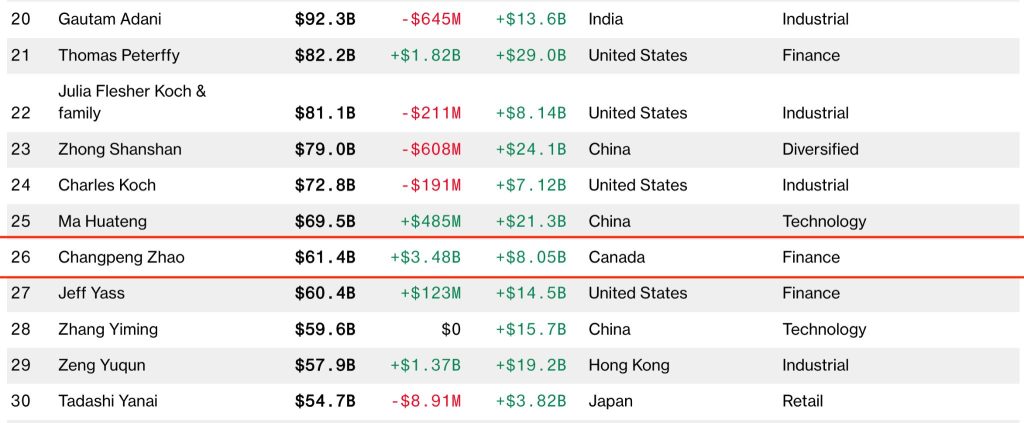

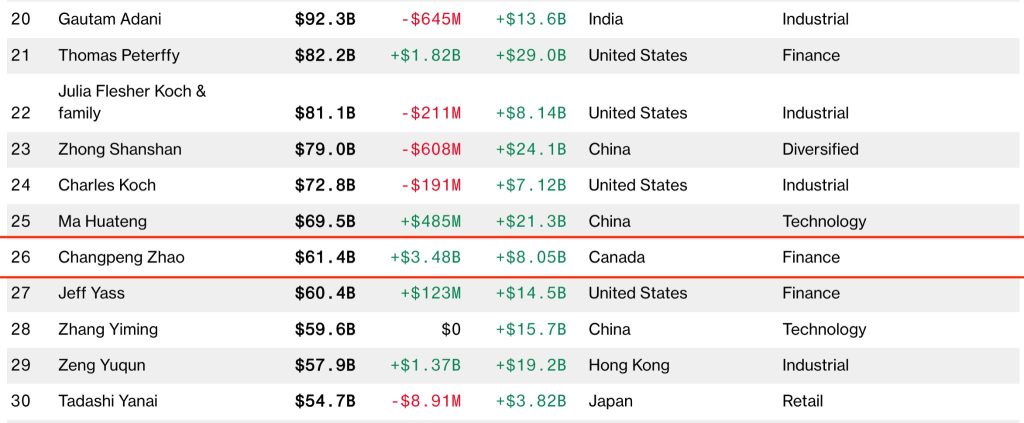

With a net worth of $61.4 billion according to the Bloomberg Billionaires Index, Zhao wields considerable influence over Binance’s blockchain ecosystem, which hosts approximately $8.7 billion in assets and ranks third behind Ethereum and Solana.

The timing aligns with Trump’s embrace of digital assets as a political platform, as the president’s family has profited over $1B from the crypto sector.

Binance recently facilitated the launch of USD1, a stablecoin project for Trump-linked World Liberty Financial, expected to generate tens of millions annually, an arrangement that has drawn sharp criticism from Democratic lawmakers who view the pardon as evidence of widening conflicts of interest.

US Market Strategy Takes Center Stage

Binance is actively evaluating options, including consolidating Binance.US into its global operation or enabling direct US market access for its main exchange, according to Bloomberg.

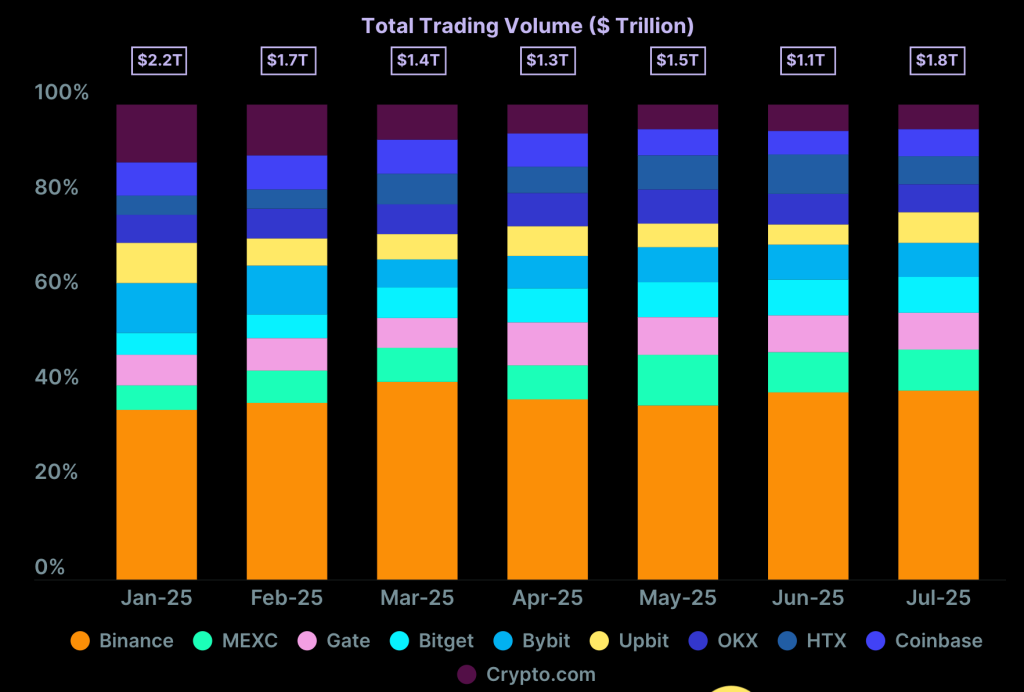

The company currently operates Binance.US as a structurally separate entity with severely limited reach, capturing less than 1% of US Bitcoin trading volume compared to the nearly 40% global market share commanded by Binance’s international platform.

Markus Thielen, chief executive officer of 10x Research, emphasized that institutional investors and investment products are driving the current crypto cycle, precisely where Binance can now shift its focus.

He predicted that Binance.US “will likely be reintegrated into the global Binance ecosystem, giving US investors direct access to the platform’s deep liquidity and comprehensive derivatives offerings.”

The US market presents profound challenges despite Zhao’s newfound political alignment, with Coinbase Global enjoying a dominant position similar to Binance’s global standing.

Owen Lau, an analyst at Clear Street, noted that Coinbase holds a first-mover advantage and operates as a trusted platform domestically.

However, Patrick Horsman, chief investment officer of Applied DNA Sciences, argued that Binance’s superior technology, liquidity, and competitive fees will make it “a dominant powerhouse in the American crypto market.“

Political Backlash and Corruption Concerns

Democratic Senator Elizabeth Warren has led fierce opposition to the pardon, writing to White House Counsel in May that “the convergence of Mr Zhao’s pardon application and Binance’s financial entanglements with the President’s family presents urgent concerns regarding the integrity of our justice system.”

She posted on X that Zhao “pleaded guilty to a criminal money laundering charge and was sentenced to prison. But then he financed President Trump’s stablecoin and lobbied for a pardon. Today, he got it.“

Congresswoman Maxine Waters also slammed the Trump administration’s decision as a way to “effectively legitimize the crypto crime CZ was convicted of” and give him “the green light to continue operating his crypto platform with virtually no guardrails to protect the hard-earned funds of everyday investors.”

She stated that “Trump’s pardon of Binance founder Changpeng Zhao [..] is an appalling but unsurprising reflection of his presidency: one defined by corruption, self-interest, and loyalty to criminals over working-class American families.”

However, White House spokeswoman Karoline Leavitt defended the decision as thoroughly reviewed by lawyers, framing the pardon as a response to heavy-handed Democratic tactics and claiming the Biden administration waged a “war on cryptocurrency” by pursuing Zhao despite no fraud allegations or identifiable victims.