After one of the most turbulent weekends in months, U.S. spot Bitcoin and Ethereum exchange-traded funds (ETFs) staged a dramatic turnaround on October 14, recording a combined net inflow of $338.8 million.

The rebound comes just a day after the same funds saw over $755 million in withdrawals, suggesting that institutional investors may be shifting back into accumulation mode.

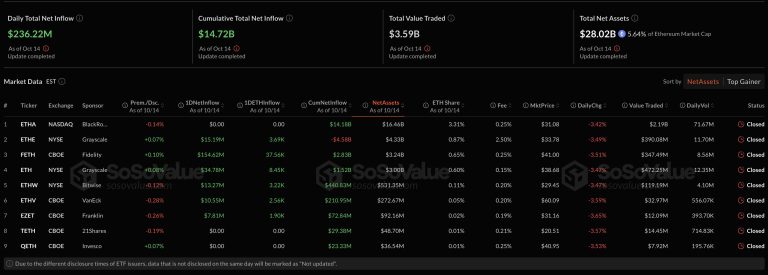

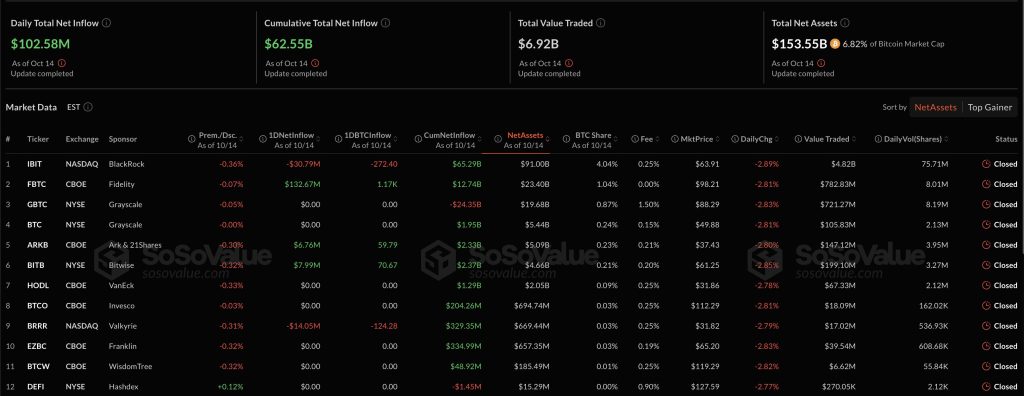

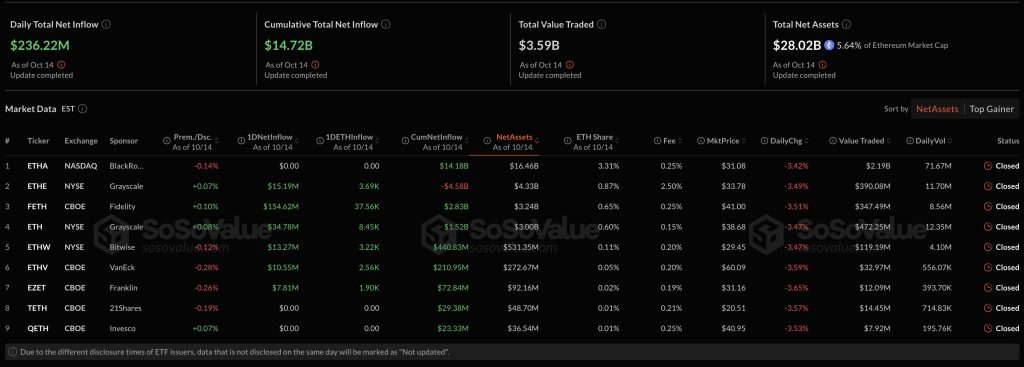

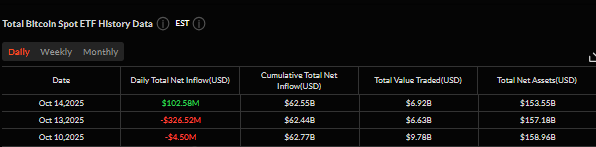

According to data from SoSoValue, Bitcoin spot ETFs pulled in a total of $102.58 million in net inflows on Monday, while Ethereum ETFs attracted $236.22 million.

The recovery follows a weekend sell-off that erased more than $500 billion from the crypto market amid renewed U.S.–China trade tensions and a wave of liquidations across exchanges.

With the reversal after the brutal weekend and days that follow, is it a sign for accumulation or just a blip?

Speaking to CryptoNews, Kevin Lee, Chief Business Officer at Gate, described the rebound as “encouraging but premature.”

“One strong inflow day is a constructive signal, not a verdict,” he said. “To call it durable, we need consistent net creations across issuers and normalization in futures and options.”

Lee added that sustained ETF inflows and diversification across both BTC and ETH products would confirm a true return of institutional confidence.

“ETF buyers are price-insensitive allocators who rebalance into weakness,” he noted. “This reversal shows risk appetite remains intact, though data will drive Q4 flows.”

Siraaj Ahmed, CEO at Byrrgis, took a more optimistic view: “I’d call this the first real sign of early accumulation rather than a random blip. Institutions don’t chase panic—they buy fear—and that’s exactly what this looks like heading into Q4.”

With ETF inflows rebounding, on-chain accumulation rising, and macro conditions stabilizing, analysts suggest that markets could be entering a renewed build-up phase after last week’s sharp correction.

Bitcoin and Ethereum ETFs See Renewed Demand After $900M Outflow Week

Fidelity’s Wise Origin Bitcoin Fund (FBTC) led the charge with $132.67 million in new inflows, bringing its total historical net inflows to $12.74 billion. Bitwise’s BITB followed with $7.99 million in inflows, while BlackRock’s iShares Bitcoin Trust (IBIT) saw $30.79 million in redemptions.

As of October 14, Bitcoin spot ETFs collectively hold $153.55 billion in assets under management, representing 6.82% of Bitcoin’s total market capitalization.

Cumulative inflows have now reached $62.55 billion, while daily trading volumes stood at $6.92 billion, reflecting strong investor activity even amid ongoing volatility.

Ethereum ETFs saw even stronger momentum. Fidelity’s FETH led the pack with $154.62 million in inflows, followed by Grayscale’s ETH with $34.78 million and Bitwise’s ETHW with $13.27 million.

Total assets under management across Ethereum ETFs climbed to $28.02 billion, equal to roughly 5.6% of Ethereum’s market capitalization.

The swift turnaround follows three consecutive days of redemptions that began on October 10. During that stretch, Bitcoin ETFs lost $331 million, while Ethereum ETFs saw $611 million in outflows.

The renewed inflows suggest a shift in sentiment toward accumulation rather than retreat.

“It appears institutional confidence never really faded,” said Ivo Georgiev, CEO and founder of Ambire, speaking to CryptoNews.

Data supports that view. Despite market turbulence and more than $20 billion in leveraged positions liquidated across exchanges, CoinShares reported $3.17 billion in inflows last week, even as over $20 billion in leveraged positions were liquidated across exchanges. Analysts say this resilience points to sustained institutional demand.

Despite the turbulence, both Bitcoin and Ethereum showed signs of resilience. At press time, Bitcoin is trading around $113,054, up 1.1% in the past 24 hours but down 7.2% over the week. Ethereum rose 4.3% on the day to $4,180.55, though it remains about 15% below its all-time high of $4,946.

The quick rebound in ETF flows and price action suggests that, while retail sentiment remains cautious, institutional demand for crypto exposure is far from over.

Institutional Confidence Quietly Rebuilds as Crypto ETFs Near $1 Trillion in Assets

Market data indicates that institutional confidence may be quietly rebuilding.

ETF analyst Eric Balchunas noted that overall crypto ETF assets are nearing the $1 trillion milestone, with an estimated $30 billion in inflows recorded in just the past seven days.

Bitcoin ETFs alone added over $1 billion in new capital during that period, underscoring sustained institutional demand even as prices consolidated.

According to Ivo Georgiev, the recent liquidation event did little to shake long-term institutional confidence.

“It appears institutions are simply taking advantage of this period to increase their spot positions,” he said, adding that the muted price reaction relative to the scale of liquidations suggests deeper accumulation under the surface.

Meanwhile, macroeconomic signals are turning more favorable for risk assets. Federal Reserve Chair Jerome Powell suggested this week that the central bank may soon end its balance sheet reduction program and prepare for possible rate cuts, citing weakening labor data.

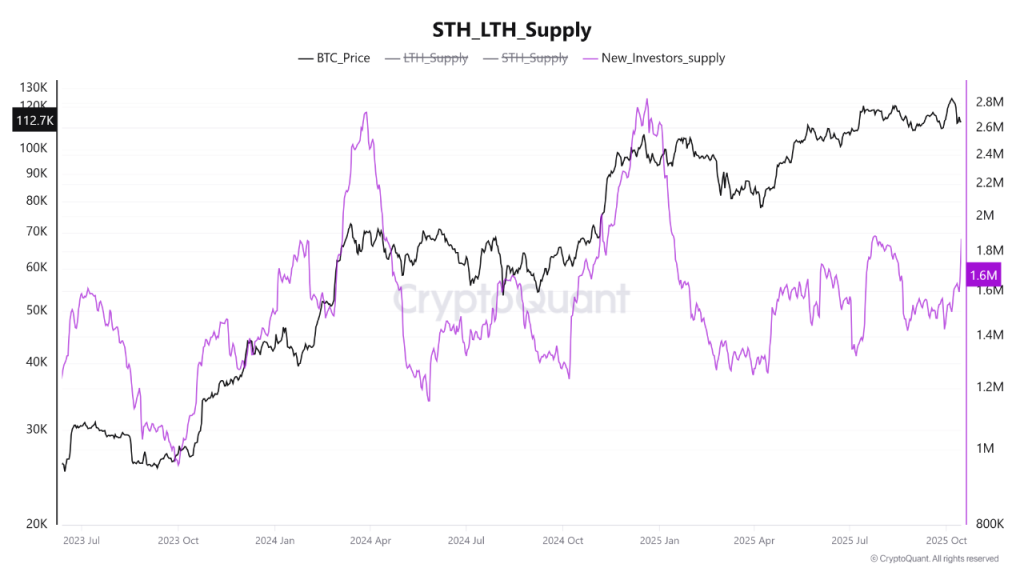

On-chain metrics also support the idea that accumulation is underway. CryptoQuant data shows that short-term Bitcoin holders, those owning coins for less than a month, have increased their supply from 1.6 million BTC to over 1.87 million BTC in recent days.

Analysts interpret this as fresh capital entering the market and forming a new demand floor following the correction.

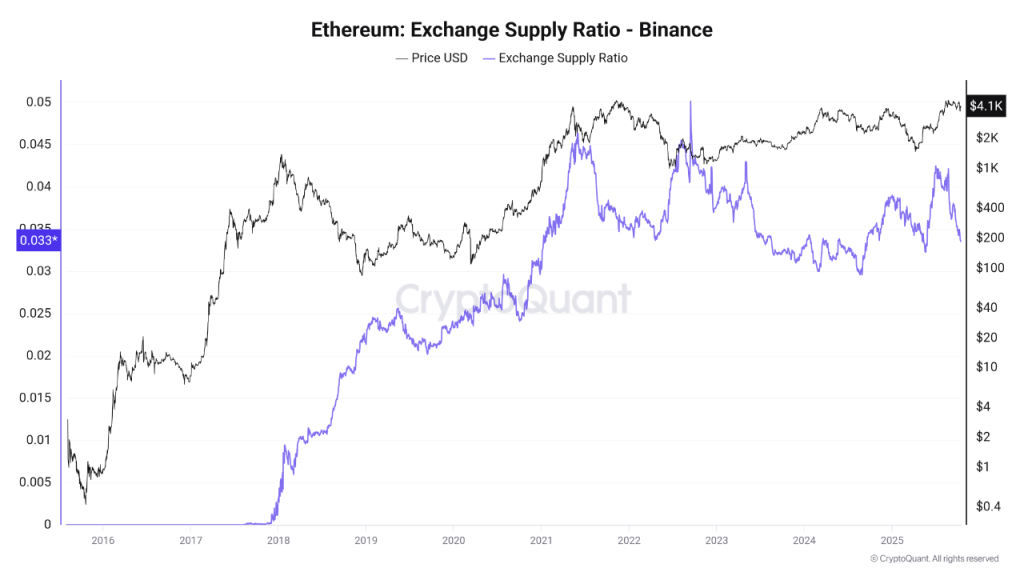

Ethereum data tells a similar story. Exchange data shows that the Ethereum supply held on Binance has dropped to a multi-month low of 0.33, signaling that investors are moving coins to self-custody.

Historically, such withdrawals have preceded upward price movements as available exchange supply tightens.