Bitcoin continues to dominate headlines after smashing through a new all-time high of $112,000 last week, reinforcing bullish sentiment across the crypto markets.

Yet, despite the hype, on-chain data from CryptoQuant suggests traders should tread with caution—a cooling period may be on the horizon.

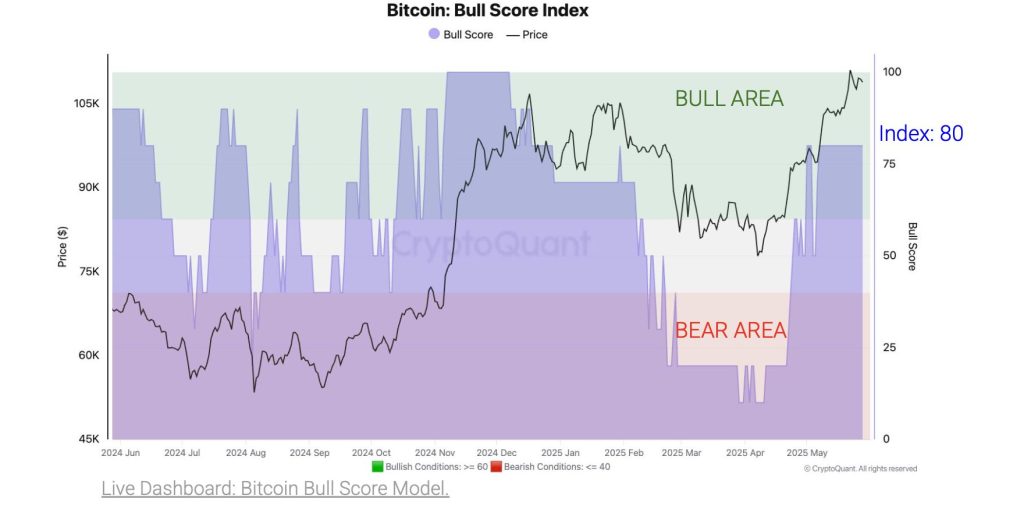

Bull Score Index Points to Bull Market Continuation

According to CryptoQuant, Bitcoin remains solidly in bull market territory. The Bull Score Index—a key measure of on-chain activity—currently stands at 80.

Historically, this index has reliably indicated that Bitcoin continues to trend upwards as long as it remains above 50. This strong score reflects robust participation from retail and institutional investors, further fueled by macro tailwinds and increasing global adoption.

The market’s optimism is backed by substantial demand: in the past 30 days alone, Bitcoin demand grew by an estimated 229,000 BTC. While this is still under the 279,000 BTC peak seen in December 2024, it’s getting close—a potential indicator that the current buying frenzy might be losing steam.

Whale Accumulation Slows, Demand Nears Historical Top

Though investor enthusiasm is still evident, there are early signs that the rally could be approaching a plateau. Whale-held Bitcoin balances have climbed 2.8% in the last month—a pace that has historically preceded a slowdown in large-scale accumulation.

With buying activity nearing levels associated with local tops, Bitcoin may enter a period of consolidation. CryptoQuant’s data implies that while the bull market isn’t over, the current growth rate may not be sustainable without a short-term correction or pause.

Traders’ Profit Margins Hint at Imminent Resistance

Another key metric to watch is the Trader’s Unrealized Profit Margin, which rose to 32% last week. When this figure nears 40%, or drops below its 30-day moving average—currently at 19%—price momentum often weakens.

If Bitcoin does maintain its upward trajectory, $120K could act as the next major resistance. This level coincides with the upper band of the On-chain Traders’ Realized Price—a historical ceiling during past bull runs.

In short, while the broader outlook remains bullish, CryptoQuant’s indicators suggest caution. As Bitcoin scales new heights, savvy investors should watch the metrics closely—the next few weeks could determine whether this rally continues or cools off.