Bitcoin reached a key supply milestone this week, with total mined coins exceeding 19.95 million BTC, or 95% of its fixed 21 million cap. Fewer than 1.05 million BTC are left to be mined, and issuance will slow sharply as the network advances through future halvings.

Permanently Lost and Unspendable BTC

A portion of Bitcoin’s supply can never re-enter circulation. Roughly 230 BTC are unspendable due to the genesis block subsidy and early invalid scripts. Additional coins are believed lost through forgotten or unrecoverable private keys, further tightening the effective supply.

How Bitcoin’s Halvings Cut Issuance

Bitcoin’s supply halves every 210,000 blocks. The most recent halving on April 20, 2024, reduced block rewards from 6.25 BTC to 3.125 BTC, lowering daily issuance from 900 BTC to about 450 BTC.

Earlier halvings in 2012, 2016, and 2020 brought the subsidy down from 50 BTC to its current level, pushing annualized supply growth below 1%.

The next halving is estimated for April 2028, and the final fractions of Bitcoin are expected to be mined around 2140.

Bitcoin (BTC/USD) Price Pullback Aligns With Technical Weakness

Despite a tightening supply, price action has weakened. Bitcoin has fallen toward the mid-$80,000s, breaking below a long-term ascending trendline that supported most of the 2024 advance.

BTC now trades under both the 20-EMA and 50-EMA on the daily chart, reinforcing bearish momentum.

The chart also reflects a completed ABCD pattern near the $115,000 high and a breakdown from a rising wedge, both common precursors to broader corrections.

Price is approaching the $83,800–$74,500 demand zone, an area that previously generated strong buying interest. RSI near 28 shows oversold conditions, although a clear bullish divergence has not yet formed.

TradingView’s projected path suggests BTC may drift slightly lower before forming a stabilization pattern within the demand zone. A hammer or bullish engulfing candle would signal buyer re-entry.

Levels to Watch in the Weeks Ahead

A recovery above $96,000 would be the first sign of stabilization. A move through $100,700 could open the way to a retest of $115,200, provided sentiment improves. Failure to hold the demand area would expose $74,500 as the next key level.

For traders, current conditions resemble the early phase of an accumulation zone. If BTC reclaims its short-term EMAs and confirms support, the next rally could extend to major altcoins, including ETH, SOL, and XRP.

Bitcoin Hyper: The Next Evolution of BTC on Solana?

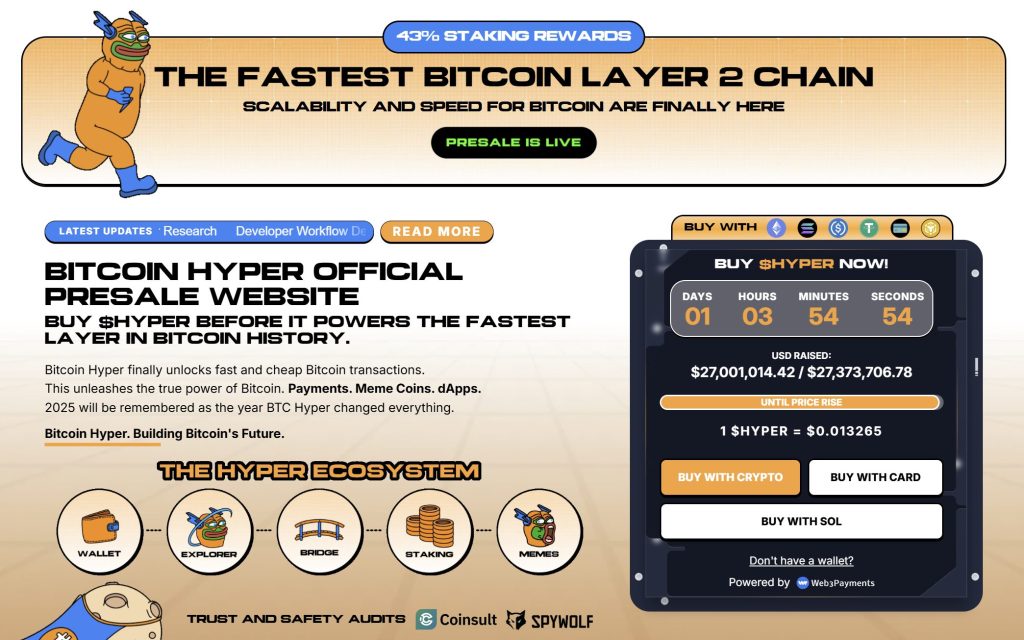

Bitcoin Hyper ($HYPER) is bringing a new phase to the Bitcoin ecosystem. While BTC remains the gold standard for security, Bitcoin Hyper adds what it always lacked: Solana-level speed. The result: lightning-fast, low-cost smart contracts, decentralized apps, and even meme coin creation, all secured by Bitcoin.

Audited by Consult, the project emphasizes trust and scalability as adoption builds. And momentum is already strong. The presale has surpassed $27 million, with tokens priced at just $0.013265 before the next increase.

As Bitcoin activity climbs and demand for efficient BTC-based apps rises, Bitcoin Hyper stands out as the bridge uniting two of crypto’s biggest ecosystems. If Bitcoin built the foundation, Bitcoin Hyper could make it fast, flexible, and fun again.

Click Here to Participate in the Presale