Bitcoin is at $110,085, down nearly 2.50% in the last 24 hours, with $84 billion in daily volume. Market cap is $2.19 trillion, still dominant after the big correction. The decline is as global policy signals, institutional adoption, and technicals all line up for the next phase of Bitcoin.

Japan’s Crypto-Friendly Stance

In Tokyo this week, Japan’s Finance Minister Katsunobu Katō highlighted the role of cryptocurrencies in diversifying investment portfolios. Despite volatility, Katō emphasized that BTC and other assets can help investors hedge risks.

His remarks arrive at a time when Japan is grappling with a debt-to-GDP ratio above 200% and pressure from a weakening yen. With savings eroding under low interest rates and inflation risks, digital assets present an increasingly attractive alternative.

Katō also noted that Japan seeks to encourage crypto innovation without overregulation — a signal that could spur greater domestic adoption of Bitcoin.

CBDC Fears Strengthen Bitcoin

Across the globe, central bank digital currencies (CBDCs) continue to spark debate. A U.K. think tank warned that programmable CBDCs could give governments “total control” over money, comparing them to Orwell’s 1984. Susie Violet Ward, CEO of Bitcoin Policy UK, called CBDCs the “weaponization of money in its purest form.”

The US and Europe are going in different directions. Trump banned CBDCs in January 2025; the European Central Bank will launch a digital euro in October with privacy built in. Against that backdrop, Bitcoin’s decentralized model looks like a safety net against overreach, and that’s why it’s a long-term store of value.

Webull Expands U.S. Bitcoin Access

In the United States, access to BTC just widened. Investment platform Webull reintroduced crypto trading in its main app, integrating tokens directly with stocks and options. The platform now supports over 50 assets, including Solana (SOL), Ethereum (ETH), and Bitcoin (BTC).

Webull’s U.S. CEO, Anthony Denier, cited clearer regulations and rising demand as reasons to re-enter the crypto space. The move puts Webull in closer competition with Robinhood, making Bitcoin more accessible for retail investors and boosting long-term demand.

Bitcoin Price Prediction – Technical Outlook

Technically, Bitcoin price prediction is bearish as it’s still in a descending channel, with lower highs and lower lows. 50-EMA ($114,180) and 100-EMA ($115,000) are acting as resistance, capping rallies.

Momentum signals show weakness but also potential exhaustion:

- RSI at 32 hovers near oversold levels.

- MACD remains negative, though histogram bars are narrowing.

- Candlesticks with long lower wicks around $110,000 signal dip-buying interest.

If Bitcoin fails to hold $110,000, downside targets include $108,700 and $105,150. Above $112,000 could retest $115,000, above $116,850 could open up $120,900, and retest $124,450. Looking forward, if bulls take control, we could see $130,000 in the next few months.

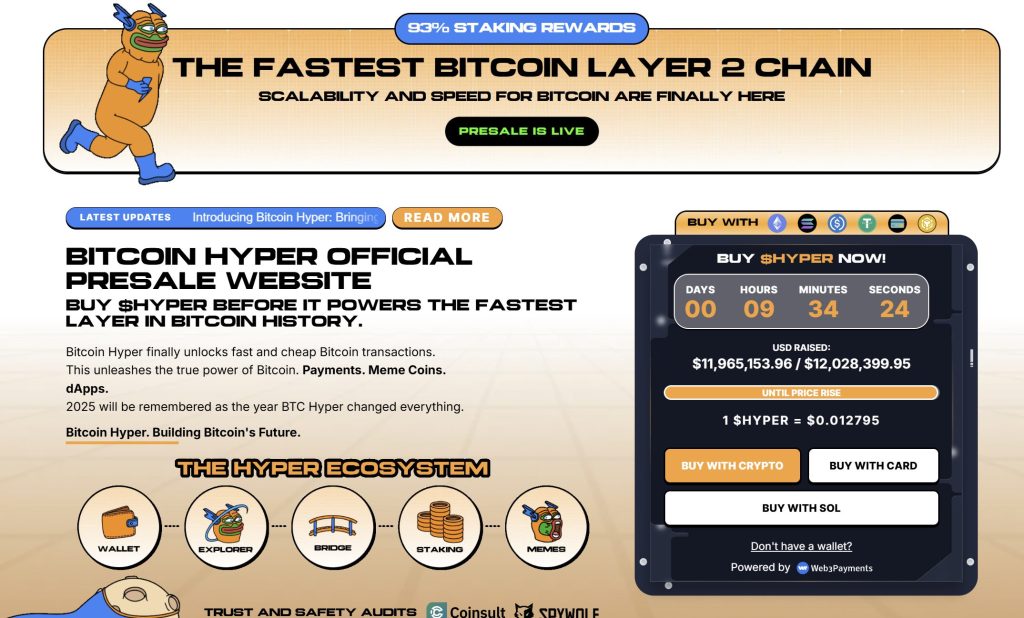

Presale Bitcoin Hyper ($HYPER) Combines Bitcoin Security With Solana Speed

Bitcoin Hyper ($HYPER) is positioning itself as the first Bitcoin-native Layer 2 powered by the Solana Virtual Machine (SVM). Its goal is to expand the Bitcoin ecosystem by enabling lightning-fast, low-cost smart contracts, decentralized apps, and even meme coin creation.

By combining Bitcoin’s unmatched security with Solana’s high-performance framework, the project opens the door to entirely new use cases, including seamless BTC bridging and scalable dApp development.

The team has put strong emphasis on trust and scalability, with the project audited by Consult to give investors confidence in its foundations.

Momentum is building quickly. The presale has already crossed $11.9 million, leaving only a limited allocation still available. At today’s stage, HYPER tokens are priced at just $0.012795—but that figure will increase as the presale progresses.

You can buy HYPER tokens on the official Bitcoin Hyper website using crypto or a bank card.

Click Here to Participate in the Presale