Bitcoin is currently trading at about $87,650, down 0.29% over the last 24 hours. The market is dealing with the fallout from crypto ETF outflows and the usual holiday trading slowdown. Despite a bit of a pullback, Bitcoin’s price movements are still orderly and not all over the place.

The overall market capitalisation of Bitcoin stands at $1.75 trillion, which is still a healthy number given its circulating supply of nearly 20 million.

The most notable thing here is Bitcoin’s stability. Even on the inside of a pullback, buyers are still holding the line above that $86,700 to $87,000 zone. That tells you more about consolidation than distribution.

Bitcoin Technical Analysis: Symmetrical Triangle in Play

Bitcoin price prediction seems neutral as on the 2-hour chart, you’ll find that BTC is being corralled by a symmetrical triangle. It’s a pattern that has been chewing away at price since mid-month. The lower boundary aligns with current support levels, while the upper boundary caps the price near $90,000 to $90,200.

Even with the 50-day and 100-day EMAs converging around $87,900, the balance still looks to be holding. The candlestick chart is also saying the same thing: buyers have been stepping in quickly on all these little pullbacks. There hasn’t been a single decisive close below those key averages, suggesting sellers just aren’t getting enough follow-through.

RSI is right in the mid-50s, easing back a bit from the previous highs but never actually entering bearish territory. That tends to precede some bit of a volatility expansion, especially when you’ve got a tightening triangle on the go.

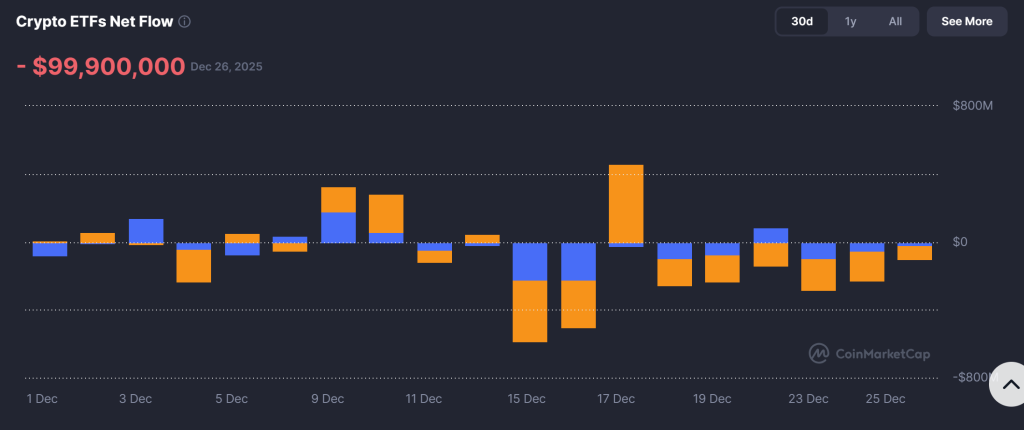

ETF Outflows Add To The Pressure But No Panic Yet

According to the latest data, crypto ETFs recorded a net outflow of $99.9 million on December 26. This has had some impact on how the market’s feeling right now, but the price action suggests it’s absorbing the flow without panicking.

Other indicators are still a bit mixed but remain pretty stable:

- The fear and greed index is at thirty, which is associated with some base-building, so it’s a good sign.

- The altcoin season index currently sits at 20 out of 100, confirming that Bitcoin is in charge.

- The overall crypto market capitalisation is $2.97 trillion, with trading volume slightly above $110 billion.

Bitcoin (BTC/USD) Breakout Levels Are Worth Keeping An Eye On

If the price of Bitcoin can break over that $90,200 level, it would likely open the floodgates to $92,200. Whereas, an additional bullish breakout is likely to take it all the way up to $94,500 to $95,000, based on the triangle’s range. However, a downside break below $86,500 would take it to $85,200 – although that’s a secondary scenario and unlikely unless the structure starts to fail.

As Bitcoin tightens up and prepares to move, this feels more like a period of accumulation than a sell-off on absolute exhaustion. If momentum returns, the next up leg could have a big impact on the market direction in early 2026. That said, it could set the stage for some renewed optimism that could permeate the entire crypto space.

Bitcoin Hyper: The Next Evolution of BTC on Solana?

Bitcoin Hyper ($HYPER) is bringing a new phase to the Bitcoin ecosystem. While BTC remains the gold standard for security, Bitcoin Hyper adds what it always lacked: Solana-level speed. The result: lightning-fast, low-cost smart contracts, decentralized apps, and even meme coin creation, all secured by Bitcoin.

Audited by Consult, the project emphasizes trust and scalability as adoption builds. And momentum is already strong. The presale has surpassed $29.8 million, with tokens priced at just $0.013495 before the next increase.

As Bitcoin activity climbs and demand for efficient BTC-based apps rises, Bitcoin Hyper stands out as the bridge uniting two of crypto’s biggest ecosystems. If Bitcoin built the foundation, Bitcoin Hyper could make it fast, flexible, and fun again.

Click Here to Participate in the Presale