Bitcoin developers have approved a major protocol update set to go live on October 30, one that could reshape the network’s data capabilities, and the debate is already heated. Dubbed Bitcoin Core 30, the upgrade removes the long-standing 80-byte OP_RETURN limit, allowing up to 4MB of data to be embedded in transactions.

Supporters say this change improves how Bitcoin handles metadata, enabling use cases like NFTs and tokenized documents to be directly on-chain. Critics, however, worry that the move undermines Bitcoin’s original ethos as a peer-to-peer monetary system and fear it could accelerate network bloat, leading to further centralization.

While developer Gloria Zhao argues the update formalizes what miners are already doing, detractors claim the change lacks sufficient consensus.

One community member went so far as to call it “a disgraceful precedent,” citing inadequate transparency and stakeholder involvement. Whether it’s an innovation or a deviation remains to be seen, but the October fork is now locked in, and the market is watching closely.

Bitcoin Technical Setup Supports $112K Breakout

Despite the controversy, the Bitcoin price prediction remains resilient, as BTC is currently trading at $109,717, up 0.04% in the last 24 hours, with a market cap of $2.18 trillion and a volume of over $52.9 billion.

On the 1-hour chart, price continues to follow an ascending channel, with the 50-EMA ($108,908) offering dynamic support.

Price recently bounced off $108,910, a key horizontal level, and is now consolidating below the $110,568 resistance. The MACD indicator is flat but not bearish, while neutral candlesticks suggest the price is coiling ahead of a breakout. If price clears $110,568 with substantial volume, targets include:

- $112,000: Next resistance in the current range

- $113,500: Upper boundary of the ascending channel

On the downside, losing $108,900 could open room for a drop to $106,960. Until then, bulls remain in control of the trend.

Long-Term Metrics Reinforce Bullish Outlook

Market internals paint a more robust picture. Realized capitalization, a key measure of long-term holder conviction, reached an all-time high of $934.88 billion on June 7, despite prices ranging between $102,000 and $106,000.

This suggests that long-term investors are accumulating, rather than selling, even in the face of policy uncertainty.

Moreover, the total crypto market cap soared by $50 billion on June 9, reclaiming the $2.14 trillion mark following a clean double-bottom pattern. This, combined with constant inflows and robust on-chain activity, indicates that whales and institutions stay confident.

Conclusion

Bitcoin’s upcoming Core 30 upgrade is dividing opinion but not derailing price. The technical setup is bullish, long-term investors are holding, and market inflows remain strong. If Bitcoin clears $110,568, a run toward $113,500 is well within reach, even with October’s fork looming.

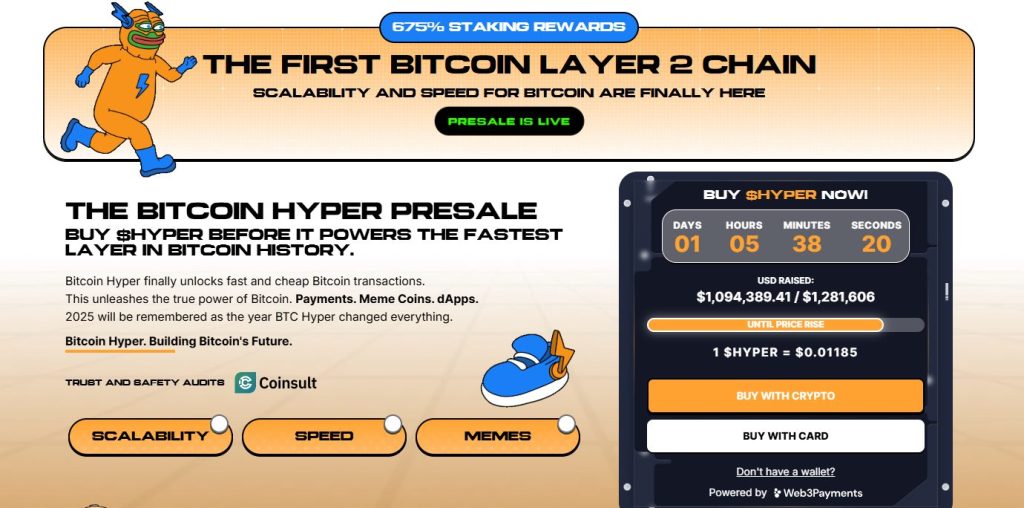

Bitcoin Hyper Presale Surges Past $1M—Layer 2 Just Got a Meme-Sized Boost

Bitcoin Hyper ($HYPER) has smashed through the $1 million mark in its public presale, raising $1,094,415.49 out of a $1.28 million target. With just hours left before the price jumps to the next tier, buyers can still lock in $0.01185 per HYPER.

As the first Bitcoin-native Layer 2 powered by the Solana Virtual Machine (SVM), Bitcoin Hyper brings fast, low-cost smart contracts to the BTC ecosystem. It merges Bitcoin’s security with SVM’s scalability, enabling high-speed dApps, meme coins, and payments—all with cheap gas fees and seamless BTC bridging.

Audited by Consult, Bitcoin Hyper is engineered for speed, trust, and scale. Over 77.7 million $HYPER are already staked, with estimated 675% APY post-launch rewards. The token also powers gas fees, dApp access, and governance.

The presale accepts crypto and cards, and thanks to Web3Payments, no wallet is needed. Meme appeal meets real utility—Bitcoin Hyper might be Layer 2’s breakout star of 2025.