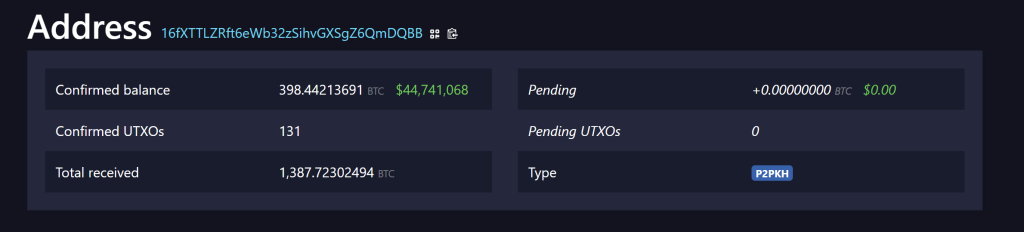

Bitcoin is trading around $112,300 today, with daily trading volumes topping $47.78 billion and a market cap of more than $2.23 trillion. But beyond the price, one story has caught the market’s attention: a Bitcoin wallet that hadn’t moved its coins since 2012 suddenly came alive.

The wallet held 479 BTC, worth over $52 million at today’s prices. This week, it shifted around 80 BTC (roughly $8.9 million) into new addresses. Moves like this from “whales”, large holders, often grab attention because they can signal selling or repositioning after years of inactivity.

This isn’t the only whale activity lately.

Just days ago, another holder deposited 2,000 BTC ($216 million) onto an exchange and swapped it into Ethereum. In July, a massive 80,000 BTC transfer, one of the largest ever, was handled by Galaxy Digital on behalf of a client.

Why Whales Matter

Whales aren’t always individual traders; they can be early miners or institutions that collected coins in Bitcoin’s early years. When they start moving coins, traders watch closely, since selling pressure could weigh on prices.

At the same time, experts argue that gradual selling by whales often helps avoid sudden, extreme volatility.

Right now, Bitcoin has cooled from its $124,128 high last month, slipping about 12%. It’s been stuck between $110,000 and $120,000 for weeks. Interestingly, in prediction markets, about 70% of traders expect BTC to drop toward $105,000 before attempting another breakout to $125,000.

Bitcoin (BTC/USD) Short-Term Technical Outlook

On the chart, the Bitcoin price prediction appears bullish as BTC is forming an ascending triangle, a pattern that often signals a breakout to higher levels. Price is pressing against the $113,152 zone, which lines up with the 200-day EMA (a key moving average).

Since bouncing from $106,000, BTC has been building higher lows, showing buyers are stepping in.

The RSI at 60 signals momentum is healthy but not overextended. A bullish engulfing candle at $111,200 confirms demand is strong. If Bitcoin clears $113,400, it could run toward $115,600 and $117,500. On the downside, if support at $111,200 breaks, we could see dips to $109,350 or $107,407.

For traders, the setup looks promising: a breakout above $113,400 could be an entry, with targets at $115,600–$117,500.

Looking further ahead, if momentum holds, Bitcoin could eye the $130,000 milestone, giving long-term holders plenty to stay optimistic about.

Presale Bitcoin Hyper ($HYPER) Combines Bitcoin Security With Solana Speed

Bitcoin Hyper ($HYPER) is positioning itself as the first Bitcoin-native Layer 2 powered by the Solana Virtual Machine (SVM). Its goal is to expand the Bitcoin ecosystem by enabling lightning-fast, low-cost smart contracts, decentralized apps, and even meme coin creation.

By combining Bitcoin’s unmatched security with Solana’s high-performance framework, the project opens the door to entirely new use cases, including seamless BTC bridging and scalable dApp development.

The team has put strong emphasis on trust and scalability, with the project audited by Consult to give investors confidence in its foundations.

Momentum is building quickly. The presale has already crossed $14 million, leaving only a limited allocation still available. At today’s stage, HYPER tokens are priced at just $0.012865—but that figure will increase as the presale progresses.

You can buy HYPER tokens on the official Bitcoin Hyper website using crypto or a bank card.

Click Here to Participate in the Presale