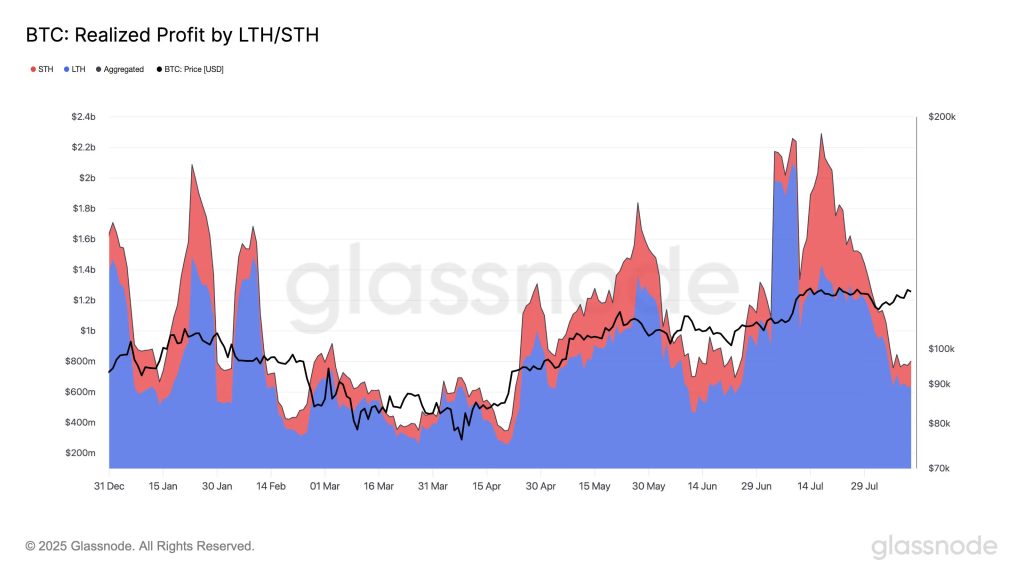

Bitcoin (BTC) is holding firm near $121,930 after rallying from $116,000 earlier this week, even as profit-taking activity remains muted. On-chain data from Glassnode shows that daily realized profits are averaging under $750 million in August—well below January and July peaks of $2 billion, despite BTC trading close to record highs.

This is mainly due to long-term holders (LTH) who have held through the recent volatility. Glassnode’s Realized Profit metric, which measures the profit from coins sold above their acquisition price, shows a clear trend: LTHs make more profit than short-term holders (STH) except during major breakouts.

The last such instance was in July, when STH profits spiked as Bitcoin hit its $123,000 all-time high—many of those gains traced back to buyers from March’s “tariff tantrum” dip to $76,000.

With current realized profits significantly below prior peaks, market sentiment appears more committed than speculative. This disciplined holding behavior could be the stability catalyst needed for Bitcoin’s next major leg up.

Bitcoin (BTC/USD) Technical Picture Signals Breakout Potential

From a technical perspective, Bitcoin has broken above the descending channel that had been capping price since mid-July. This bullish breakout was accompanied by a big increase in volume, showing increased conviction.

The daily chart shows BTC re-taking the 23.6% fib at $117,335 and bumping up against the $123,236 swing high – a resistance where sellers may appear.

The bigger picture is still intact, price is supported by higher lows and the 50 day SMA at $114,724.

Momentum indicators are equally supportive: RSI stands at 66.26, suggesting strong but not yet overextended buying, while the MACD has confirmed a bullish crossover above the zero line. Price action has printed consecutive wide-bodied green candles, reinforcing the strength of current demand.

A daily close above $123,236 would open the door to $127,000, with $130,000 as a psychological milestone. If sellers hold this line, immediate supports lie at $117,335, followed by $113,650 and the 50-day SMA.

Bitcoin (BTC/USD) Trade Outlook and Risk Levels

For crypto traders, the trading setup offers both breakout and pullback opportunities:

- Bullish scenario: Enter on a confirmed break above $123,236, with stops at $119,800. Initial targets: $127,000 and $130,000.

- Conservative entry: Wait for a retest of $117,335 and enter on signs of a bounce.

- Bearish play: Short rejections at $123,000–$123,500 with tight stops above $123,500, targeting a retracement toward $117,000.

With long-term holders keeping supply off the market, upside pressure could intensify quickly if resistance levels break. Traders should watch for strong volume confirmation before positioning for a sustained move higher.

New Presale Bitcoin Hyper ($HYPER) Combines Bitcoin Security With Solana Speed

Bitcoin Hyper ($HYPER) is the first Bitcoin-native Layer 2 powered by the Solana Virtual Machine (SVM), built to supercharge the Bitcoin ecosystem with fast, low-cost smart contracts, dApps, and meme coin creation.

By merging Bitcoin’s security with Solana’s performance, it unlocks powerful new use cases – all with seamless BTC bridging.

The project is audited by Consult and built for scalability, simplicity, and trust.

Investor interest is surging, with the presale already surpassing $9 million and only a small allocation remaining.

HYPER tokens are currently available at just $0.012675, but that price is set to rise soon.

You can buy HYPER tokens on the official Bitcoin Hyper website using crypto or a bank card.

Click Here to Participate in the Presale