Bitcoin (BTC) continues to hover near $107,500, consolidating in a tight range between $106,450 and $108,980 during Monday’s U.S. session. While the price action remains calm, institutional momentum is building.

Michael Saylor’s Strategy (formerly MicroStrategy) disclosed the acquisition of 4,980 BTC for $531.9 million, averaging $70,982 per coin. The move raises Strategy’s total holdings to 597,325 BTC, further entrenching its position as the world’s largest corporate Bitcoin holder.

Joining the buying spree, Japan’s Metaplanet added 1,005 BTC worth $108 million, boosting its total to 13,350 BTC, now valued at around $1.45 billion.

The firm used zero-interest bonds to fund the purchase and has outlined targets of 100,000 BTC by 2026 and 210,000 BTC by 2027. CEO Simon Gerovich noted that the firm’s 2025 BTC yield has already hit 349%. The company’s stock jumped 9% on the news, adding to a 350% YTD rally.

With back-to-back institutional buys, sentiment appears to be turning bullish, possibly laying the groundwork for a breakout above the $109,000 resistance zone.

Robinhood Pushes Crypto and Tokenized Equities Into Europe

Robinhood has officially expanded into the European market using Arbitrum, an Ethereum Layer-2 scaling solution. The platform now enables European users to trade tokenized U.S. stocks and crypto futures with up to 3x leverage, adding fresh competition to centralized and decentralized platforms alike.

New product rollouts include:

- A proprietary Ethereum L2 focused on real-world assets

- Staking services for Ethereum and Solana (U.S. only)

- A 0.1% FX fee to reduce conversion friction

- Crypto tax management tools and a cashback crypto credit card

While the expansion temporarily shifts market focus to Ethereum, the move broadly strengthens crypto infrastructure, an indirect benefit for Bitcoin adoption across new markets.

Bitcoin Technical Outlook: All Eyes on $109K Breakout

Technically, Bitcoin remains locked in a sideways range. The price is holding above its 50-period EMA at $107,377, but momentum is fading. The MACD histogram is flattening, and signal lines are converging near zero, typical of consolidation phases before a decisive move.

Key Levels to Watch:

- Resistance: $108,980 → $110,448 → $111,944

- Support: $106,450 → $104,840 → $103,030

Trade Setup Ideas:

- Bullish: Enter on confirmed breakout above $109,000, targeting $110,448 and $111,944

- Bearish: Sell below $106,450, with downside targets at $104,840 and $103,030

Until the range breaks, traders should stay patient, keeping Bitcoin price prediction neutral. A close outside this channel, particularly with volume, will likely define Bitcoin’s next move.

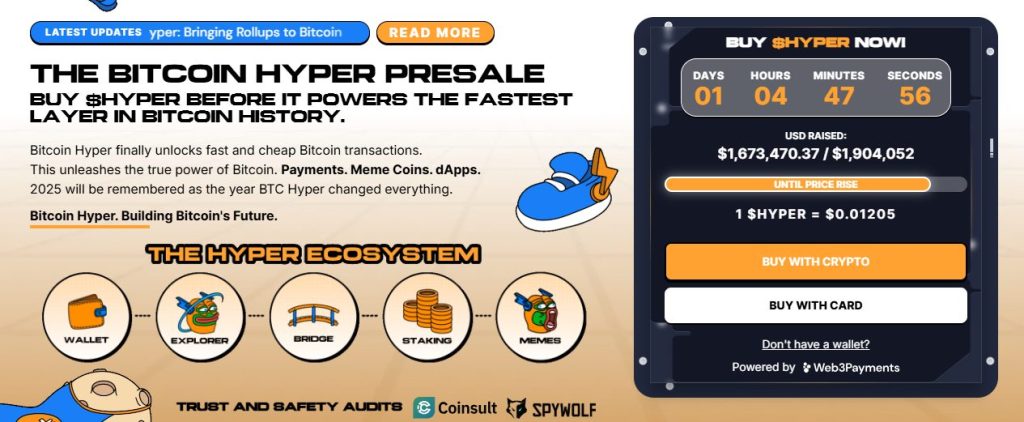

Bitcoin Hyper Presale Surges Past $1.74M as Price Rise Nears

Bitcoin Hyper ($HYPER), the first Bitcoin-native Layer 2 powered by the Solana Virtual Machine (SVM), has surpassed $1.74 million in its public presale, with $1,748,091.98 raised out of a $1,974,249 target. The token is priced at $0.012075, with the next price tier expected within hours.

Designed to merge Bitcoin’s security with Solana’s speed, Bitcoin Hyper enables fast, low-cost smart contracts, dApps, and meme coin creation, all with seamless BTC bridging. The project is audited by Consult and engineered for scalability, trust, and simplicity.

The golden cross of meme appeal and real utility has made Bitcoin Hyper a Layer 2 contender to watch in 2025. With staking, a streamlined presale, and full rollout expected by Q1, $HYPER is gaining serious traction.