Bitcoin price has entered a sideways trading pattern following its peak at $123,200 reached one week ago.

While this price consolidation has contributed to a decline in Bitcoin dominance, smart money and institutional investors have intervened strategically, pushing BTC back above the crucial $119,000 resistance threshold.

The current Bitcoin market structure has prompted analysts to anticipate a potential new all-time high in the near term, with many suggesting that the present dip could represent the final opportunity to acquire BTC before it reaches $150,000.

Bitcoin Price Prediction to $150k: Smart Money Accumulation Drives Market

CryptoQuant data indicate that at this stage of the bull cycle, retail accumulation has shifted significantly to the negative side.

However, a distinct accumulation pattern has emerged, spearheaded by whales and sophisticated investors.

Evidence suggests that institutions, investment funds, and high-volume wallets, including ETFs, have begun aggressive Bitcoin accumulation.

Fadi Aboualfa, Copper’s head of research, echoes this sentiment, noting that BTC’s recent return to all-time highs has been predominantly fueled by institutional capital, with “leverage-driven retail mania fading into history.”

Aboualfa believes Bitcoin “appears primed for another significant leg upward” and anticipates an accelerated rally targeting the $140,000 to $200,000 range in the coming period.

Conversely, on-chain analytics firm Glassnode has issued warnings about impending “froth” in Bitcoin and the broader cryptocurrency market.

This condition is characterized by elevated open interest levels across derivatives markets, which may jeopardize upward momentum.

Bitcoin Price Analysis: RSI Bearish Divergence Points to $116K Gap Fill

As of July 24, Bitcoin is trading near $119,100 after cooling off from its recent all-time high of $123,218.

The price has entered a consolidation phase, hovering just below the $120,000 resistance zone and forming a tightening structure on the 1-hour chart.

A visible bearish divergence on the Relative Strength Index (RSI) suggests weakening bullish momentum, increasing the probability of a short-term pullback.

One key area of interest is the unfilled liquidity gap near $116,000 — a fair value zone that could act as a magnet before any continuation higher.

If that support fails, further downside could extend to the $112,000–$108,000 region, though this remains unlikely unless broader sentiment sharply turns.

On the flip side, a clean breakout above $120,000 would invalidate the bearish setup and put $123,000 back in play, opening the door to fresh highs in the $130K–$150K range.

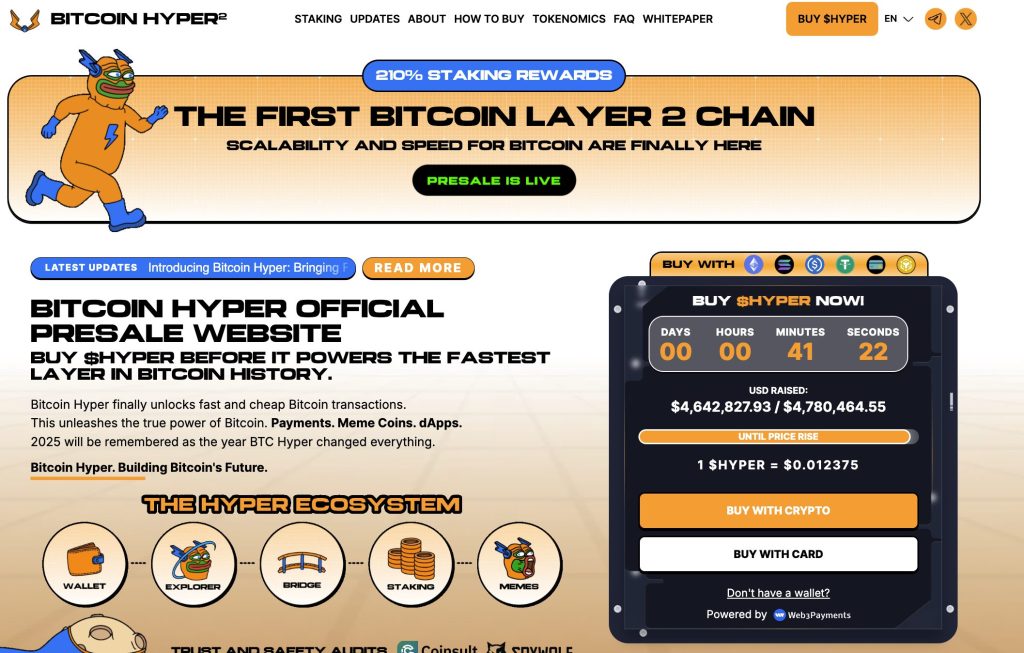

Why Investors Are Eyeing the $HYPER Token – A New Bitcoin Layer 2 With Big Potential

With Bitcoin looking ready to climb again, smart investors are turning to smaller, fast-moving altcoins that could deliver even bigger returns.

One of the most talked-about projects right now is Bitcoin Hyper ($HYPER) – and for good reason.

It’s already raised over $4.5 million in early funding, showing strong interest from early movers.

Bitcoin Hyper is a “Layer 2” project – basically, it supercharges Bitcoin by making it faster, cheaper to use, and capable of running smart contracts.

In simple terms: it gives Bitcoin the power of modern blockchains, without losing what makes it great.

For anyone looking to get in early on the next wave of BTC innovation, $HYPER could be a serious opportunity.

To join the presale, you can visit the official Bitcoin Hyper website.

You can use crypto or a card to complete the transaction.