Bitcoin is trading in a tight $87,000–$90,000 range, but recent developments suggest this consolidation may be more than a pause. On January 22, 2026, reported that Bitwise Asset Management launched the Bitwise Proficio Currency Debasement ETF (BPRO), an actively managed fund that combines Bitcoin, gold, silver, precious metals, and mining equities under one structure.

The message from Wall Street is clear. BTC is no longer being framed as a speculative trade alone, but as part of a broader hard-asset allocation strategy designed to hedge currency debasement. Bitwise manages over $15 bn in client assets, while Proficio Capital Partners oversees roughly $5 bn, placing this product firmly in institutional territory. The ETF allocates at least 25% to gold, with flexible exposure to Bitcoin and other scarcity-based assets, signaling long-term conviction rather than short-term positioning.

This matters for price. When institutional vehicles treat Bitcoin alongside gold, flows tend to be slower, larger, and more persistent.

Bitcoin (BTC/USD) Technical Analysis: Why the $87K–$90K Zone Matters for BTC

From a technical perspective, Bitcoin price prediction seems bearish as BTC’s current range reflects compression, not breakdown. Price has repeatedly held above the $87,400–$88,000 support zone, an area defined by prior demand and reinforced by long lower candlestick wicks. These candles show sellers losing follow-through rather than accelerating downside momentum.

On the 4-hour chart, BTC remains inside a broader ascending channel, with price consolidating into a descending flag. The 50-EMA and 100-EMA are flattening, while the 200-EMA continues to rise near the mid-$86,000s, preserving the higher-timeframe trend. RSI is stabilizing near the high-30s to low-40s, recovering from oversold conditions without flashing bearish continuation signals.

In practical terms, this structure often precedes range expansion, not further liquidation.

Institutional Framing Supports a Breakout Case

What strengthens the technical setup is the macro narrative behind it. According to Bitwise, gold ETFs currently account for just 0.17% of private financial holdings, despite gold’s long-standing role as a store of value. Bitcoin’s inclusion alongside gold highlights how institutions are positioning for currency debasement, not short-term volatility.

Key takeaways from the BPRO launch:

- Actively managed exposure to BTC and precious metals

- Minimum 25% allocation to gold

- Designed as a hedge against declining fiat purchasing power

- Listed on NYSE under ticker BPRO

- Expense ratio of 0.96%

As these structures gain adoption, Bitcoin’s role shifts from tactical trade to portfolio component, which historically supports higher price floors.

Bitcoin Price Prediction: Why BTC’s $87K–$90K Range Could Set Up the Next Breakout

On the technical front, Bitcoin is trading near $89,000, and despite recent weakness, the broader picture still points to consolidation rather than trend failure. Price has pulled back to a rising trendline that has supported the move higher since $83,800, showing buyers remain active on dips.

If Bitcoin holds above $87,400, price could grind back toward $90,400, followed by a test of $92,000–$94,250. A break below $87,400 would delay this outlook and expose $85,600, but for now, pullbacks continue to look corrective rather than structural.

BTC Trade idea: Buy near $88,000–$87,500, target $94,000, stop below $85,500.

Bitcoin Hyper: The Next Evolution of BTC on Solana?

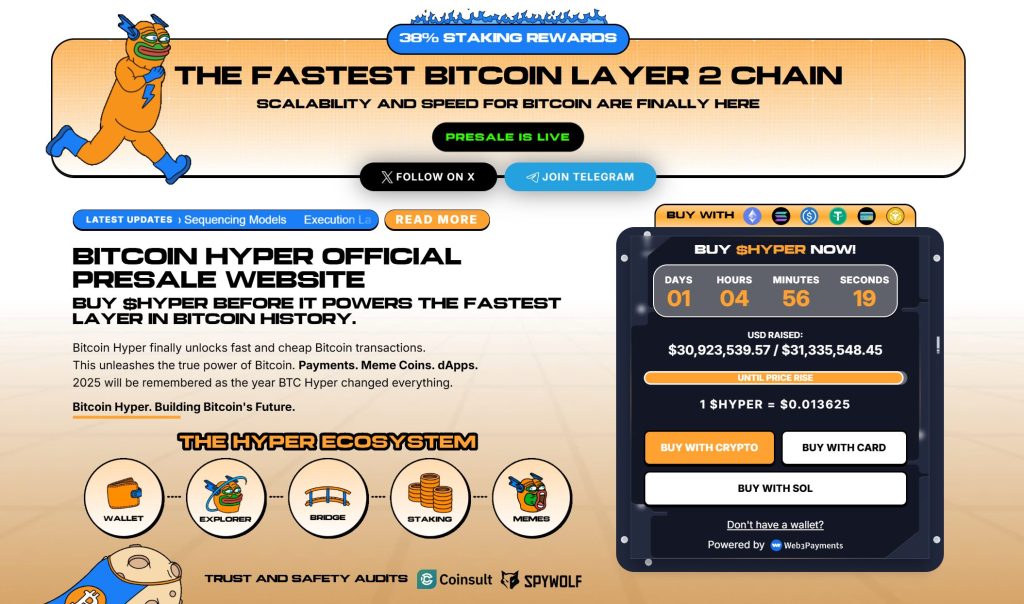

Bitcoin Hyper ($HYPER) is bringing a new phase to the BTC ecosystem. While BTC remains the gold standard for security, Bitcoin Hyper adds what it always lacked: Solana-level speed. The result: lightning-fast, low-cost smart contracts, decentralized apps, and even meme coin creation, all secured by Bitcoin.

Audited by Consult, the project emphasizes trust and scalability as adoption builds. And momentum is already strong. The presale has surpassed $30.9 million, with tokens priced at just $0.013625 before the next increase.

As Bitcoin activity climbs and demand for efficient BTC-based apps rises, Bitcoin Hyper stands out as the bridge uniting two of crypto’s biggest ecosystems. If Bitcoin built the foundation, Bitcoin Hyper could make it fast, flexible, and fun again.

Click Here to Participate in the Presale