Bitcoin is trading at $119,040, staging a modest rebound after slipping from the $123,236 resistance earlier this week. On the 4-hour chart, price remains within a broad ascending channel that has guided its uptrend since early August.

The 50-SMA at $118,753 is acting as dynamic support, repeatedly halting intraday pullbacks, while the 0.236 Fibonacci retracement level at $117,335 has so far held as a structural floor.

The RSI has bounced from the mid-40s, signaling that selling pressure is easing, while the MACD histogram is flattening out, hinting that bearish momentum is losing steam.

If Bitcoin manages to maintain this footing above $117,300, bulls could attempt another push toward the $123,236 resistance zone, with $126,242 as the next technical target.

Macro Events Keep Traders on Edge

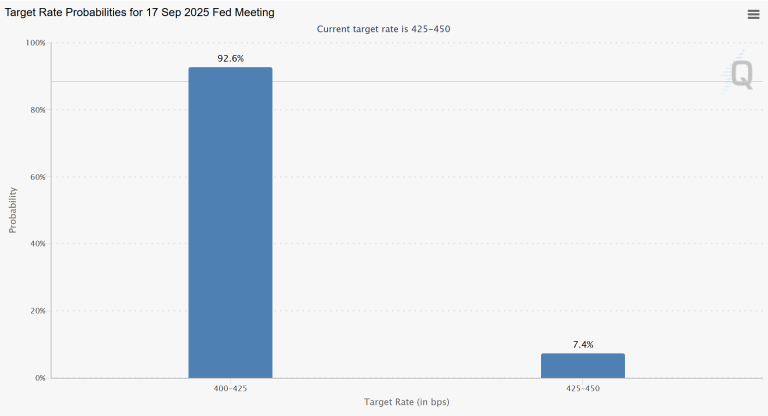

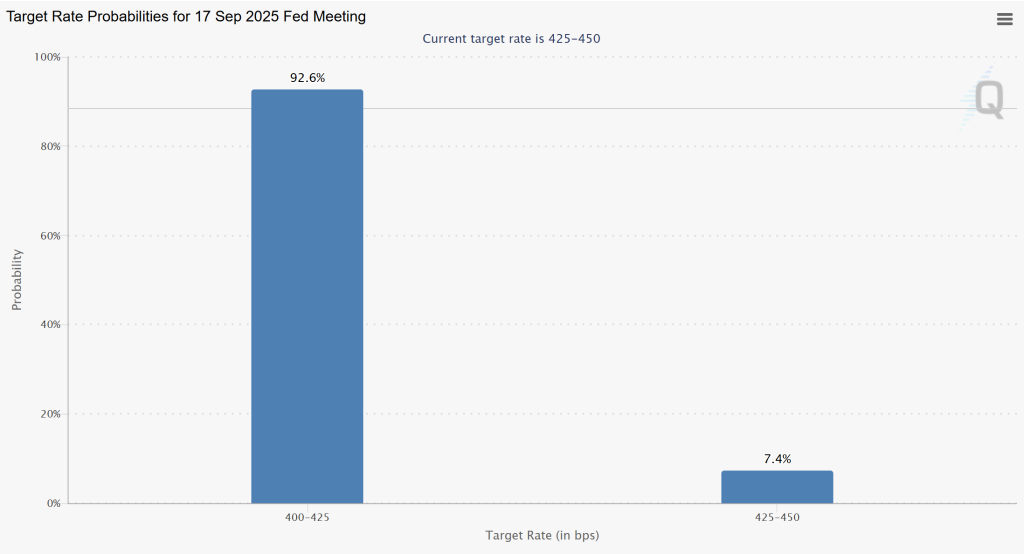

The macro backdrop is playing a critical role in shaping near-term sentiment. CME FedWatch Tool data shows traders are now pricing a 92.6% probability of the Federal Reserve cutting rates to 4.00–4.25% at its September 17 meeting, down from the current 4.25–4.50% range.

This expectation shift came after U.S. PPI data surprised to the upside at +0.9% versus the 0.2% forecast, while weekly jobless claims held steady at 224K.

Now onto Friday’s US retail sales and consumer sentiment numbers, which will tell us if the Fed will stick to the rate cut script. A soft print will boost risk appetite and give Bitcoin the push it needs to clear the overhead resistance.

Bitcoin (BTC/USD) Price Prediction: Technical Route to $130K

From a structural perspective, the price action is bullish. The channel is still intact, and higher lows are reinforcing the trend. A break above $126K will trigger buying and accelerate the move to $130K, which is a supply zone and psychological round number resistance.

If this break happens, the channel’s upper boundary will project to $150K in the coming quarters. On the flip side, a close below $117,300 will expose the $113,650 invalidation level, where the 100-SMA is.

Bitcoin (BTC/USD) Trade Setup

For traders, the accumulation zone between $117,300-$118,000 is a good risk-reward setup. Longs can target $123,200 first and then $126,200 with stops just below $113,650 to protect against a deeper correction.

With the technicals stable, the Fed leaning dovish, and macro catalysts coming up, Bitcoin’s next big move may happen sooner than we think. If the bulls can hold the current support and regain momentum, a move to $130K and higher is back on the table.

New Presale Bitcoin Hyper ($HYPER) Combines Bitcoin Security With Solana Speed

Bitcoin Hyper ($HYPER) is the first Bitcoin-native Layer 2 powered by the Solana Virtual Machine (SVM), built to supercharge the Bitcoin ecosystem with fast, low-cost smart contracts, dApps, and meme coin creation.

By merging Bitcoin’s security with Solana’s performance, it unlocks powerful new use cases – all with seamless BTC bridging.

The project is audited by Consult and built for scalability, simplicity, and trust.

Investor interest is surging, with the presale already surpassing $9.6 million and only a small allocation remaining.

HYPER tokens are currently available at just $0.012725, but that price is set to rise soon.

You can buy HYPER tokens on the official Bitcoin Hyper website using crypto or a bank card.

Click Here to Participate in the Presale