Bitcoin spot exchange-traded funds (ETFs) saw its second-highest record daily inflows of $1.18 billion on July 10, per Sosovalue data.

The significant institutional activity in the form of ETF inflows has driven the token’s price to a fresh record of $116,664 on Thursday. Bitcoin is currently trading at $118,140 at press time, briefly surpassing $118,450.

Additionally, the BTC spot ETFs have surpassed $51 billion in cumulative total net inflows, marking the first time and highlighting consistent investor appetite.

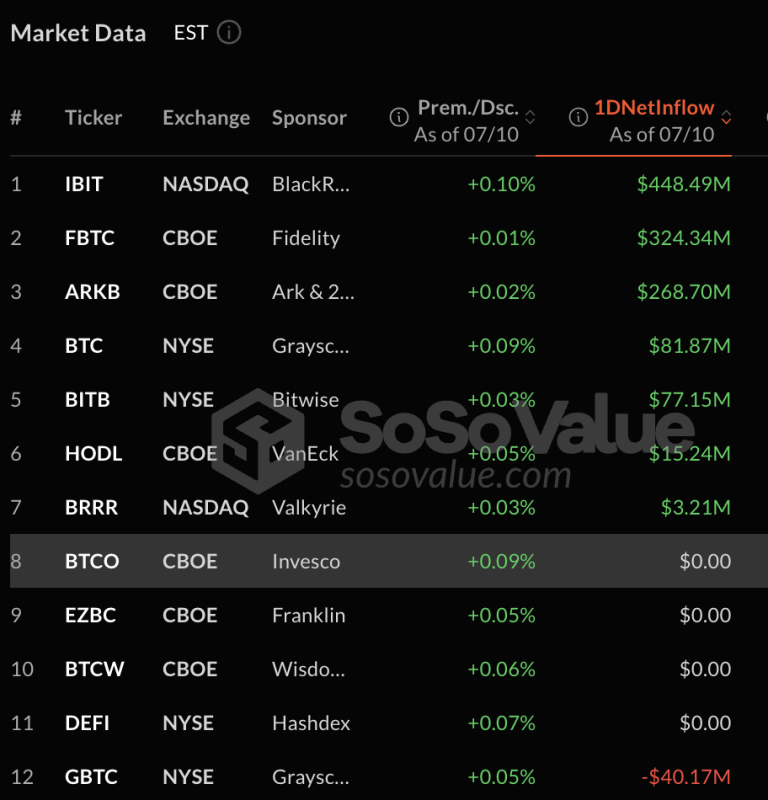

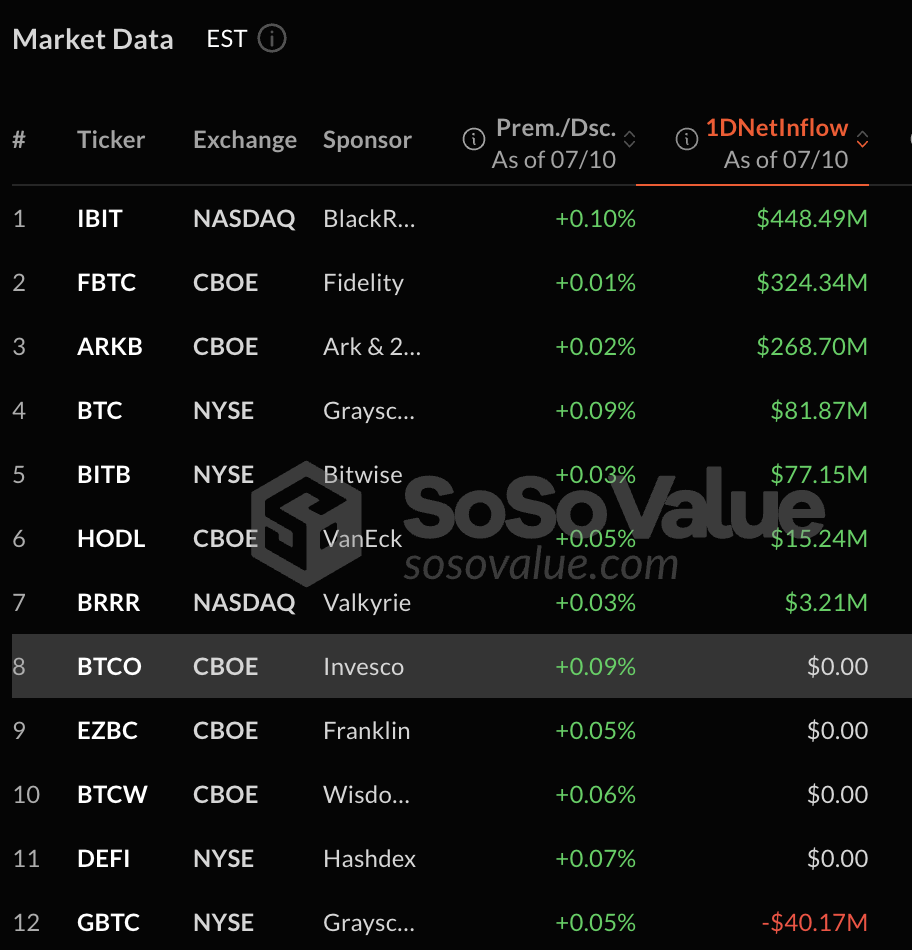

On Thursday, seven out of 12 Bitcoin funds reported net inflows, led by $448.49 million moving into BlackRock’s IBIT. Following IBIT, Fidelity dominates the flow leaderboard with its Bitcoin fund (FBTC) witnessing $324.34 million positive flows.

Ethereum Spot ETFs see $383M Total Net Inflows, Signals Strong Conviction

Ethereum spot ETFs also saw a total net inflow of $383 million, marking the second-highest record. Ether ETFs have $5.10 billion in cumulative net inflows so far.

Fueled by ETF demand, Ether is up 8% with a clean push beyond $3,000. “It’s showing more strength than Bitcoin this week, with fresh institutional flows and BlackRock’s ETH ETF hitting record volumes,” wrote Rachael Lucas, crypto analyst at BTC Markets. Ether is currently trading at $3,014 at the time of writing.

The Ether spot ETF daily net inflows of $300.93 million on July 10 is led by BlackShares iShares Ethereum Trust (ETHA), followed by Grayscale’s ETHE fund.

Further, ETHA saw significant investor interest with over $1.2 billion collected since June, indicating bullish market sentiment.

Lucas noted that the optimism marks a “defining moment” in both cryptos’ institutionalization.

“What we’re seeing is not a retail-driven frenzy, but a steady pipeline of capital from asset managers, corporate treasuries, and wealth platforms finally stepping into the market. Weeks of consistent inflows confirm that,” she added.