Bitcoin Spot ETFs have absorbed more than $12b in inflows since mid-April, yet its price remains stagnant.

On June 18, US spot Bitcoin ETFs pulled in $389m, according to SoSoValue data. BlackRock’s IBIT and Fidelity’s FBTC led the inflow surge, but the market has refused to rally in tandem.

Analysts at 10X Research suggest that surface-level bullish signals are masking underlying selling pressure. Inflows into ETFs may look strong, but they are likely being offset by quiet distribution from large holders, miners, and over-the-counter desks.

“There is a persistent bias toward highlighting positive developments—especially inflows and buying—while largely ignoring the equally important selling pressure,” the firm wrote in a report released Thursday.

No FOMO, No Fuel: Bitcoin Struggles as Retail and Risk Appetite Fade

Beyond the inflows, several headwinds are dampening momentum. Retail participation, a key driver in previous bull runs, remains unusually muted.

On-chain data shows a lack of smaller transactions (under $10,000), while Google Trends reveals low retail interest in Bitcoin compared to the frenzied peaks of 2017 and 2021.

Without widespread retail speculation, the kind that creates parabolic moves, prices have little fuel to break higher.

Geopolitical tensions and macroeconomic uncertainty are also contributing to the stall. The Israel-Iran conflict, potential US tariff shifts and mixed signals from the Federal Reserve are creating a cautious risk environment.

Despite Inflows, Market Stalls as Liquidations and Weak Liquidity Bite

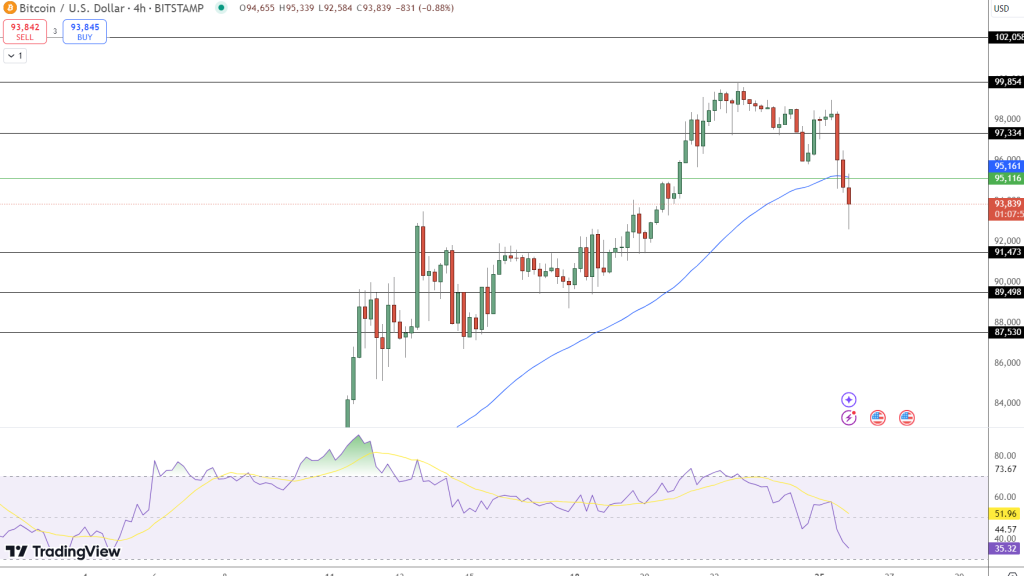

Bitcoin has responded by trading sideways, and recent liquidations totaling $1.2b in leveraged positions have only added downward pressure.

Liquidity conditions remain tight. Since March 2025, USD liquidity has been flat to slightly negative, limiting the flow of capital into speculative assets like Bitcoin. Even with ETF demand, the broader environment lacks the monetary backdrop seen in previous rallies.

At the same time, technical signals point to a market on edge. Volatility has compressed, a common precursor to large moves. Meanwhile, activity from long-dormant wallets has raised questions about whether early holders are exiting into strength.

For now, momentum appears stuck. Trump’s crypto-friendly stance and steady institutional inflows continue to make headlines, but the price action tells a different story. As 10X Research puts it, traders would do well to focus less on surface-level inflows and more on where real pressure is quietly building.