Key Takeaways:

- BitGo now competes directly with EU’s top crypto custodians.

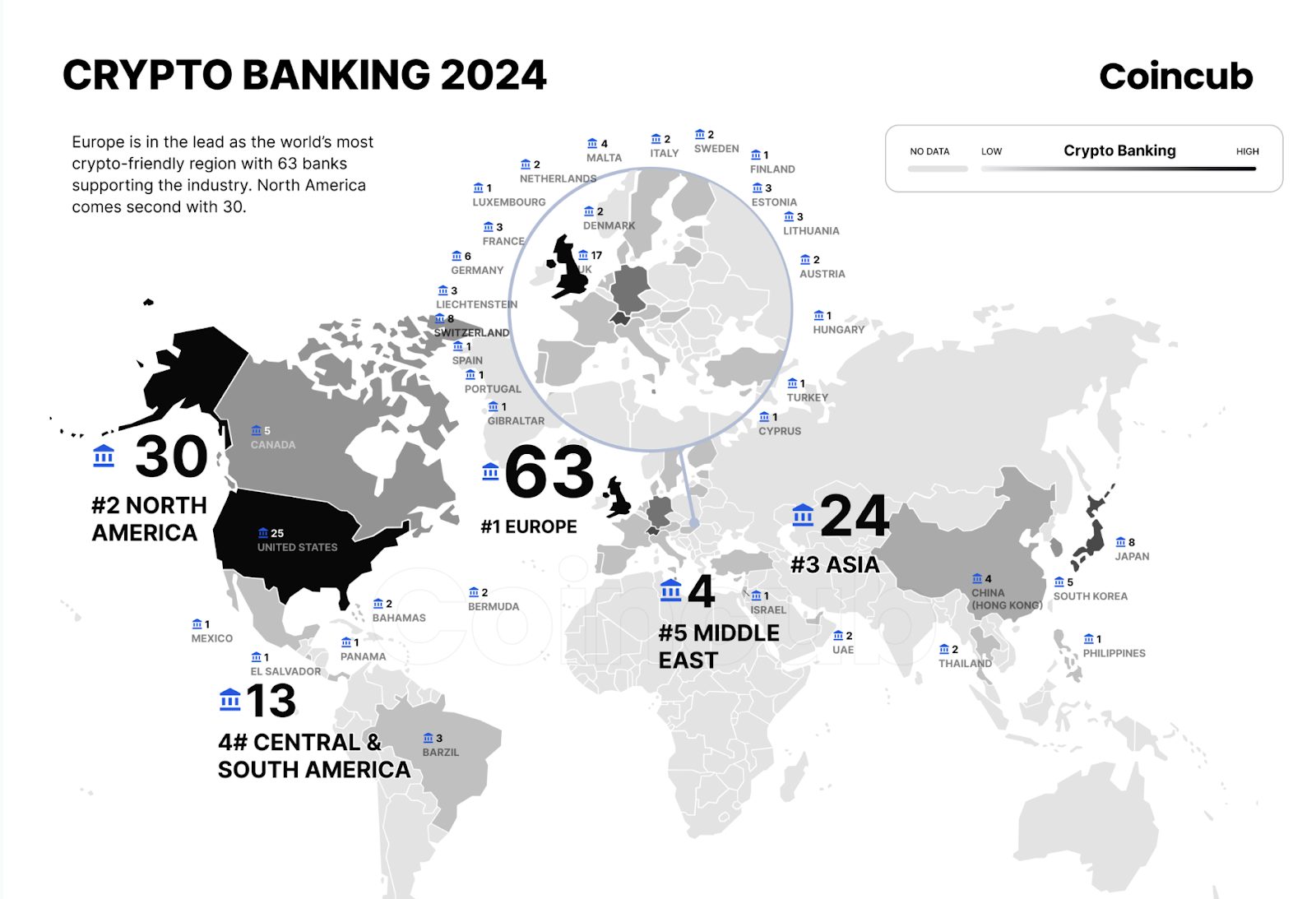

- Europe hosts twice as many crypto banks as North America.

- US crypto banking stalls despite political support.

Germany’s top financial watchdog, BaFin (the Federal Financial Supervisory Authority), approved a Markets in Crypto-Assets (MiCA) license for BitGo on May 12, unlocking crypto services across all 27 EU states. The approval catapults the California-based firm into head-to-head competition with homegrown titans like Boerse Stuttgart Digital and Bitpanda.

Can BitGo Outpace Europe’s Established Crypto Players?

According to an official press release by BitGo, the license grants the company the authority to serve both crypto-native firms and traditional financial institutions, including banks and asset managers.

Reacting to the recent achievement, Harald Patt, Managing Director of BitGo Europe, stated that BitGo looks forward to playing a key role in driving crypto adoption throughout Europe.

While this marks a major step in BitGo’s expansion strategy, the company has yet to announce the specific services it will roll out immediately under the MiCA license.

Nevertheless, the company’s latest regulatory win is part of a bigger push into the European market.

BitGo established its European headquarters in Frankfurt in 2023. Since then, BitGo Europe has secured regulatory registrations in Italy, Spain, Poland, and Greece, showing clear evidence of its commitment to building a strong regulated European presence.

BitGo isn’t alone in its pursuit. Boerse Stuttgart Digital, a unit of the Stuttgart Stock Exchange, became the first to receive a MiCA crypto asset service provider (CASP) license from BaFin back in January 2025.

Austria-based exchange Bitpanda followed suit through its German subsidiary, obtaining a MiCA CASP license earlier this year.

Global crypto exchange OKX also recently secured a MiCA license, clearing the path to operate across all 27 EU countries, including Germany.

BitGo’s timing couldn’t be better. As Europe accelerates its crypto regulations under the MiCA framework, companies with proper licensing will have a massive advantage.

Can Europe’s Crypto Banking Dominance Challenge the US?

While BitGo and other crypto firms gain momentum in Europe, a larger shift is underway. Europe is becoming the global epicenter for crypto-friendly banking.

Data from Coincub reveals 63 European banks currently provide a wide range of crypto services. These include crypto custody, staking, payments, stablecoin support, and even full banking services designed for crypto firms.

Circle’s Senior Director for EU Policy and Strategy, Patrick Hansen, believes this leadership isn’t coincidental.

Europe now hosts the largest number of crypto-friendly banks in the world, a direct result of the EU’s regulatory clarity and long-term investment in digital finance infrastructure.

Major institutions like Standard Chartered UK, BBVA Switzerland, and Barclays UK have invested heavily in crypto initiatives. Their efforts reflect Europe’s deliberate regulatory push to embrace new ideas and technologies, competition, and modernization in financial services.

In contrast, the United States lags behind with only 25 banks providing crypto services.

Nonetheless, there have been recent steps forward. In March, the U.S. Office of the Comptroller of the Currency (OCC) issued fresh guidance. The policies allow banks to engage in activities like stablecoin operations and crypto custody.

By the end of April, the Federal Reserve reversed earlier guidelines that had discouraged banks from working with crypto.

These moves align with President Trump’s renewed promise to make America the global crypto capital, but policy statements and short-term reversals may not suffice.

Europe has spent years building its regulatory foundation. The MiCA license serves not just as a symbol of control, but as a bridge connecting banks, fintechs, and the blockchain economy.

For example, BBVA Spain announced plans to allow customers to buy, sell, and manage Bitcoin and Ethereum directly from its mobile app. Deutsche Börse in Germany is also joining the trend as it moves quickly to launch crypto custody services for institutional clients, beginning with BTC and ETH.

The region’s head start in crypto custody and digital asset services could present a real challenge to the U.S.—unless it accelerates regulatory clarity and industry support. For now, the momentum is clearly in Europe’s favor.

Frequently Asked Questions (FAQs)

MiCA ensures stablecoins are safe and transparent. Issuers must hold enough cash or liquid assets to fully back their tokens. Independent auditors verify these reserves regularly, protecting users across the EU.

Tether doesn’t yet meet MiCA’s strict reserve and reporting rules. As a result, major exchanges like Binance have delisted USDT for European users, limiting its availability.

ESMA oversees MiCA’s implementation, working with national regulators like Germany’s BaFin. They audit crypto firms and monitor markets to block unauthorized assets.