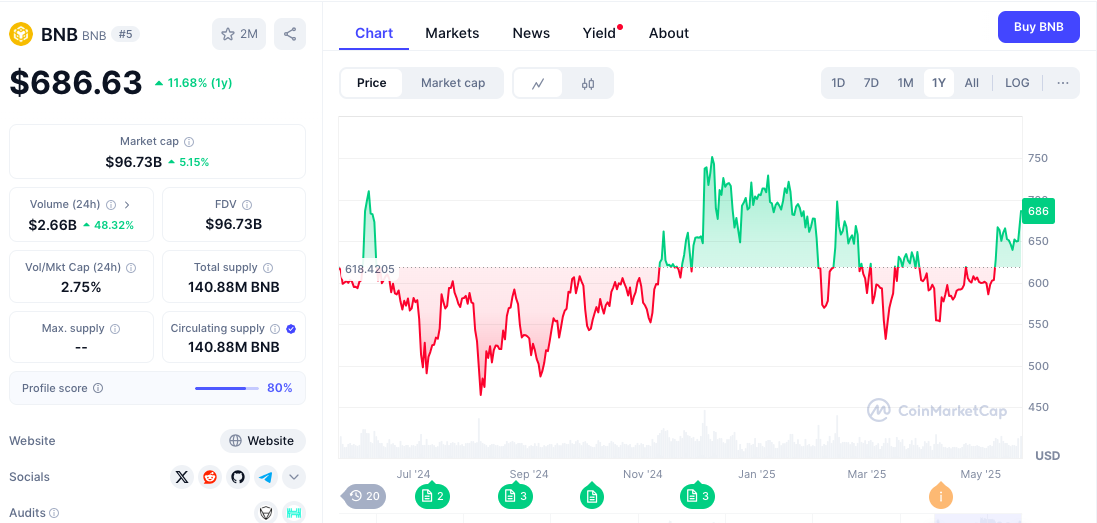

BNB Chain’s $96 billion token blasted past $668 on May 22, eclipsing Solana as transactions soared 600% and fees slid to $0.11—now bulls whisper about an $800 breakout.

The surge spotlights how rock-bottom costs and fresh DeFi buzz are funneling liquidity toward BNB Chain just as the broader market keeps its eyes on Bitcoin. This growth may be due to increased DeFi activity, stablecoin developments, and market speculation, though no single driver has been confirmed.

BNB Chain Activity Rises as CZ’s Posts Draw Market Attention

Since Changpeng Zhao (CZ) stepped down from his role at Binance in late 2024 as part of a legal settlement, his social media activity has occasionally coincided with increased attention on the BNB Chain.

While CZ no longer holds an official position at Binance, some market participants have interpreted his posts as influencing trading activity.

Honest newbie question. How does this work? I share my dog's name and picture, and then people create memcoins? How do you know which one is "official"? or does that even matter?

(I see many people asking for a name and a picture. 😂) https://t.co/ZcvEhzgwmM

— CZ 🔶 BNB (@cz_binance) February 12, 2025

One instance occurred in February when CZ shared a post mentioning his dog’s name, “Broccoli.” Shortly after, multiple memecoins referencing the name were launched on the BNB Chain, including one called “CZ’s Dog (BROCCOLI),” which briefly reached a market capitalization of $300 million.

BNB Chain stat snapshot 📊

🔝 Daily transactions just hit a 6-month high.

💰 Stablecoin market cap has officially crossed $10B.

🔒 Real TVL (excluding staking and double-counting) continues to climb strong.Shoutout to all the builders pushing the ecosystem forward 🫡 pic.twitter.com/a3vLqb85aZ

— BNB Chain (@BNBCHAIN) May 20, 2025

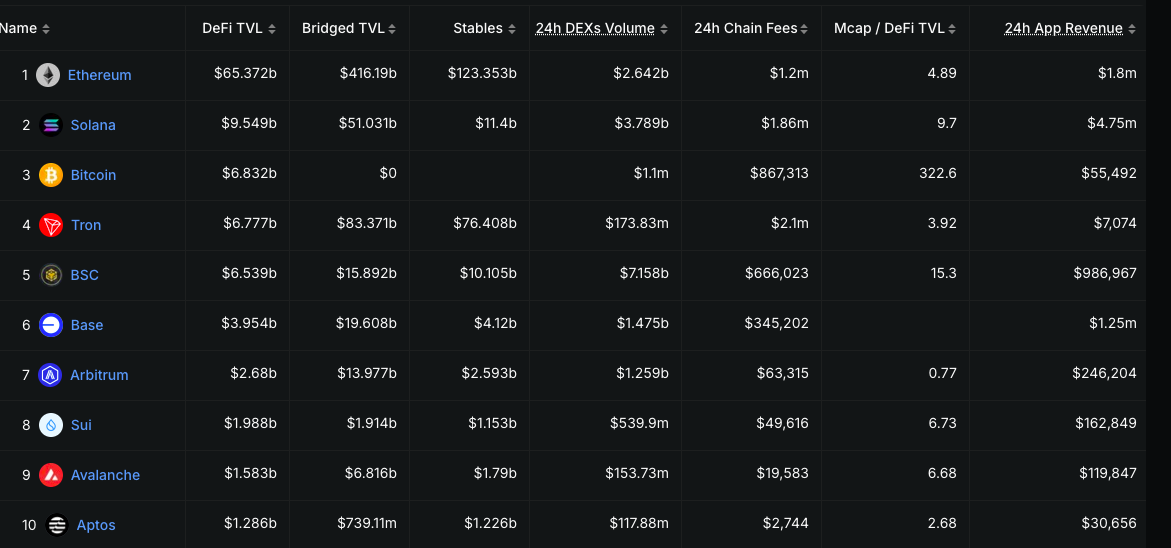

Since then, liquidity on the BNB Chain has risen, with daily transactions reaching a six-month high of $11.03 million. The chain’s market cap has also crossed the $10 billion mark, just a billion shy of Solana’s and bigger than those of Base, Arbitrum, Sui, and Aptos combined.

Data from DeFiLlama also shows that the BNB Chain is currently the most dominant chain in DEX activities, with its DEX volume averaging $7 billion on a daily basis.

Trump-Linked USD1 Stablecoin Adds Fuel to BNB Chain Growth

One of the protocols leading the growth of the BNB chain is $USD1, a token deployed by the Trump-affiliated company, World Liberty Financial (WLFI), which chose the BNB chain as its launchpad.

Also, the massive reduction in gas fees has supported increased transactions and active wallet addresses on the BNB chain.

On May 8, the BNB chain transaction fee dropped to 0.11 Gwei, less than $0.11 to carry out any transaction on the blockchain.

High gas fees on BNB Chain? No Gwei…

Median gas price is ~0.11 Gwei!

Track the gas price 👇 https://t.co/j3rBfOnVjO https://t.co/LMETaRY5IN pic.twitter.com/N5inFNEUhl

— BNB Chain (@BNBCHAIN) May 21, 2025

This is 100 times cheaper than Ethereum gas fees. Now, on most centralized crypto exchanges, the BNB chain has been the preferred network for stablecoin transfers, as most exchanges charge zero fees for transfers on the network.

These factors have prompted one crypto chart expert to assert that although $BNB hardly gets the attention it deserves, it should see a price breakout above $800.

$BNB hardly gets the attention it deserves. Breakout target shown in the chart. I believe a breakout after such a long (4-yr) consolidation won't be rewarded with a three-month bull market. This may continue for a little while longer. pic.twitter.com/7mQVdNiEsr

— Joey Keasberry (@birdseye88) May 22, 2025

According to him, $BNB has been in a four-year consolidation and won’t be rewarded with a three-month bull market. He believes the current price rally should extend for a bit longer.

Binance Coin Price Prediction: Can $BNB Break $740 or Pull Back?

Looking at the $BNB/$USD daily chart, the price is at $673.4, up 1.81%, and has broken above key resistance at $686.

The chart shows $BNB completing a corrective pattern from $720 down to $520 lows and now appears to be in recovery mode.

The orange Elliott Wave labels suggest this upward move could target the $740 area.

Key levels to watch are the major resistance zone at $720-$740 (red box) above and support at $686 (now broken resistance) and $561 (blue box) below.

Being a $BNB maxi excited for seeing hitting $1,000. Ohh yes i can only see, not planning to sell at all. Why?

Holding BNB you can get so much by staking, only. And there is a list of passive income ways you can make, by just holding BNB. pic.twitter.com/U9ahSxYFao— Zeus 🔶 Hamad (@ZeusInCrypto) May 21, 2025

The breakout above $686 with decent volume suggests genuine buying momentum, but the real test will be whether BNB can push through the $720-$740 resistance zone. A failure there could lead to consolidation, while a break above would likely accelerate the uptrend.