BNB Chain validators have proposed slashing gas fees by 50% and accelerating block speeds to maintain competitiveness against Solana and Base as the BNB token surges past $1,000 for the first time in history.

The proposal would reduce the minimum gas price from 0.1 Gwei to 0.05 Gwei, while shortening block intervals from 750 milliseconds to 450 milliseconds.

Average transaction costs would drop to approximately $0.005 per transaction under the proposal, positioning BNB Smart Chain alongside the cheapest networks in the crypto space.

Binance founder Changpeng Zhao endorsed the initiative on X shortly after the proposal emerged.

The timing coincides with BNB reaching an all-time high of $1,005 earlier this month, which pushed its market capitalization to nearly $140 billion and solidified its position as the fifth-largest cryptocurrency.

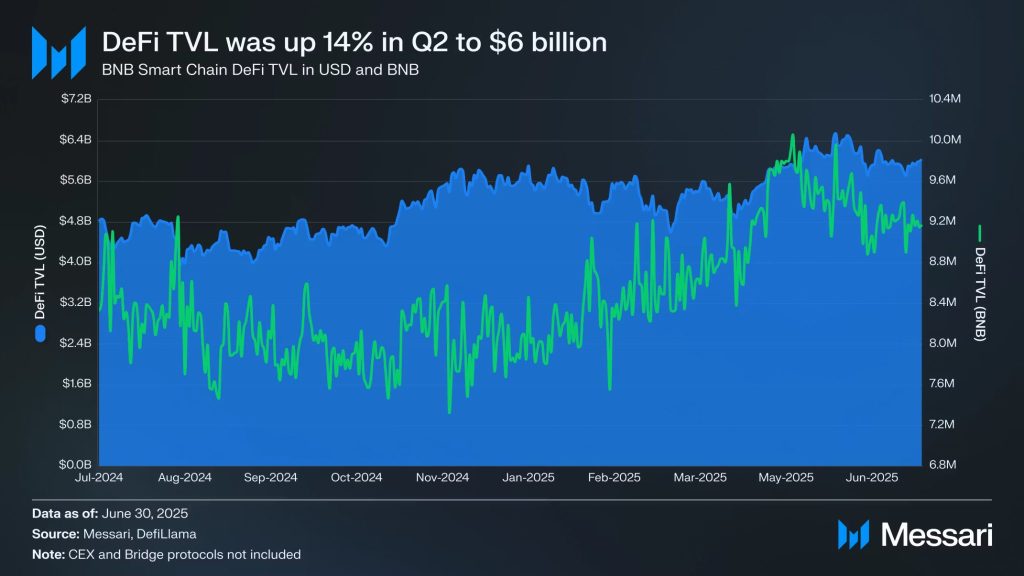

Previous fee reductions led to a massive increase in usage, with daily transactions surging 140% to exceed 12 million following the earlier cuts.

Validators established a core principle requiring BNB Chain to maintain the lowest possible gas fees as long as staking APY remains above 0.5%.

The long-term target aims for $0.001 per transaction, representing a 90% reduction from historical levels.

Fee Wars Heat Up Against Solana Competition

The proposed changes directly target Solana’s dominance in low-cost transactions, where fees typically range from $0.0001 to $0.0025 per transaction, but BNB’s enhanced speed could offset the marginal cost difference.

Ethereum mainnet averages $0.41 per transaction despite recent reductions from over $1.85 earlier in 2025. Layer 2 solutions offer sub-$0.03 fees but sacrifice direct mainnet security guarantees that BNB Chain provides natively.

Base maintains transaction costs below $0.01 with approximately 6-second block times, making it BNB’s closest competitor in terms of speed and cost balance.

However, BNB’s proposed 450-millisecond blocks would deliver nearly 13x faster confirmation times.

Historical data validates the fee reduction strategy. When gas prices dropped from 3 Gwei to 1 Gwei in April 2024, transaction volume increased substantially.

Another reduction, from 1 Gwei to 0.1 Gwei, in May 2025 lowered the median fees by 75%, from $0.04 to $0.01.

Trading has become the dominant use case on BNB Chain. The network operates at less than 30% capacity, providing room for increased activity without straining the infrastructure.

Validator rewards remain sustainable through higher transaction volumes, similar to previous fee reduction cycles.

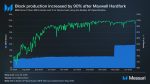

Multiple technical upgrades support the enhanced performance targets. The Maxwell upgrade in June reduced block times from 1.5 seconds to 0.75 seconds, establishing BNB as the fastest major blockchain with sub-second finality.

Technical Supremacy Drives Ecosystem Growth

BNB Chain’s performance improvements coincided with a remarkable ecosystem expansion during Q2 2025, as daily transactions more than doubled to 9.9 million amid strategic fee reductions.

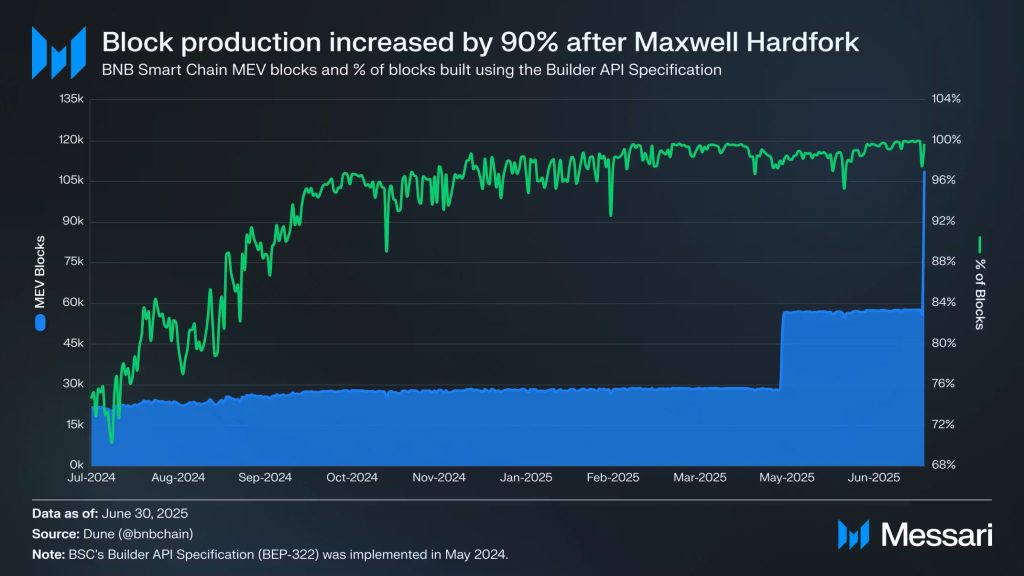

The total value locked in DeFi protocols increased 14% to $6 billion, despite a 37.5% decline in network revenue.

The Maxwell upgrade implemented three critical proposals, including BEP-524 for faster block intervals, BEP-563 for enhanced validator communication, and BEP-564 for smarter block fetching protocols.

These improvements enabled the production of 0.75-second blocks while maintaining network stability.

Stablecoin market capitalization surged 49.6% to $10.5 billion, positioning BNB Chain as the third-largest network by stablecoin holdings behind Ethereum and TRON.

The 0-Fee Carnival initiative eliminated transaction costs for stablecoin transfers, covering $4 million in gas fees since launch.

Daily active addresses increased 33.2% to 1.6 million users while processing an average daily DEX volume of $3.3 billion, surpassing all other chains.

PancakeSwap maintained an 85.1% market share despite growing competition from Uniswap, which posted a 755% quarterly growth rate.

Meanwhile, CZ’s wealth soared past $110 billion as BNB reached its all-time high, largely driven by his holdings of approximately 94 million BNB tokens.

The milestone prompted him to change his Twitter bio back to “@binance,” sparking speculation about a potential return to leadership following his removal last year.