Standard Chartered’s crypto analyst Geoffrey Kendrick has issued a bold call to investors, declaring that Bitcoin’s recent dip below $100,000 may represent “the last one ever.”

With Bitcoin trading around $103,045 on November 6, Kendrick outlined a staged buying strategy centered on the 50-week moving average at $103,000 and the Bitcoin-gold ratio threshold of 30.

His aggressive stance comes as multiple technical indicators suggest a critical moment for the world’s largest cryptocurrency.

The timing carries particular weight as Bitcoin currently trades just $1,100 above its critical 50-week moving average.

Historical patterns indicate that Bitcoin has definitively lost this weekly support level only four times, with each instance leading to tests of the 200-week moving average, currently around $55,000.

Standard Chartered Maps Three-Stage Entry Strategy

Kendrick’s trading plan is broken down into three distinct phases, designed to capture potential upside while managing downside risk.

He recommends deploying 25% of the maximum allocation immediately at current levels, adding another 25% if Bitcoin closes above $103,000 on Friday, and committing the remaining 50% when the Bitcoin-gold ratio returns to above 30.

The strategy reflects Kendrick’s broader thesis that decentralized finance will eventually overtake traditional finance, with Bitcoin serving as the foundational apex asset that cannot afford to collapse.

Meanwhile, a trader, known as Elon Trades on X, offers a more cautious perspective, identifying Bitcoin’s retest of the 50-week exponential moving average around $100,000 as a critical juncture.

If this level holds, he anticipates a mid-cycle reset before the next leg higher, while a break would target the $90,000–$92,000 demand zone as the next support area.

Crisis Performance Data Shows Bitcoin’s Superior Long-Term Returns

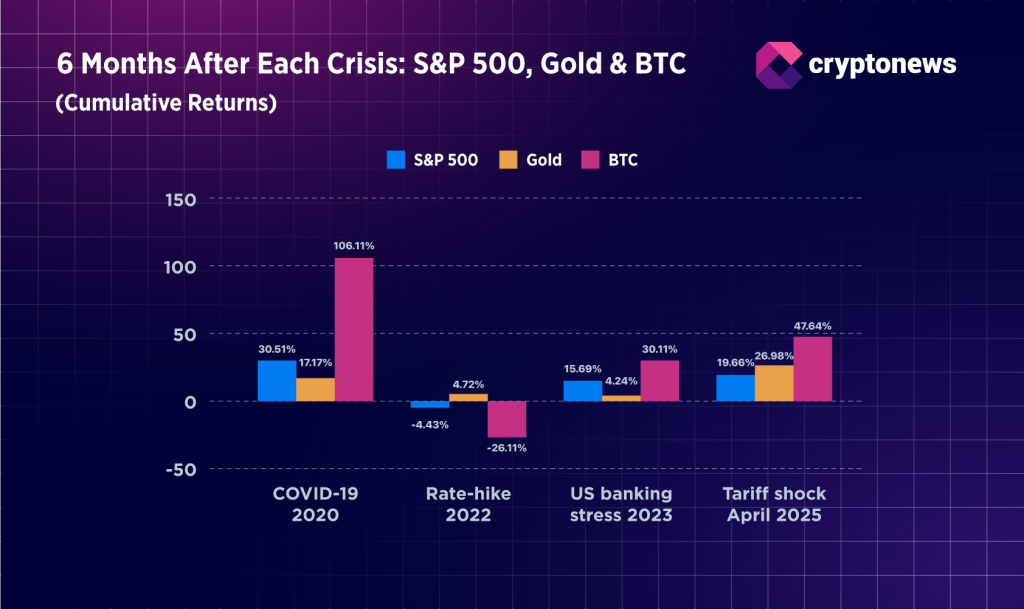

Analysis of four major market crises since 2020 reveals that Bitcoin’s pattern is to outperform gold and equities once the initial panic subsides, despite behaving like a high-risk asset during periods of acute stress.

During the COVID-19 crash in March 2020, Bitcoin required two months to recover to pre-crisis levels but delivered 220% gains over the following six months, vastly exceeding gold’s 17% advance and the S&P 500’s full recovery by August 2020.

The 2022 rate-hike shock saw Bitcoin plunge 53.4% from its March levels.

Gold emerged as the most stable defensive asset during this period, declining by just 13.7% and trading 4.7% above its March 2022 level by April 2023, while Bitcoin remained 26% below its starting point, despite rebounding 58.6% from its October low.

More recent episodes paint a nuanced picture, with Bitcoin showing asynchronous behavior during the March 2023 regional banking crisis and the April 2025 tariff shock.

In both cases, Bitcoin moved independently of equity markets rather than serving as a traditional safe haven, yet ultimately delivered strong returns once volatility subsided.

Since 2020, a $100 investment in Bitcoin grew to $1,473.87 by July 2025, compared to just $209.85 for the S&P 500, representing an 88% outperformance that has attracted surging institutional interest.

Market Faces Powder Keg of Concentrated Liquidations

Bitcoin’s current consolidation around $110,000 masks extreme fragility in market structure, with roughly $11.39 billion in short positions vulnerable to liquidation on a 10% upward move and $7.55 billion in long positions at risk if prices fall by the same magnitude.

Speaking with Cryptonews, VALR CEO Farzam Ehsani warns that this concentration creates a “powder keg effect,” heightening sensitivity to Federal Reserve signals and trade developments between Washington and Beijing.

However, MEXC Research Chief Analyst Shawn Young maintains cautiously optimistic expectations for November, projecting that Bitcoin could reach $117,000 if key resistance at $111,000–$113,000 is broken.

“A break of this level could trigger upward momentum and pave the way to $117,000, and with favorable macroeconomic news, a retest of the all-time high of $126,000,” he said.

StealthEx CEO Maria Carola strikes a more cautious tone, arguing that the market appears overheated and vulnerable to sharp corrections from geopolitical shocks or uncertainty in Federal Reserve policy.

“If the US shutdown continues and the Fed fails to set a clear rate stance, the likelihood of a repeat test of $100,000 remains high,” she stated, asserting that Bitcoin now has to prove itself as a mature institutional instrument.