Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

Risk-on sentiment returned to the altcoin market with Trump’s 90-day global tariff pause, yet only XRP exchange-traded products captured fresh retail liquidity.

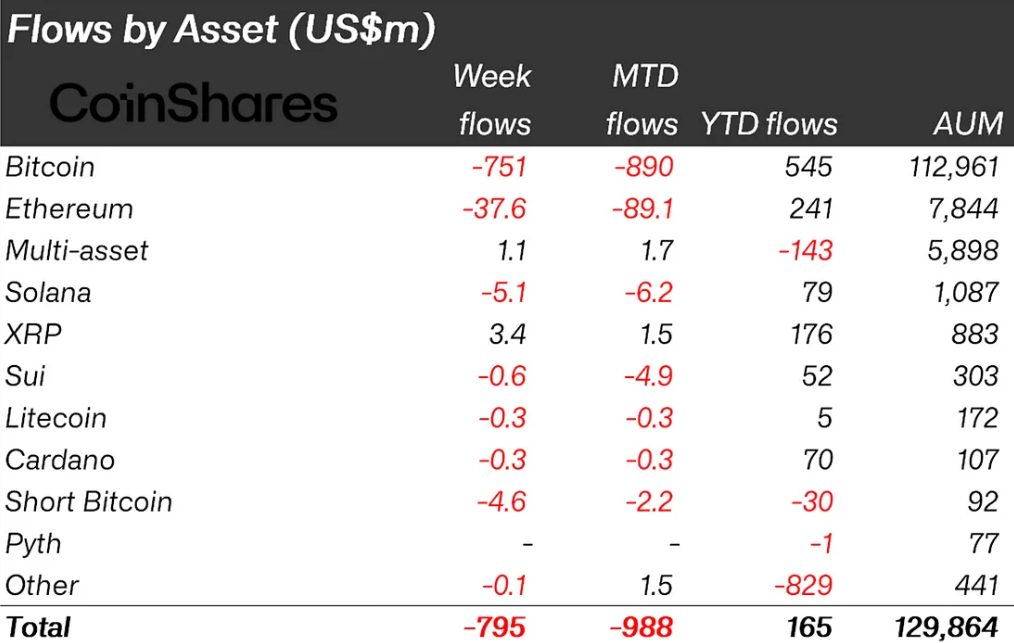

A CoinShares report notes that while Ethereum and Solana-linked funds lost $38 and $5 million, respectively, investors poured $3.5 million into the newly launched leveraged XRP ETF.

XRP continues to beat out the bear market—maintaining its 25% gain from last week’s lows and pushing its way back into the “best crypto to buy” conversation.

XRP Price Analysis: Can XRP Hold This Momentum?

In the report, CoinShares Head of Research James Butterfill noted that “institutions are not seeing this as an opportunity just yet.”

The full impact of the ETF launch may not be completely priced into XRP price forecasts as institutions opt to sit on the sidelines under persistent FUD.

However, that could change soon. Institutional interest may return with XRP nearing a breakout from the falling wedge pattern that has defined its multi-month downtrend.

This scenario looks increasingly likely, with the Relative Strength Index (RSI) hovering near neutral at 48—suggesting that selling pressure has eased.

More so, the MACD approaches a potential golden cross, eyeing a crossover above the signal line for the first time since the post-election rally—a typical trend-reversal signal.

A confirmed breakout could mark the start of a major recovery, unlocking a possible 75% move toward the $3.80 target.

However, this target likely hinges on continued demand, such as with the approval of spot XRP ETFs.

This New ICO Could Lead the Web-3 Wave

After a multi-month freefall across the altcoin market, presale investing has become a popular strategy—offering a hedge against downturns and a shot at above-average returns.

SUBBD ($SUBBD) is capturing particular attention, as an AI-powered web-3 content platform redefining a $85B industry by giving fans true access and creators better monetization tools.

Traditional creator-subscriber platforms often take hefty cuts—up to 20%—while giving users little agency over their communities.

SUBBD flips the script, cutting out the middleman and putting the power directly in creators’ hands—to great support with almost $170,000 raised in the initial presale weeks.

These perks extend to fans in an access-driven ecosystem. Token-gated content, discounts, and early access allow supporters to engage with their favorites in a meaningful way.

You can keep up with SUBBD on X, Telegram, and Instagram, or join the presale on the SUBBD website.