A short-lived golden cross could invalidate a long-brewing bullish move, with a death cross during Thursday trading dampening the near-term Cardano price outlook.

A 10% weekly drop has caused the mid-term trend to dip below the long-term average—a technical shift that challenges ADA’s standing as one of the best cryptos to buy in June.

The altcoin market has broadly softened amid U.S. trade uncertainty, a cooling labor market, and Elon Musk’s warnings of a potential tariff-driven recession later this year.

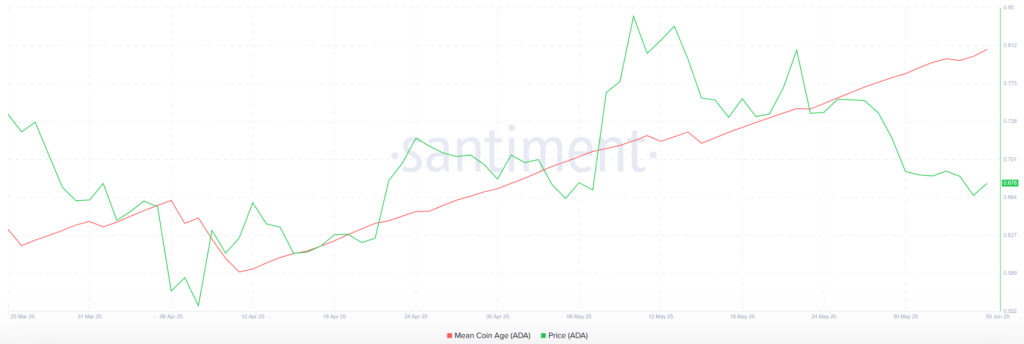

According to Santiment data, this may just be a shakeout of weak hands as the Mean Coin Age (MCA) continues to rise—long-term holders are holding their bags.

Cardano’s most committed holders continue to resist selling in the face of short-term volatility, strengthening support levels against the bearish trend.

Cardano Price Analysis: Are Long-Term Holders Right to Hold?

While the recent death cross between the 200EMA and 50EMA confirms that mid-term price action has weakened relative to the longer-term average, it may not be damning just yet.

A sharp green daily candle has preserved the broader falling wedge structure forming since late 2024, flipping its upper boundary from resistance to support despite the prevailing bearish trend.

With it, momentum indicators now show signs of recovery. The RSI has sharply reversed from oversold territory at 30 to 40, suggesting recent selling pressure may be exhausted.

More so, the MACD line has begun to flatten, leaving room for trend reversal into a bullish crossover above the signal line—a potential early bull signal.

Immediate resistance at $0.68 will be critical. Surpassing it would continue the falling wedge and fuel a move toward its $1.40 technical target—an upside of 110% from current levels.

Failure to break resistance would put pressure on a key support zone at $0.60. A drop below that level could force another wedge retest—losing it would invalidate the structure entirely.

In this case, the next key support lies 22% below current prices at $0.50.

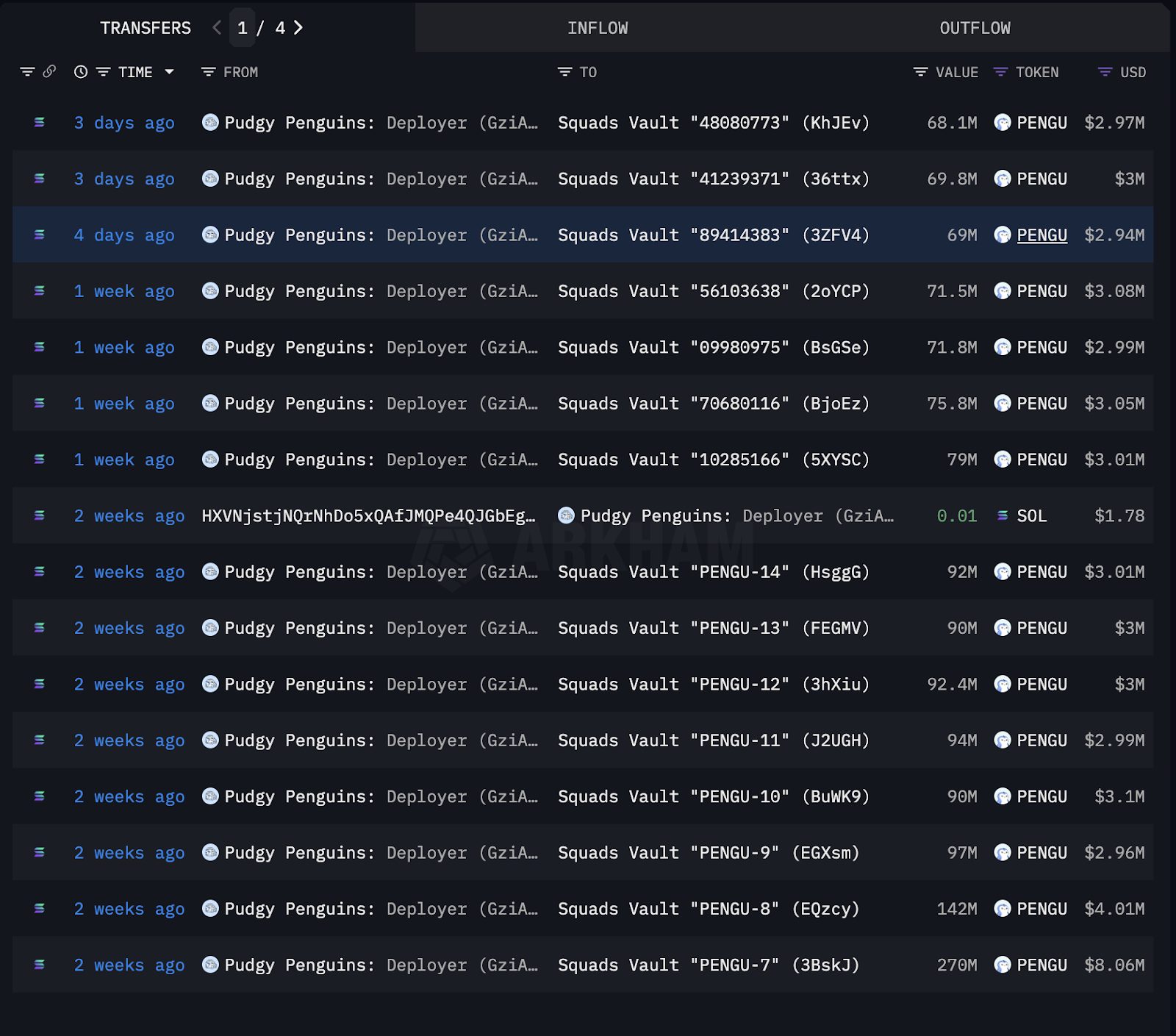

The Solana Ecosystem Could Soon Take the Spotlight

Those who jumped to Cardano over alternative Layer-1s may be forced to reconsider as the Solana ecosystem finally addresses its biggest limitation: scalability.

The narrative has shifted with the arrival of Solaxy ($SOLX), Solana’s first-ever Layer-2 scaling solution.

Solana has long lacked this capability, limiting its DeFi and cross-chain use case—until now.

By processing transactions off-chain and finalizing them on Solana, Solaxy significantly reduces congestion and lowers transaction costs, while offering seamless interoperability across both blockchains.

With almost $45 million in its ongoing presale, investors are already rallying behind the project. When demand for altcoins returns, it could be the one to reap fresh Solana ecosystem liquidity.

There are just under 10 days before this phase ends, unlocking the untapped demand of exchanges.

You can keep up with Solaxy on X and Telegram, or join the presale on the Solaxy website.