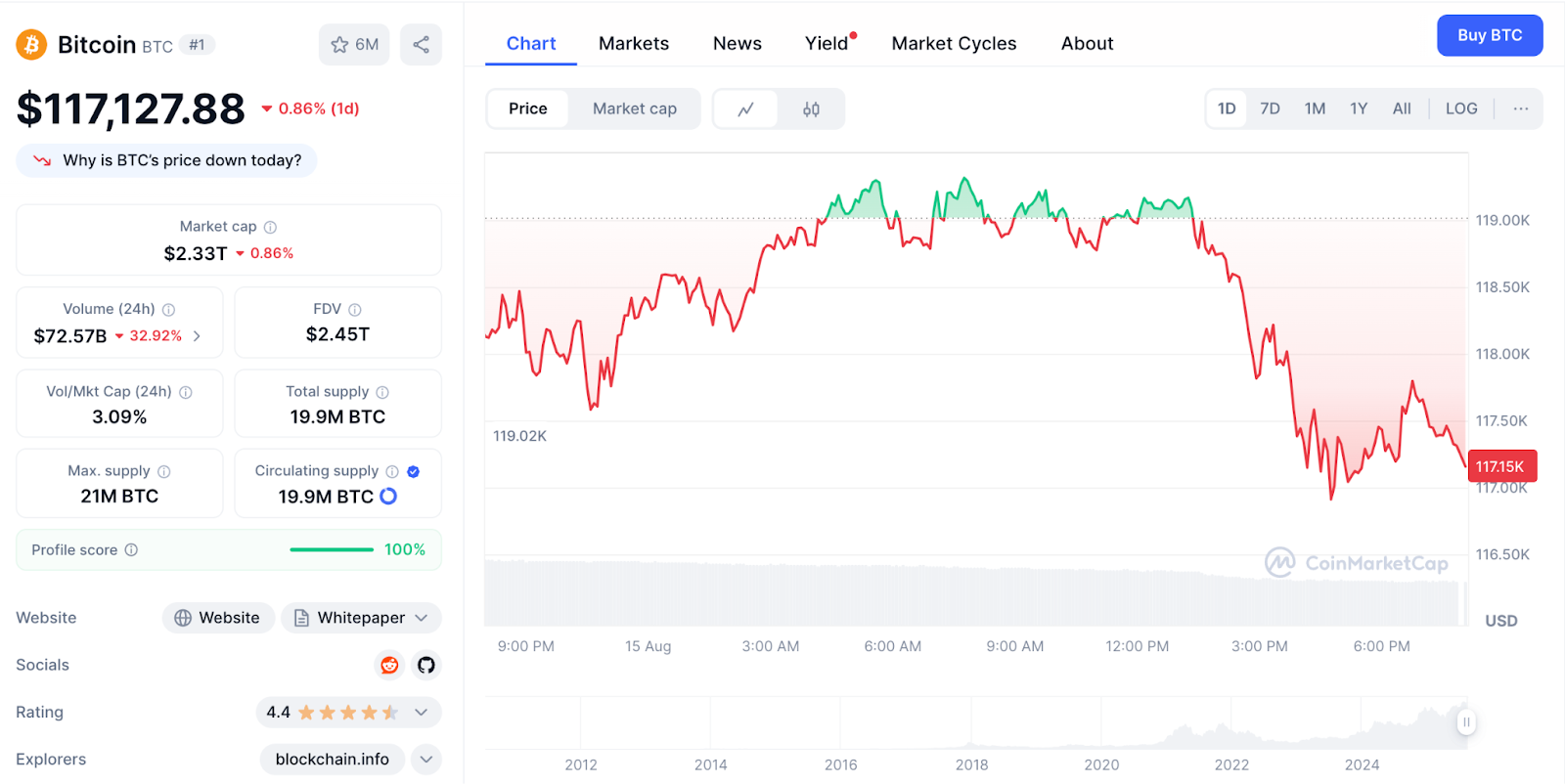

ChatGPT’s Bitcoin analysis has revealed Bitcoin consolidating at a historic $117,208 level with a minor -0.92% decline, as Treasury Secretary Scott Bessent clarifies that the U.S. will pursue budget-neutral Bitcoin acquisitions rather than direct purchases for strategic reserves.

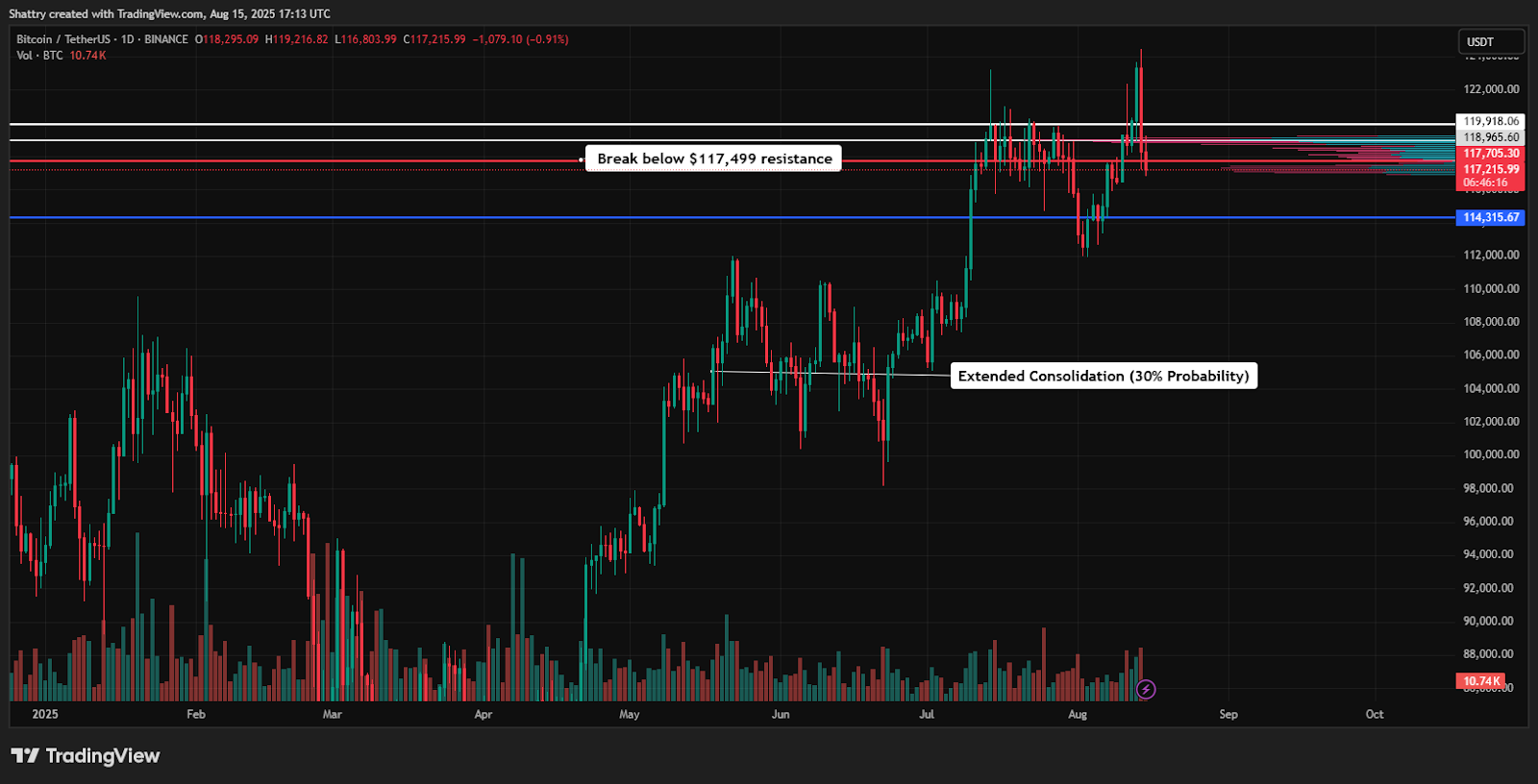

At the same time, Bitcoin maintains a bullish structure above key 50-day ($114,797), 100-day ($109,975), and 200-day ($102,522) EMAs despite testing 20-day EMA resistance at $117,499, positioning for a potential breakout or deeper correction.

ChatGPT’s Bitcoin analysis synthesizes 19 real-time technical indicators to assess BTC’s trajectory amid Treasury policy clarification and consolidation at historically elevated levels around $117K.

Technical Analysis: Historic Level Consolidation Tests Key Resistance

Bitcoin’s current price of $117,208.67 reflects a modest -0.92% decline from the opening price of $118,295.09, establishing a tight consolidation range between $119,216.82 (high) and $116,827.29 (low). This 2.0% intraday range shows controlled volatility typical of institutional positioning phases at historic levels.

The RSI at 50.61 sits perfectly neutral, providing balanced momentum without oversold or overbought conditions.

Moving averages reveal strong bullish positioning with Bitcoin trading 2.1% above the 50-day EMA at $114,797, 6.2% above the 100-day EMA at $109,975, and 12.5% above the 200-day EMA at $102,522.

MACD shows exceptionally strong bullish momentum at 135.68, well above zero, with a signal line at 1,067.32 and a positive histogram at 931.64.

This momentum strength during price consolidation often precedes major breakout moves, as technical indicators remain bullish despite sideways price action.

Volume analysis shows unusually low activity at 9.87K BTC, indicating reduced retail participation while institutions position for the next major move.

ATR presents a volatility paradox at 105,232.55, suggesting massive potential despite current price stability.

Market Context: Treasury Clarification Creates Measured Response

Bitcoin’s August performance demonstrates resilience following Treasury Secretary Scott Bessent’s clarification that U.S. Bitcoin acquisitions will be budget-neutral rather than direct government purchases.

The measured -0.92% response reflects institutional sophistication in processing policy nuances rather than panic selling.

The 2025 trajectory shows remarkable progression from January’s $93,576 opening to the current $117K levels, with strong volatility including February’s dip to $78,258 and July’s peak near $119,447.

Current positioning represents healthy consolidation within this historic bull run.

Current pricing maintains a 5.12% discount to the August 14 all-time high of $124,457 while securing extraordinary gains from historic lows.

The proximity to recent peaks demonstrates Bitcoin’s resilience despite policy uncertainty and broader market liquidations affecting other cryptocurrencies.

Market Fundamentals: Strong Metrics Support Historic Levels

Bitcoin maintains the dominant cryptocurrency position with a $2.33 trillion market cap despite a modest 0.85% decline.

The market cap stability accompanies reduced volume of $75.25 billion (-29.7%), indicating consolidation rather than distribution as institutional participants await directional clarity.

The 3.23% volume-to-market cap ratio suggests measured trading activity typical of consolidation phases at historic levels.

Circulating supply of 19.9 million BTC represents 94.8% of the maximum 21 million token supply, with approaching scarcity supporting long-term value dynamics.

Market dominance of 58.86% (+1.08%) demonstrates Bitcoin’s strength relative to altcoins during uncertainty.

The fully diluted valuation of $2.45 trillion reflects total network value at current pricing, while the controlled supply mechanism continues to support institutional confidence.

The technical fundamentals show Bitcoin trading 240,564,075% above its 2010 low of $0.04865, with a store of value over 15 years of proven resilience.

LunarCrush data reveals cautious social performance with Bitcoin’s AltRank declining to 292 during Treasury policy clarification. A Galaxy Score of 38 reflects a temporary cooling of sentiment as participants process changes to the government’s Bitcoin acquisition strategy.

Engagement metrics show substantial activity with 101.05 million total engagements despite a decline and 291.1K mentions (+108.02K).

Recent social themes focus on institutional accumulation, with Brevan Howard disclosing $2.3 billion in Bitcoin holdings and reports of accumulation demand reaching historic levels.

Community discussions center on support defense, breakout potential, and long-term institutional adoption despite short-term policy noise.

Major developments also include Jack Dorsey’s continued Bitcoin advocacy and ETF speculation momentum.

Overall, social analysis suggests institutional positioning continues despite reduced retail participation during consolidation phases.

ChatGPT’s Bitcoin Analysis: Support Structure Remains Intact

ChatGPT’s Bitcoin analysis reveals exceptional support layering beneath current levels, with immediate support at today’s low around $116,827, followed by key support at the 50-day EMA ($114,797).

The 100-day EMA at $109,975 provides major support with strong institutional significance.

Key resistance emerges at the 20-day EMA around $117,499, representing the primary obstacle for bullish continuation.

Breaking this level could trigger momentum toward $119K–$121K targets, while failure might test $114K–$110K support zones.

The technical setup suggests a coiled spring formation with low volume, neutral RSI, and extremely strong MACD momentum, creating ideal conditions for a major directional move.

Historical patterns indicate such consolidation phases often resolve with substantial volatility matching the extreme ATR potential.

Three-Month Bitcoin Price Forecast: Breakout Scenarios

Bullish Breakout (50% Probability)

Successful break above $117,499 resistance combined with continued institutional adoption could drive Bitcoin toward $119K–$125K, representing 2–7% upside from current levels.

This scenario requires volume confirmation and Treasury policy stability.

Extended Consolidation (30% Probability)

Continued range-bound trading between $114K–$119K allows technical indicators to reset while institutional positioning continues.

This scenario provides accumulation opportunities near support levels.

Correction Testing (20% Probability)

A break below $114,797 support could trigger selling toward $119,975–$110K major support levels, representing 6–7% downside before potential recovery acceleration.

ChatGPT’s Bitcoin Analysis: Historic Consolidation Signals Major Move

ChatGPT’s Bitcoin analysis reveals Bitcoin at a key inflection point between Treasury policy clarity and technical breakout potential.

The consolidation at $117K levels with extremely strong MACD momentum suggests institutional preparation for a significant directional move.

Next Price Target: $119K-$125K Within 90 Days

The immediate trajectory requires a decisive break above $117,499 resistance to validate bullish continuation toward $119K psychological levels.

From there, sustained institutional adoption could propel Bitcoin toward $125K+ historic resistance, representing meaningful breakout potential.

However, failure to hold $116,827 support would signal a deeper correction to $114K–$110K range, creating an optimal accumulation opportunity before the next institutional wave drives Bitcoin toward cycle highs above $125K.