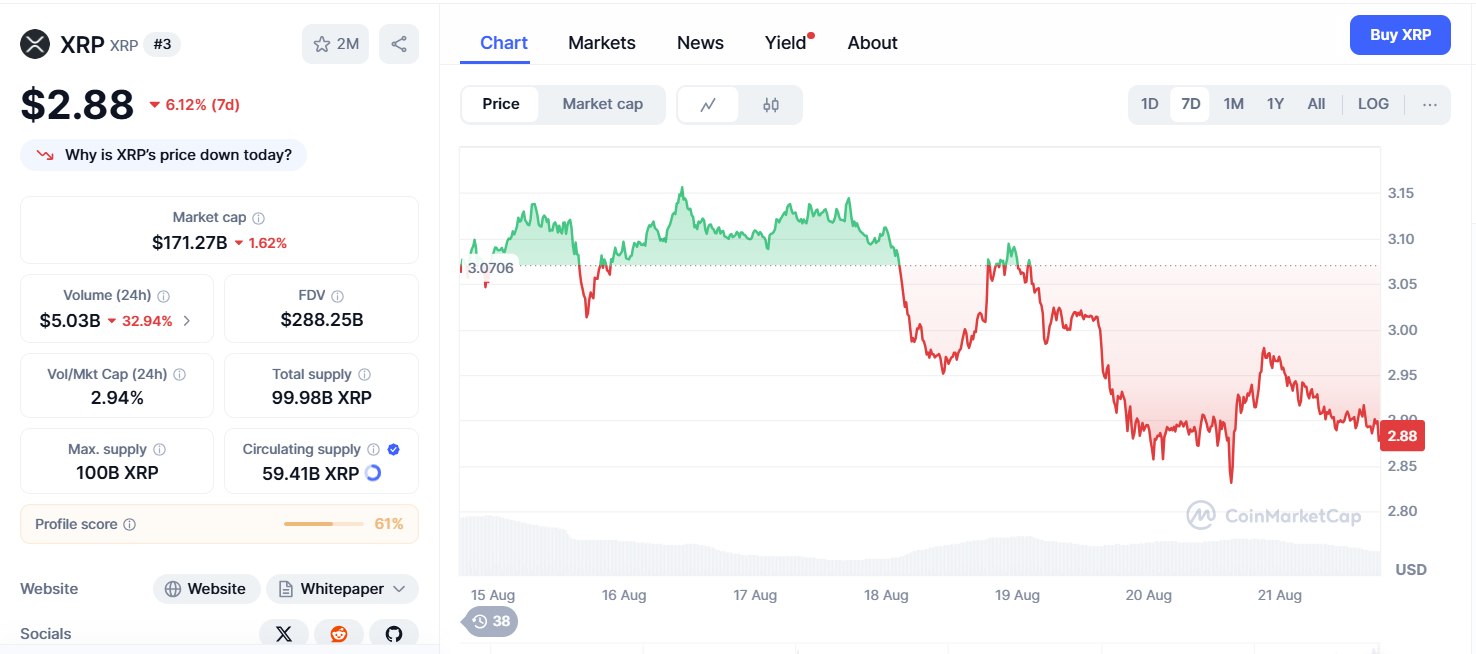

ChatGPT’s XRP analysis has revealed XRP consolidating at $2.8993 with a minimal 0.41% decline, trading below all major EMAs as SWIFT announces live digital asset trials by November 2025, processing $150 trillion annually, with XRP and HBAR identified as primary integration candidates.

At the same time, XRP faces a bearish technical structure with RSI approaching oversold territory at 41.00 while positioned below the 20-day ($2.9546), 50-day ($3.0190), 100-day ($3.0629), and 200-day ($3.0271) EMAs, creating multiple resistance layers for recovery attempts.

ChatGPT’s XRP analysis synthesizes 21 real-time technical indicators to assess XRP’s trajectory amid a bearish technical structure.

Technical Analysis: Bearish Consolidation Below EMA Resistance

XRP’s current price of $2.8993 reflects a minor -0.41% decline from the opening price of $2.8874, establishing a tight consolidation range between $2.9102 (high) and $2.8820 (low).

This 1.0% intraday range demonstrates controlled volatility typical of consolidation phases below key resistance levels.

The RSI at 41.00 approaches oversold territory, providing potential bounce conditions for contrarian positioning.

Moving averages reveal challenging bearish positioning with XRP trading below all major EMAs: 20-day at $2.9546 (+2.2%), 50-day at $3.0190 (+4.0%), 100-day at $3.0629 (+5.5%), and 200-day at $3.0271 (+4.2%).

MACD shows mixed signs with slight bullish positioning at 0.0037 above zero, but the signal line at -0.0427 and a negative histogram at -0.0464 suggest weakening momentum.

This momentum divergence during consolidation often precedes directional clarity as technical indicators align with price action.

Volume analysis shows low activity at 2.18 million XRP, indicating reduced retail participation during consolidation phases.

The ATR maintains high readings at 2.8358, suggesting strong volatility potential despite current tight trading range characteristics.

Market Context: SWIFT Integration Creates Fundamental Catalyst

XRP’s consolidation occurs amid strong fundamental developments, with SWIFT announcing live digital asset trials beginning in November 2025.

According to reports, “SWIFT will launch live trials that allow the use of digital assets and tokenized currency transactions across its network, which currently handles over $150 trillion in transactions each year.”

The integration potential represents massive institutional validation as “this development could also benefit crypto-related payment networks such as XRP and HBAR, known for fast, low-cost transfers.”

Recent RLUSD stablecoin developments demonstrate ecosystem expansion with NYSE-listed companies moving $1.5 billion through the XRP Ledger and portions of Bullish’s IPO proceeds settling in RLUSD.

Additionally, Title Trust has filed for income and leveraged XRP ETF applications, expanding institutional access channels.

The 2025 trajectory shows volatility from January’s $3.04 peak through spring’s $2.09–$2.21 consolidation range to July’s $3.10 recovery and current $2.96 positioning.

The ups and downs reflect institutional uncertainty amid regulatory clarity achievements and infrastructure development progress.

Market Fundamentals: Strong Metrics Despite Technical Weakness

XRP maintains substantial positioning with a $171.85 billion market cap despite a -0.82% decline during consolidation phases.

The market cap stability accompanies reduced volume at $5.06 billion (-34.22%). The 2.95% volume-to-market cap ratio suggests measured trading activity typical of consolidation below resistance levels.

The circulating supply of 59.41 billion XRP represents 59.4% of the maximum 100 billion supply, with controlled release supporting price stability during institutional positioning phases.

Market dominance of 4.47% positions XRP as a major cryptocurrency with proven institutional adoption potential.

Current pricing maintains a 24.84% discount to the 2018 all-time high of $3.84 while securing extraordinary 102,938% gains from 2014 lows, validating XRP’s institutional adoption trajectory despite temporary consolidation below key resistance levels.

LunarCrush data reveals moderate social performance with XRP’s AltRank at 579 during consolidation phases.

A Galaxy Score of 46 reflects neutral sentiment as participants process SWIFT integration potential versus current technical weakness.

Engagement metrics show declining activity with 8.7 million total engagements (-2.29M), while mentions increase to 49.14K (+16.72K), demonstrating continued attention during infrastructure developments.

Social dominance of 3.35% maintains visibility while sentiment registers at a robust 81% positive despite technical challenges.

Recent social themes focus on SWIFT integration announcements, with community discussions emphasizing the potential of “$150 trillion worth of transactions” and ETF filing developments.

Major whale activity includes a $3.68 million long position at $2.93, suggesting institutional confidence despite consolidation.

Prominent analysts have also identified golden retracement patterns targeting the $3.41 resistance levels, while technical discussions center on the 0.618 retracement holding at $2.88 as key Elliott Wave validation for potential bullish continuation toward higher resistance zones.

ChatGPT’s XRP Analysis: Infrastructure Potential Meets Technical Resistance

ChatGPT’s XRP analysis reveals XRP facing a key resistance testing phase below all major EMAs despite fundamental catalyst development.

The consolidation below $2.90 represents institutional assessment of SWIFT integration potential versus current technical positioning challenges.

Immediate resistance emerges at the 20-day EMA around $2.9546, followed by layered resistance at 50-day ($3.0190), 100-day ($3.0629), and 200-day ($3.0271) EMAs.

Breaking above these levels would validate institutional confidence despite the bearish structure.

Support begins at today’s low around $2.8820, followed by key support at the $2.8000–$2.8200 levels.

Volume patterns and momentum indicators suggest institutional positioning continues despite technical weakness.

Three-Month XRP Price Forecast: Breakout Scenarios

Infrastructure-Driven Breakout (40% Probability)

A successful break above $2.95 EMA resistance, combined with SWIFT integration progress, could drive recovery toward $3.20–$3.40, representing 10–17% upside from current levels.

This scenario requires institutional confidence restoration and volume confirmation.

Extended Consolidation (35% Probability)

Continued technical resistance testing could result in consolidation between $2.80 and $3.00, allowing EMA structure realignment while infrastructure development progresses through SWIFT trial implementations.

Support Testing (25% Probability)

A break below $2.88 support could trigger selling toward the $2.75–$2.80 support levels, representing 3–5% downside.

Recovery would depend on infrastructure, catalyst activation, and major support defense validation.

ChatGPT’s XRP Analysis: Technical Resistance Meets Infrastructure Expansion

ChatGPT’s XRP analysis reveals XRP at a key juncture between technical resistance challenges and infrastructure adoption acceleration.

The consolidation below $2.90 represents institutional positioning amid SWIFT integration developments and RLUSD ecosystem expansion validation.

Next Price Target: $3.20-$3.40 Within 90 Days

The immediate trajectory requires a decisive break above $2.95 resistance to validate infrastructure adoption confidence over technical weakness.

From there, SWIFT integration progress could propel XRP toward $3.20 psychological resistance, with sustained institutional adoption driving toward $3.40+ breakout levels.

However, failure to break $2.95 would indicate extended consolidation toward $2.80–$2.85 range, creating an accumulation opportunity before the next infrastructure wave drives XRP toward $4.00+ targets as SWIFT trials validate global payment integration potential.