China’s central bank has issued one of its strongest warnings yet against stablecoins, calling them a threat to global financial stability and vowing to tighten its crackdown on domestic cryptocurrency activities.

Speaking at the 2025 Financial Street Annual Meeting in Beijing, Pan Gongsheng, governor of the People’s Bank of China (PBoC), said that stablecoins, digital assets pegged to fiat currencies like the U.S. dollar, have created new vulnerabilities in the global financial system and could undermine the monetary sovereignty of smaller economies.

Can Stablecoins Ever Meet China’s Strict Financial Standards?

Pan said virtual currencies remain in their early stages of development, despite the rapid expansion of the market in recent years.

He warned that “stablecoins have amplified weaknesses in the global financial system,” citing their role in market speculation and their failure to meet key compliance standards such as customer identification and anti-money laundering (AML) requirements.

“Stablecoins, as a form of financial activity, still cannot meet the basic requirements of financial supervision,” Pan told the conference.

“They expose loopholes that can facilitate illegal fund transfers, terrorist financing, and money laundering.”

Pan said the central bank would continue to work closely with law enforcement to crack down on cryptocurrency operations and speculative activities within mainland China.

He described the measures implemented by the PBoC in recent years as “effective,” reaffirming the country’s zero-tolerance policy toward private digital currencies.

China has maintained a sweeping ban on crypto trading, mining, and exchange operations since 2017, citing financial risks and the potential for consumer harm.

The PBoC has consistently positioned digital assets as a threat to economic order while promoting the state-backed digital yuan (e-CNY) as a safer alternative.

Pan also said the central bank would “closely monitor and assess the development of stablecoins in overseas markets,” suggesting that the PBoC remains wary of how foreign stablecoin growth could influence China’s financial stability.

The warning comes amid growing global debate over the rapid expansion of the stablecoin sector.

Chinese Economists Warn USD Stablecoin Growth Threatens Yuan Internationalization

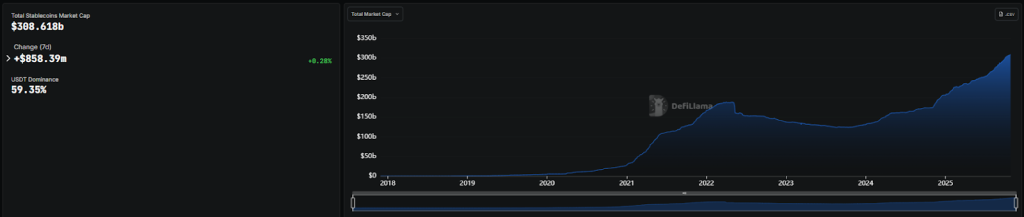

According to data from blockchain analytics firm DefiLlama, the total market capitalization of stablecoins has reached about $308 billion, with Tether (USDT) and USD Coin (USDC) accounting for nearly 87% of the supply.

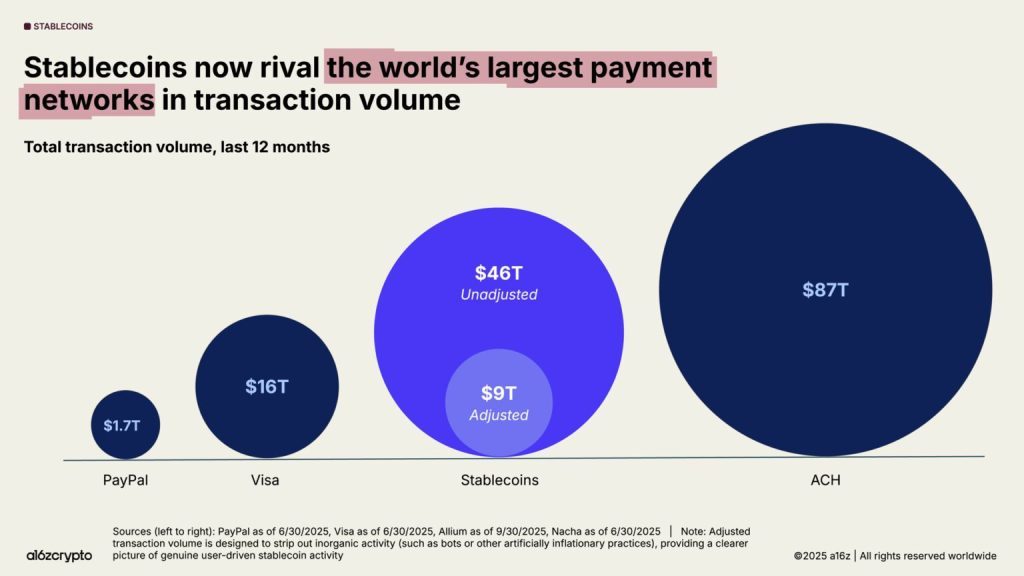

The two tokens have processed more than $27 trillion in settlements over the past year, according to research from Andreessen Horowitz.

Stablecoin transaction volumes have surged to $46 trillion in total value over the past twelve months, roughly comparable to the U.S. Automated Clearing House (ACH) system that underpins much of the American banking network.

Even when adjusted for artificial trading activity, the sector processed about $9 trillion, representing more than half of Visa’s global payment volume.

This explosive growth has sparked warnings not only from China but also from international regulators.

During the recent International Monetary Fund (IMF) and World Bank Annual Meetings in Washington, D.C., global finance ministers and central bank governors raised concerns about the systemic risks posed by stablecoins.

Many officials echoed Pan’s comments, saying the tokens fall short of basic AML and know-your-customer (KYC) standards and could enable illicit financial flows.

Economists in China have also voiced concerns that the global rise of U.S. dollar-backed stablecoins could weaken the country’s financial autonomy.

Wang Yongli, a former deputy governor of the Bank of China, wrote in June that the dominance of USD-pegged stablecoins “poses a strategic challenge” to the renminbi’s internationalization.

He warned that if the digital yuan cannot compete with the efficiency and global reach of these tokens, China’s efforts to promote its currency abroad could face “serious obstacles.”

Wang urged the government to accelerate the rollout of the e-CNY and explore the possibility of an offshore yuan-denominated stablecoin through Hong Kong.

China Blocks Tech Giants’ Stablecoin Ambitions as Hong Kong Opens Licensing Regime

The issue has also touched China’s major tech companies. Earlier this month, Ant Group and JD.com paused their plans to issue stablecoins in Hong Kong following reported instructions from the PBoC and the Cyberspace Administration of China.

Officials reportedly told both firms to suspend their projects to prevent private companies from issuing tokens that function like money, arguing that the right to issue currency must remain with the state.

Hong Kong, however, has moved in the opposite direction. In August, the city introduced one of the world’s first dedicated stablecoin licensing regimes, inviting applications from major financial institutions and blockchain firms.

The Hong Kong Monetary Authority (HKMA) has already received expressions of interest from more than 40 companies, including Ant Group, JD.com, Circle, and Standard Chartered.

While Hong Kong positions itself as a global digital asset hub, Beijing’s stance remains strict. In August, Chinese regulators ordered brokerages and think tanks to halt the publication of reports or seminars that promote stablecoins, citing fraud and speculative risks.

Pan’s latest remarks reinforce that Beijing’s long-standing crypto policy is unlikely to soften soon. He emphasized that while blockchain technology holds promise, its application must “operate within strict regulatory boundaries.”

“Virtual assets and their derivatives must never undermine financial stability or monetary sovereignty,” he said. “The People’s Bank of China will continue to act decisively to safeguard economic and financial order.”