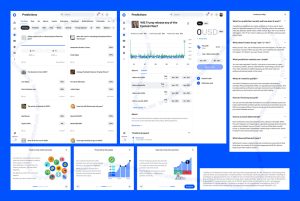

Coinbase appears to be preparing its own prediction markets platform, according to leaked screenshots shared on Tuesday by tech researcher Jane Manchun Wong.

Key Takeaways:

- Leaked screenshots show Coinbase developing a prediction markets platform built on Kalshi’s regulated infrastructure.

- The interface appears to support USDC or USD trading across categories like economics, politics, and sports.

- Coinbase would join rivals such as Crypto.com and Gemini in moving aggressively into the booming prediction market sector.

The images show Coinbase developing a dedicated website for the service, which will operate through Kalshi, the federally regulated prediction market approved by the US Commodity Futures Trading Commission (CFTC).

Coinbase Prediction Market Built Through Kalshi

Wong, known for uncovering unreleased features across major tech platforms, posted multiple screenshots to X showing Coinbase-branded prediction market pages, an FAQ section, and onboarding guides.

One screenshot states that the product is offered by Coinbase Financial Markets, the exchange’s derivatives arm, “through Kalshi,” indicating the service will rely on Kalshi’s regulatory framework.

Coinbase has signaled its interest in prediction markets before. In July, the company told CNBC that it intends to add prediction capabilities as part of its plan to evolve into an “everything exchange.”

That direction became clearer on Nov. 13 when Coinbase and Kalshi announced a partnership allowing the exchange to serve as custodian for Kalshi’s USDC-based event contracts.

The leaked images show a standard prediction market interface featuring Coinbase’s branding, seemingly allowing users to participate using USDC or US dollars.

The menu includes categories such as economics, sports, science, politics, and technology, with language suggesting that new markets would be added frequently.

Prediction markets have seen explosive growth in 2024 and 2025, with platforms like Kalshi and Polymarket posting record volumes as users turn to event-based trading ahead of major political, economic, and cultural moments.

Exchanges have been quick to take notice. Crypto.com recently launched its own prediction market product in partnership with Trump Media, while Gemini said last week that it is building a similar platform as part of its upcoming “super app.”

Gemini also filed to become a designated contract market with the CFTC, a key step toward offering regulated event contracts.

If the screenshots prove accurate, Coinbase would become the latest major exchange to enter the fast-expanding prediction market sector.

Coinbase Launches Singapore Business Platform

As reported, Coinbase has launched Coinbase Business in Singapore, marking the crypto exchange’s first international rollout of its business-focused operating platform.

The move gives local startups and small businesses access to instant USDC payments, global transfers, automated accounting integrations, and a suite of tools designed for companies that manage digital assets day to day.

The debut builds on Coinbase’s collaboration with the Monetary Authority of Singapore through the BLOOM Initiative, which focuses on improving compliant cross-border digital payments.

The platform offers USDC-based global payouts, lower-cost international transactions, and an API for automated payroll and vendor management, all backed by real-time SGD banking rails via Standard Chartered.

Coinbase said the launch supports Singapore’s fast-growing innovation economy by offering a full financial stack that blends fiat and crypto under clear regulatory standards.