Privacy-preserving clearing protocol Cycles has announced the first clearing application built on it, Cycles Prime, as well as a pre-seed round.

Cycles is a privacy-preserving clearing protocol developed by Informal Systems, a system software company offering security audits, protocol design, and formal methods for blockchain applications and infrastructure. Its CEO is Ethan Buchman, a co-founder of Cosmos and Informal Systems.

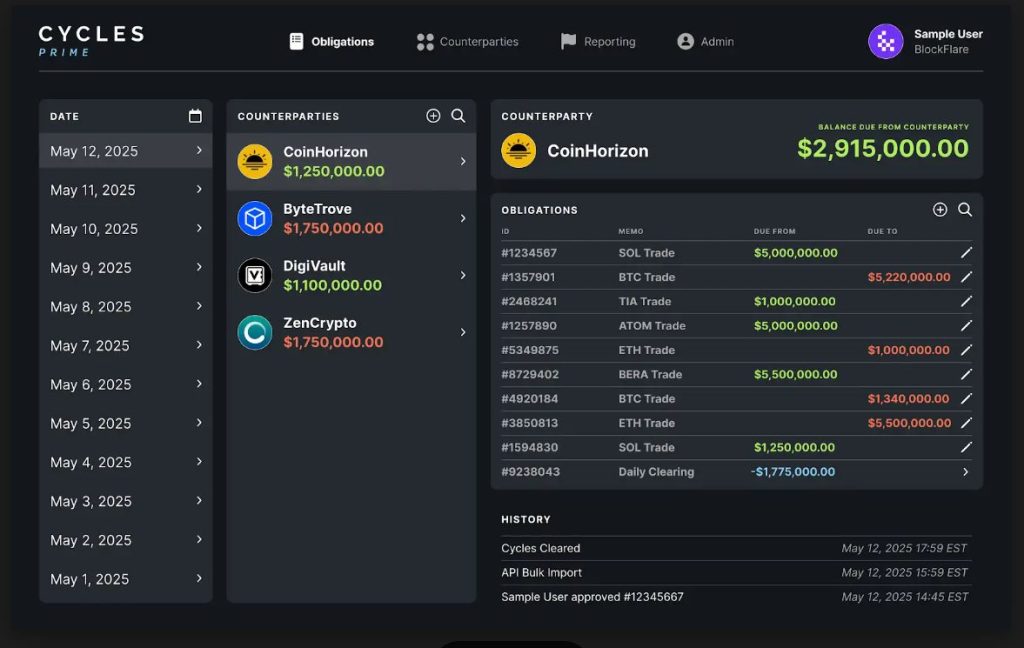

Per the press release shared with Cryptonews, the novel ZK clearing platform, Cycles Prime, offers a private, peer-to-peer clearing system with a new web app and API. allowing trading firms to clear large amounts of debt with less capital. At the same time, Trusted Execution Environment (TEE) provides privacy – with Cycles Prime’s privacy architecture being powered by Quartz, Cycles’ open-source framework – while zero-knowledge proofs verify correctness.

The team says that the product comes at a time when trading firms look for solutions to optimize capital use but not take more systemic or counterparty risks.

Therefore, the platform functions as a decentralized clearing house. It reduces outstanding short-term obligations before final settlement. Trading firms can net and clear outstanding payments, without collateral, escrow, or a central counterparty, the team claims. This means there is no posting collateral, substituting counterparty, or changing settlement flows. The product includes a daily journal and set-off reports to simplify settlement.

Additionally, it integrates with existing prime brokerage, OTC, and trade execution workflows. Companies decide what to include in the system, the announcement claims.

Cycles Prime currently offers a pilot program available to a limited number of firms. The participants get personalized onboarding, access to product teams, and a say in the product’s future development.

“As a low-overhead complement to existing settlement solutions,” Cycles Prime “relieves liquidity stress while preserving existing trading relationships,” the team behind it writes.

‘Backed by $2.3 Million in Funding’

The team has also announced Cycles’ pre-seed funding round. It was co-led by CMCC Global and Maven 11, with participation from Nascent, investors, and angels, it says.

An email to Cryptonews stated that, “backed by $2.3M in recent funding from crypto-native investors, Cycles is testing a decentralized approach designed to integrate with the way firms already operate — rather than introduce a new intermediary or require firms to overhaul workflows.”

The company will use the funds for its development, expanding the pilot, and onboarding institutional participants.

Meanwhile, the announcement notes that “credit has become scarce across the crypto industry” since the fall of massive companies in 2022. Notably, credit markets have contracted by 68%, recording a $23.7 billion decline following these events.

Therefore, many companies, be it OTC desks, exchanges, or others, still “use collateral-heavy processes to manage short-term trades.” They continue to rely on manual clearing processes that “trap liquidity and increase systemic risk.”

Cycles Prime, the team argues, lowers the “capital strain while working within the systems firms already use.”

CEO Buchman says that clearing between trading firms is where the market faces daily risk and capital inefficiency. That’s why this is Cycles’ starting point. The company wants to “create a foundation for a sustainable credit market to re-emerge,” he concludes.