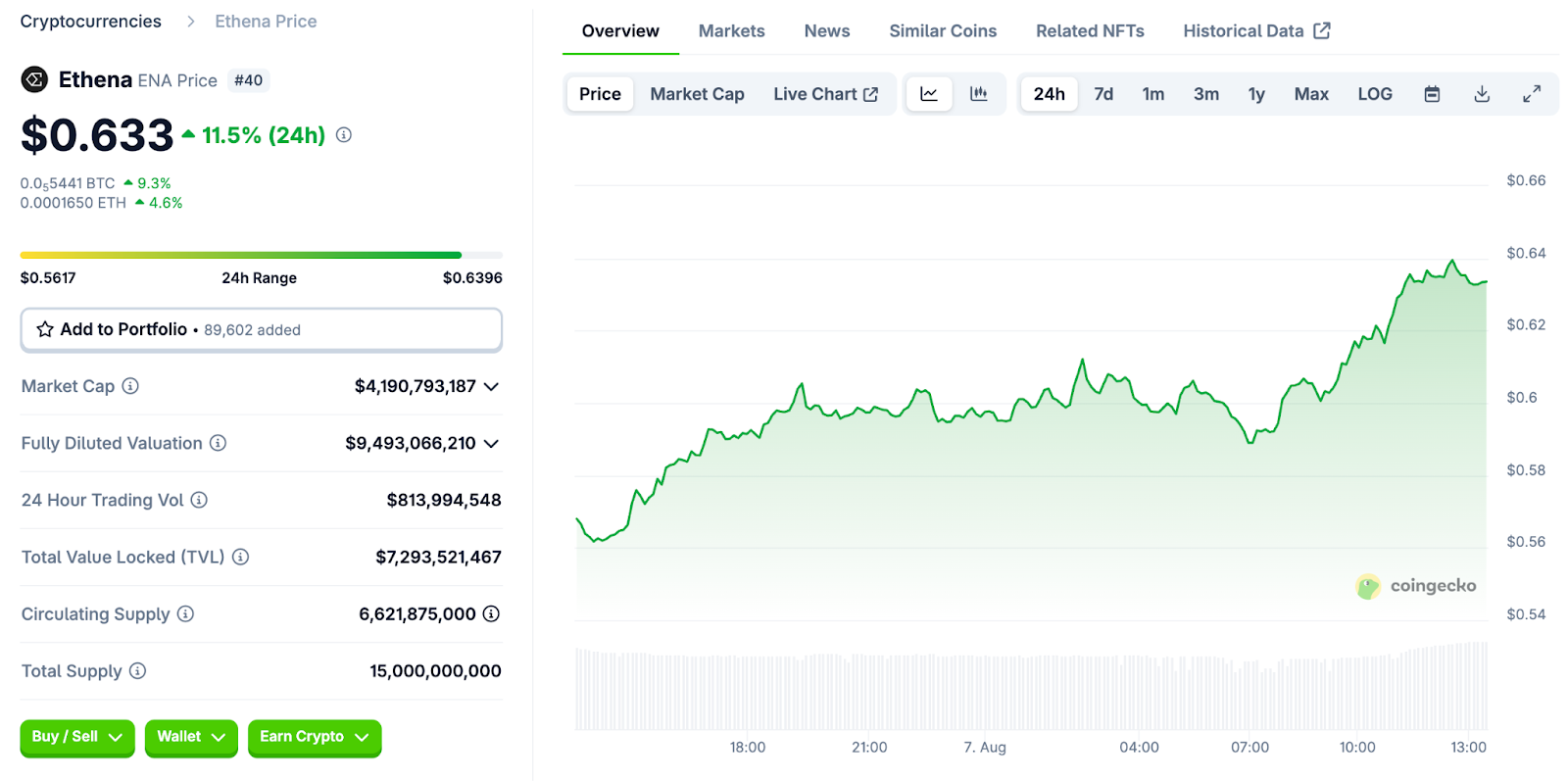

$ENA climbed 12% to $0.633 as trading activity surged, showing renewed interest in Ethena’s governance token. The move comes amid major ecosystem developments that could shape its near-term trajectory.

While the token demonstrates strong market engagement, technical patterns suggest potential volatility ahead. Traders are now monitoring key levels on its price chart as $ENA’s adoption soars despite shifting market dynamics.

Ethena ($ENA) Hits $9.5B FDV as Whales Scoop Up Tokens

Ethena ($ENA) operates with a fixed maximum supply of 15 billion tokens, of which 6 billion $ENA tokens are currently in circulation, with a fully diluted valuation of $9.49 billion. Additionally, the project’s financial performance remains strong.

According to DefiLlama, the protocol has accrued $448.8 million in annualized fees and $101.13 million in annualized revenue, showing serious economic activity.

Additionally, on-chain analysis shows that “whales” have added over 1 billion $ENA tokens, indicating institutional accumulation and supporting bullish sentiment.

In April, Ethena launched a weekly on-chain Proof of Reserves system for USDe, using independent attestors (e.g., Harris & Trotter, Chaos Labs, and Chainlink) to verify collateral backing, boosting transparency and trust.

The team also advanced its “Convergence” roadmap by building a Layer-1 chain in partnership with Celestia and Arbitrum technologies.

In terms of collaboration, Ethena partnered with the TON Foundation to bring USDe and sUSDe to Telegram’s user base via a LayerZero bridge, expanding stablecoin reach across new on-chain communities.

Additionally, governance participation is high: the community votes on Aave for USDtb listing have passed with broad support, paving the way for new borrowing strategies and deeper liquidity loops.

Together, these dynamics sketch a narrative of genuine demand, structural support, and growing adoption—ingredients that could keep $ENA’s momentum sizzling into the weeks ahead.

$ENA Holds Higher But Faces Bearish Pattern Risk

$ENA continues to hold its ground above $0.6300, trading within a rising wedge structure that’s starting to tighten.

This wedge came into focus on August 3 and quickly matured. Rising wedges are worth tracking closely, as these patterns tend to resolve lower when they form after a prolonged move up.

Despite the local bounce, price has stalled just under the $0.6400 mark and is pushing into short-term resistance. The consolidation inside the wedge comes from a fairly clean three-wave advance off the $0.5200 level. The three key simple moving averages (20, 50, and 100-period) also continue to slope upward, suggesting that the broader trend remains bullish for now.

On the other hand, volume has declined slightly from last week’s aggressive leg higher, though it hasn’t collapsed entirely. That leaves room for a retest of the upper wedge boundary and limits conviction unless buyers push with more urgency.

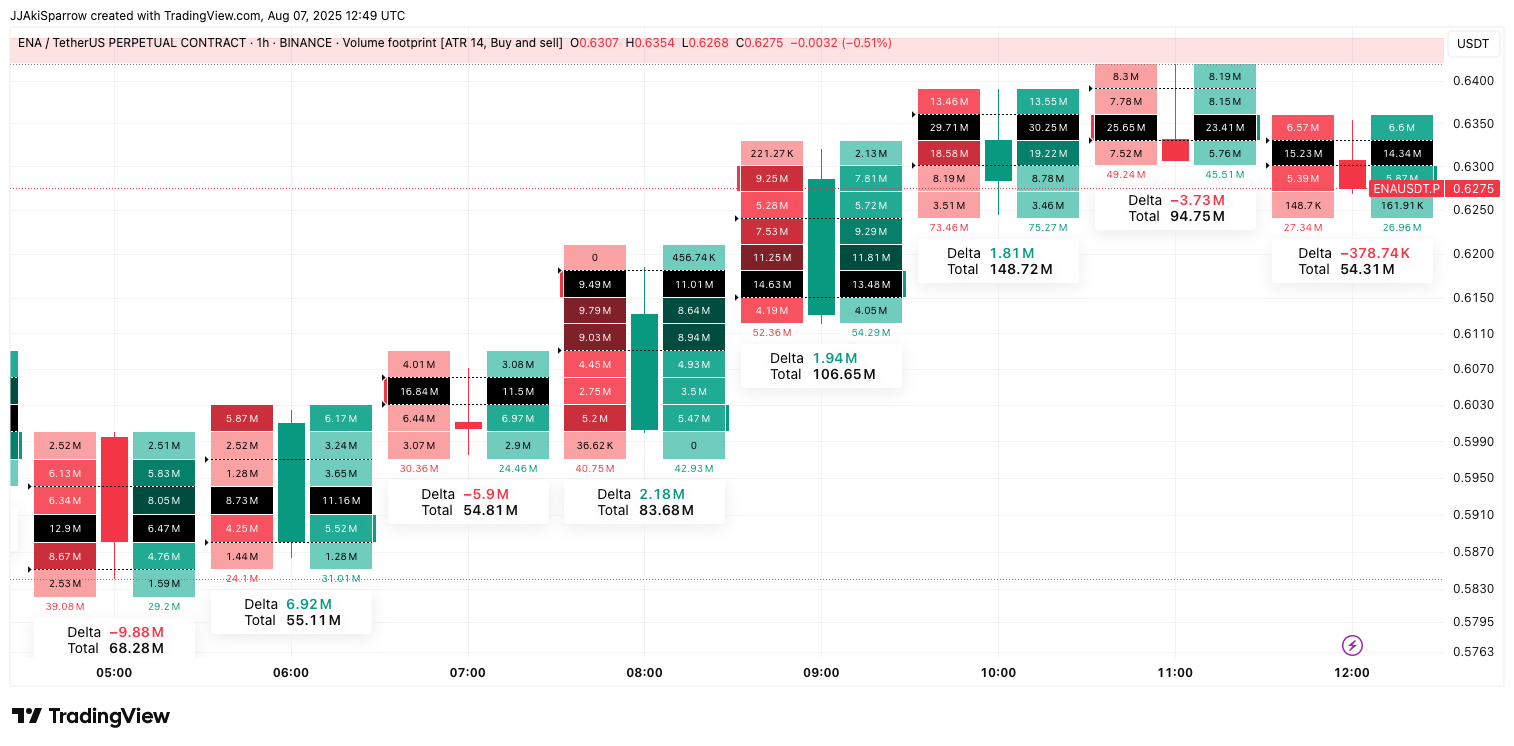

On the 1H volume footprint chart, there has been an obvious change in behavior.

Although a few candles around the $0.6280–$0.6340 zone showed a positive delta, many of them had sell-side pressure stacked above the midline of the candles, which could point to absorption rather than strength, especially when it’s not accompanied by clear follow-through in price.

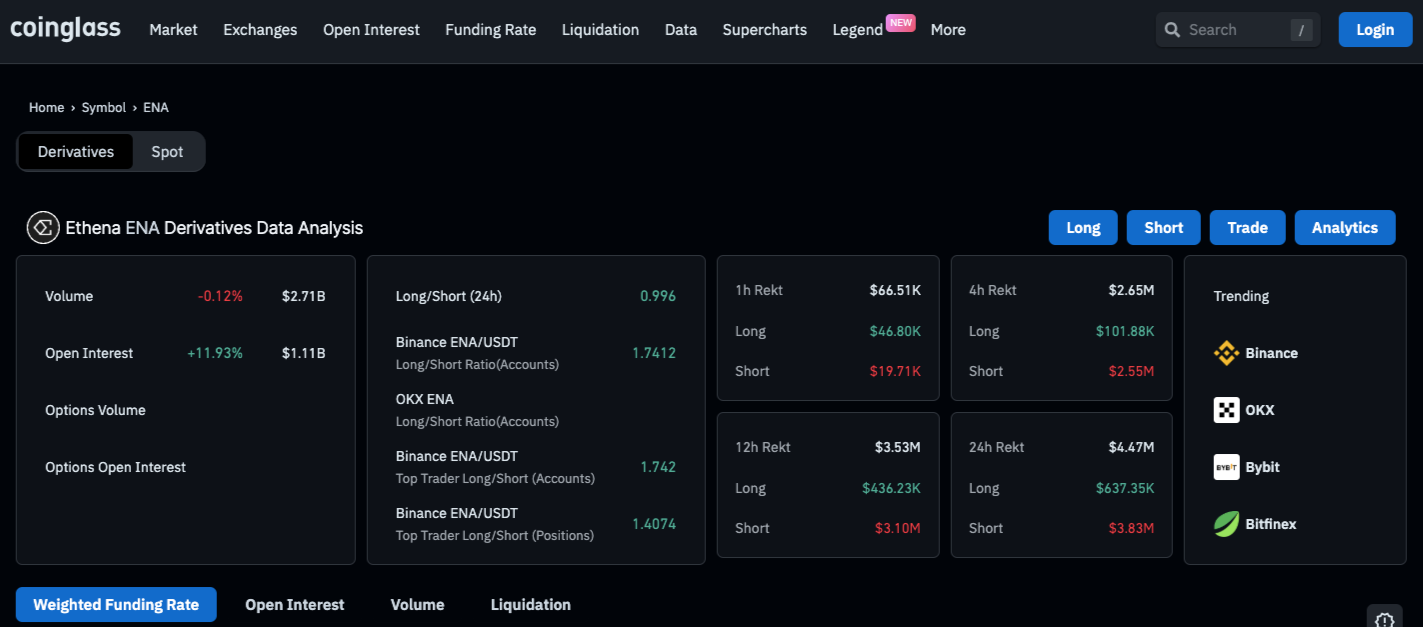

Regarding derivatives and the investor perspective, open interest is up 11.93%, while volume has remained flat. The long/short ratio skews slightly toward the bull, as the ratio across popular exchanges sits above 1.7.

Momentum indicators also look tired. MACD is still positive, but the histogram has been flatlining, hinting at weakening momentum. RSI sits around 58 and is curling slightly lower, a sign that bulls may lose the battle.

One thing is certain as the token progresses: $ENA must reclaim $0.6400 with conviction and strong volume, or it could fall through the support provided by the wedge toward $0.5200.