Ethereum is edging toward a new all-time high, with market activity showing a decisive tilt toward the second-largest cryptocurrency by market capitalization. According to a CryptoQuant research note, the price of ETH hit $4,781.24 today—its highest level since November 2021 and just shy of its record peak.

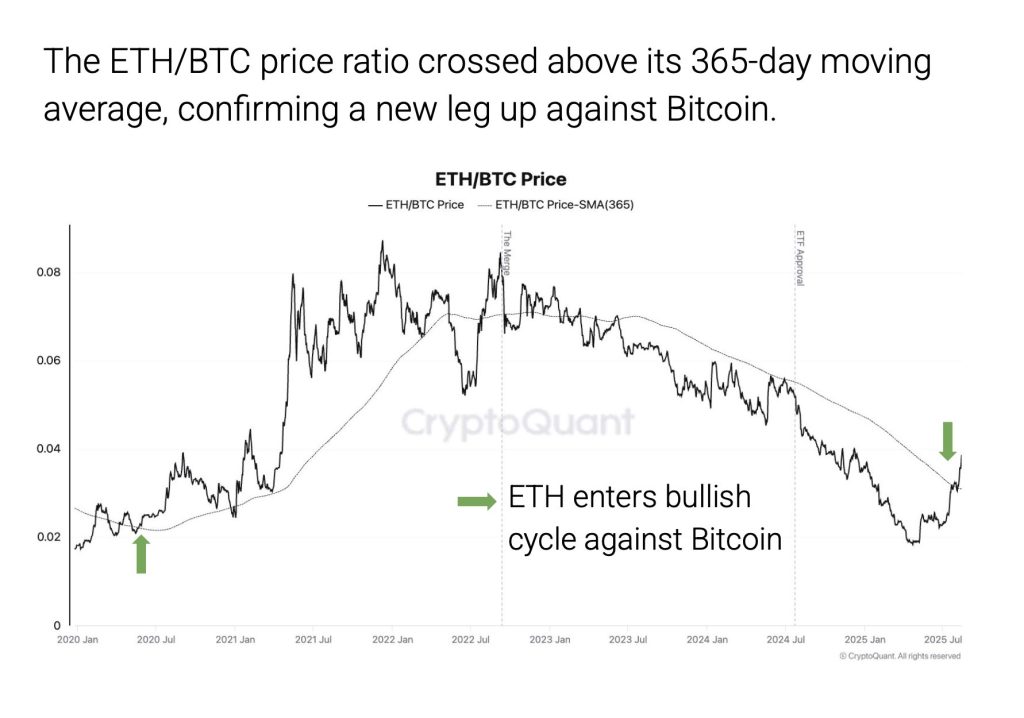

The ETH/BTC price ratio has also crossed above its 365-day moving average, a move that has historically shown the start of a bullish cycle for ETH relative to Bitcoin.

Spot ETFs and Futures Markets Show ETH Bias

Investor positioning is shifting in favor of ETH, particularly through spot exchange-traded funds (ETFs) and the perpetual futures market.

The ETH/BTC ETF holdings ratio continues to climb, indicating a growing preference for ETH within institutional products compared to Bitcoin.

Futures market data shows a similar pattern, with open interest in ETH rising at a faster pace than in BTC. This trend suggests traders are increasing leveraged exposure to Ethereum in anticipation of further price gains.

ETH inflows reached a record on Monday, with U.S. spot Ethereum ETFs drawing $1 billion in a single session. BlackRock’s ETHA fund accounted for $640 million, and Fidelity’s FETH added $277 million. Overall ETF holdings now total $25.7 billion, and cumulative inflows this cycle exceed $10.8 billion.

Trading Volumes Point to Market Rotation

ETH’s momentum is also reflected in spot trading volumes, which have recently overtaken Bitcoin’s. CryptoQuant’s data shows that ETH’s spot trading volume relative to Bitcoin reached 1.66 last week—the highest level since June 2017.

For the past four weeks, Ethereum has outpaced Bitcoin in total spot trading activity, most recently by a $10 billion margin, with ETH volumes at $24 billion compared to Bitcoin’s $14 billion.

Analysts note that this rotation could indicate a deeper market narrative shift, with traders and long-term holders alike reallocating toward Ethereum.

Early Signs of Profit-Taking Emerge

Despite the strong performance, CryptoQuant warns that some indicators point to emerging selling pressure. Daily ETH inflows into exchanges have now surpassed those of Bitcoin, suggesting that some holders may be positioning to take profits.

Historically, higher exchange inflows can precede short-term price corrections, especially when occurring near technical or psychological resistance levels.

Additionally, ETH’s relative valuation against Bitcoin is approaching levels that have previously been associated with overvaluation, which could temper further gains if sentiment turns.

Balancing Optimism with Caution

Market sentiment toward Ethereum remains broadly positive, bolstered by its outperformance against Bitcoin, robust institutional inflows, and historic trading volume dominance.

However, CryptoQuant’s research shows the importance of balancing bullish expectations with the reality of cyclical market behavior.

If selling pressure intensifies or macroeconomic factors dampen risk appetite, ETH could face headwinds in sustaining its upward trajectory. For now, Ethereum remains in the spotlight, but investors are advised to watch closely for shifts in market structure that could define the next phase of its rally.