The Ethereum price has plunged 6% in the past 24 hours, dropping to $3,625 after President Donald Trump announced sweeping new tariffs, including a 35% duty on Canadian imports.

The move rattled global markets and disrupted recent crypto momentum.

ETH is now down 1% over the past week but remains up 48% in the last 30 days and 14.5% over the past year.

While the tariff news has paused Ethereum’s rally, its medium-term outlook remains strong. Institutional demand continues to rise, with Ethereum ETFs pulling in $5.38 billion in inflows over the past 19 days.

This matches their best-ever streak and supports a very bullish long-term Ethereum price prediction.

Ethereum Price Prediction: $5.4 Billion in ETF Inflows – Big Institutions Are Buying ETH Fast

While the introduction of tariffs has spooked the markets, the past couple of weeks have been very productive for Ethereum, which has seen massive inflows from institutions.

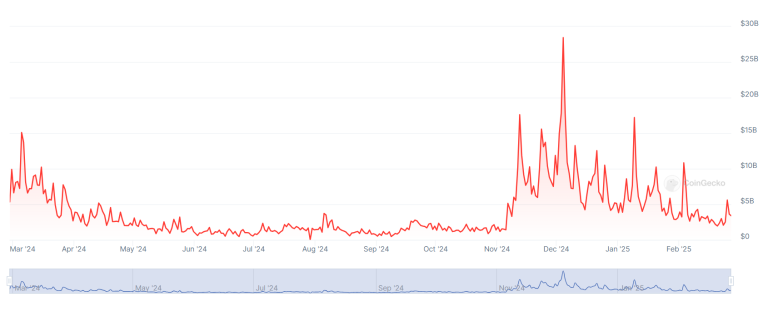

Data from the Block shows that ETH ETFs have attracted $5.38 billion in net inflows since July 3, which has been the major factor in Ethereum’s recent gains.

The past week has also been particularly strong for Ethereum ETFs, which in the seven days to July 28 saw $1.6 billion in inflows, compared to $175 million in outflows for Bitcoin.

While inflows have slowed down today amid the market’s correction, it’s clear that institutions have finally discovered Ethereum, which had been in an underpriced position for much of this year.

However, yesterday witnessed a very modest inflow total for ETH ETFs, at around $20 million, so it seems as though there may be a slowdown over the next few days.

As shown in the chart, Ethereum appears to be entering a healthy consolidation phase after its recent rally, with technical indicators suggesting a short-term correction may still be in play.

The RSI has cooled to around 45.64, down from its overbought peak near 80 in mid-July, indicating that bullish momentum has faded but not reversed entirely.

A dip toward the 40 level could mark a local bottom before renewed buying interest kicks in.

Meanwhile, the MACD histogram is also weakening, reflecting a slowdown in upward momentum and supporting the case for a pullback.

Based on the current structure, Ethereum may retest support around the $3,200 to $3,400 zone, which aligns with the rising trendline visible on the chart.

If that level holds, Ethereum could rebound and climb toward the $4,000–$4,200 range by the end of August.

Looking further out, sustained ETF inflows and macro tailwinds could help ETH push toward $5,000 by year-end, with a possible rally to $6,000 in early 2026 if the uptrend continues.

Bitcoin Hyper Presale Pushes to $6.3 Million As Excitement for Layer Two Project Grows

As strong as Ethereum is likely to remain for the foreseeable future, traders may want to consider diversifying their portfolios into newer tokens, since these can show more upwards volatility.

This is particularly the case with recently launched and presale coins, the latter of which can often rally hard when listing for the first time, especially when their sales have been big.

One coin enjoying a big sale right now is Bitcoin Hyper (HYPER), a layer-two network for Bitcoin that has now raised $6.3 million in its ICO.

Making use of Solana’s Virtual Machine (SVM) and zero-knowledge rollups, Bitcoin Hyper is aiming to become an ultra-fast sidechain that will help tap into the enormous value of the Bitcoin network.

It will offer lower fees and faster confirmation times to Bitcoin holders, who can instantly bridge their BTC to the L2’s network.

As an L2, Bitcoin Hyper will develop an ecosystem of DeFi apps and DEXes, so that traders can use their Bitcoin to make even more profits.

Its native token, HYPER, will have a max supply of 21 billion, and holders of the coin will be able to stake the token, earning themselves passive income.

They can buy it now, as part of its presale, by going to the Bitcoin Hyper website, where it currently costs $0.012475.

This price will rise later today, so interested parties should act sooner rather than later.