What began as a shakeout of weak hands has escalated into an exodus, with bearish sentiment weighing heavily on Ethereum price predictions over the past week.

The altcoin is seeing increasing sell pressure from smart money. Lookonchain reports “panic-selling” among whales with $148 million transferred to exchanges over the past 3 hours.

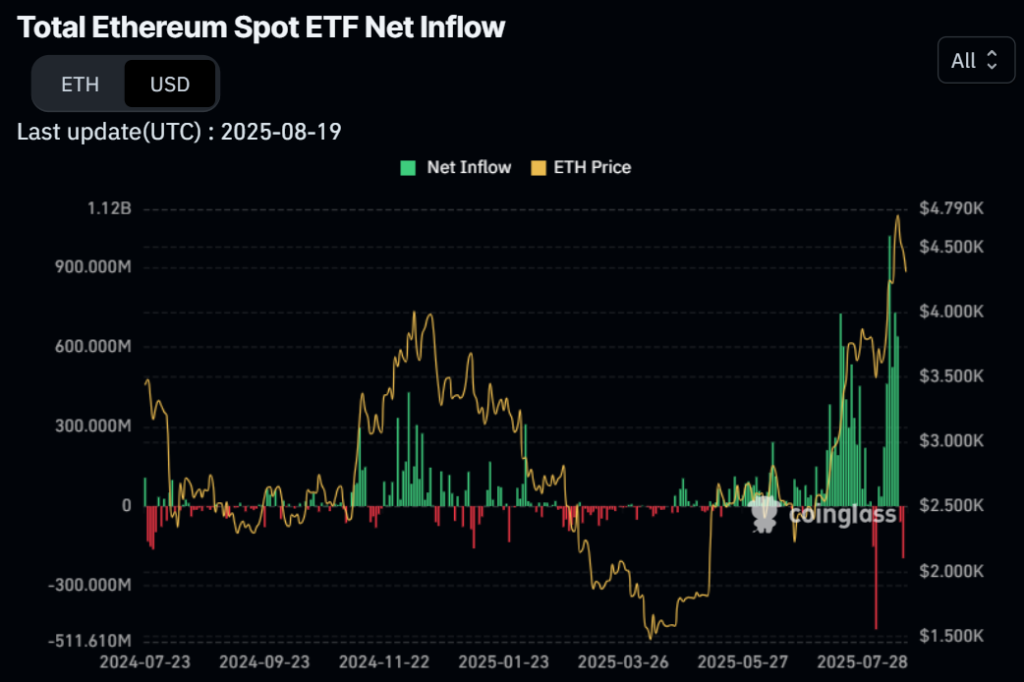

At the same time, Coinglass data shows TradFi investors are dumping ETF holdings. Monday alone saw $196.6 million in net outflows, the second-largest daily loss on record.

The sell-off trend gained momentum the previous week, with 59 million dollars in outflows on Friday, bringing the negative balance of the last two trading sessions to 256 million.

The shift from accumulation to profit-taking across both crypto and TradFi markets suggests weakening conviction and raises the risk of a deeper correction approaching key support.

Ethereum Price Prediction: Can ETH Reverse to $4,500 This Week?

ETH continues to trade within a descending channel, but momentum is starting to crack as price action approaches a key support zone.

The RSI nears oversold territory at 35, a zone that has historically marked bottoms for Ethereum as sellers reach exhaustion.

The MACD also reflects weak sell pressure, running nearly parallel to the signal line after a recent death cross, suggesting the recent downtrend may lack staying power.

Ethereum now faces a retest of the $4,150 support that triggered its last bullish leg. If buyers step in as sellers exhaust, the Ethereum price could mount a rebound toward the channel’s upper boundary.

A breakout from there opens the door for a retest of $4,790—marking a potential 14% gain from current levels.

Still, with the September FOMC meeting 29 days away, hopes of rate cuts remain distant, leaving Ethereum without an immediate macro catalyst for demand.

Bitcoin Could Beat Out Ethereum – With Some Help

Those who jumped to Ethereum as an alternative Layer 1 to the leading crypto may be forced to reconsider, as the Bitcoin ecosystem finally addresses its biggest limitation: ecosystem growth.

Bitcoin Hyper ($HYPER) is bridging the reliability of Bitcoin with Solana’s lightning-fast tech, creating a Layer-2 network that’s both secure and incredibly efficient.

Slow transactions, high fees, and limited programmability have held Bitcoin back from competing with Ethereum and Solana—until now. And just in time.

With some analysts predicting BTC could hit $250,000 this cycle as ETFs and corporate treasuries drive fresh traditional finance demand, $HYPER is well-positioned to ride the wave.

Investors are already rallying behind the project with over $10.6 million raised in its ongoing presale, potentially credited to its high 103% APY on staking that rewards early investors.

You can keep up with Bitcoin Hyper on X and Telegram, or join the presale on the Bitcoin Hyper website.

Click Here to Participate in the Presale