Ethereum slipped 2% to $4,457 in early trading after SharpLink Gaming (SBET) posted a sharp $103.4 million quarterly net loss. The setback came even as the company expanded its Ethereum holdings to 728,804 ETH, worth more than $3.2 billion, marking its first financial report since pivoting to an ETH-focused treasury strategy in June.

SharpLink Grows ETH Treasury Despite Losses

SharpLink raised more than $2.6 billion through offerings to build its Ethereum reserves, deploying nearly all holdings into staking and earning 1,326 ETH in rewards.

This move was reinforced by high-profile leadership changes, including Ethereum co-founder Joseph Lubin joining as chairman and former BlackRock executive Joseph Chalom taking over as co-CEO.

The company also struck a partnership with Consensys, recording $16.4 million in stock-based compensation tied to advisory services. Chalom highlighted the rapid progress of the strategy, stating the firm had scaled its ETH position “in a highly accretive manner.”

However, revenue for Q2 2025 fell 30% year-over-year, sliding from $1.0 million to $0.7 million, while gross profit stood at just $0.2 million. Losses were driven by an $87.8 million non-cash impairment on liquid staked ETH, a requirement under U.S. GAAP to mark down assets at their lowest traded value—$2,300 per ETH during the quarter.

Despite these accounting losses, SharpLink stressed that no ETH had been sold or redeemed, underscoring its commitment to a long-term Ethereum treasury model.

Market Impact and Ethereum’s Price Outlook

Following the announcement, SharpLink’s shares fell 15% to $19.85, while Ethereum showed heightened volatility. In the broader market, futures liquidations reached $169 million in the past 24 hours, reflecting ongoing caution among investors.

Analysts suggest SharpLink’s ETH-heavy strategy highlights a high-risk, high-reward model. While large ETH reserves and staking yields provide long-term upside, they have yet to offset near-term revenue declines and impairment-driven losses.

Ethereum is being tested. Technicals say support at $4,100, if it fails that’s $3,500. If it holds above $4,350 it’s a green light for higher.

Ethereum Technical Analysis: Key Levels to Watch

Ethereum price prediction is bullish as ETH is currently trading near $4,405, consolidating within an ascending channel that underscores its bullish longer-term structure. The 50-period SMA at $4,379 and channel support between $4,350–$4,400 form a critical demand zone. A rebound here could validate continuation toward $4,785, with the upper channel boundary extending near the psychological $5,000 mark.

- Support: $4,350–$4,400 zone; deeper floor at $4,170

- Resistance: $4,785 followed by $5,000

- RSI: 44, recovering from oversold levels

- MACD: Negative but weakening, signaling fading bearish pressure

Traders may look for a bullish engulfing candle above $4,450 as confirmation of renewed upside momentum. A sustained breakout could accelerate Ethereum’s path toward $5,000. However, a close below $4,170 risks invalidating the channel, opening downside targets toward $3,950.

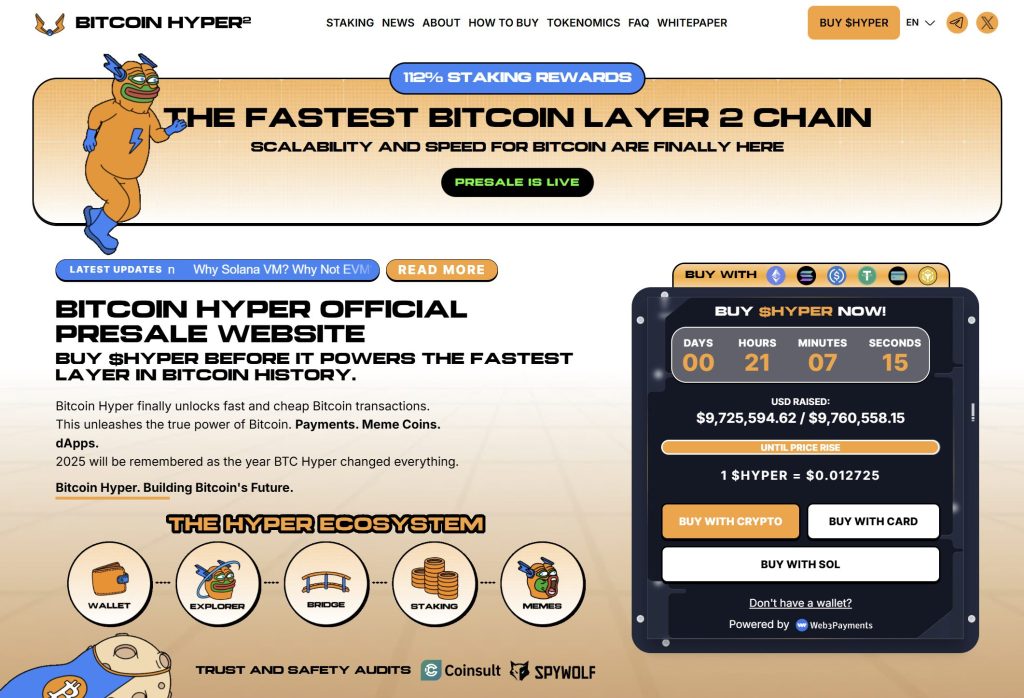

New Presale Bitcoin Hyper ($HYPER) Combines Bitcoin Security With Solana Speed

Bitcoin Hyper ($HYPER) is the first Bitcoin-native Layer 2 powered by the Solana Virtual Machine (SVM), built to supercharge the Bitcoin ecosystem with fast, low-cost smart contracts, dApps, and meme coin creation.

By merging Bitcoin’s security with Solana’s performance, it unlocks powerful new use cases – all with seamless BTC bridging.

The project is audited by Consult and built for scalability, simplicity, and trust.

Investor interest is surging, with the presale already surpassing $9.7 million and only a small allocation remaining.

HYPER tokens are currently available at just $0.012725, but that price is set to rise soon.

You can buy HYPER tokens on the official Bitcoin Hyper website using crypto or a bank card.

Click Here to Participate in the Presale