The Federal Reserve (Fed) has unveiled plans to grant stablecoin issuers and fintech companies direct access to its payment infrastructure without requiring partnerships with traditional banks.

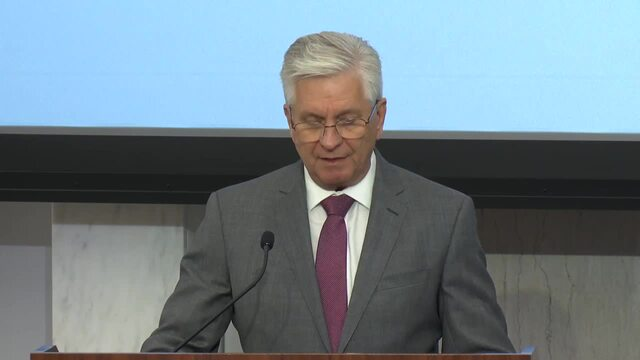

Fed Governor Christopher Waller announced the proposal during the central bank’s inaugural Payments Innovation Conference on October 21, introducing what he termed “payment accounts” or “skinny master accounts” for legally eligible institutions.

The move represents a major policy reversal from the Fed’s historically cautious stance toward crypto companies, several of which have spent years fighting for banking access.

Companies like Custodia Bank and Kraken, which have pursued Fed master accounts through lengthy legal battles, could benefit immediately from the streamlined approval process.

Streamlined Fed Accounts Target Stablecoin and Fintech Providers

The proposed payment accounts would provide direct connections to Federal Reserve payment rails while maintaining risk controls absent from full master accounts.

“This payment account concept would be targeted to provide basic Federal Reserve payment services to legally eligible institutions that right now conduct payment services primarily through a third-party bank,” Waller stated in his opening remarks.

Institutions receiving these accounts would face specific operational restrictions designed to limit Fed balance sheet exposure.

Additionally, the accounts would not earn interest on deposited balances, and they might carry mandatory balance caps to control their size.

Participants would lose access to daylight overdraft privileges, meaning transactions would be rejected once account balances reach zero.

The accounts would also exclude discount window borrowing and certain Fed payment services where the central bank cannot adequately control overdraft risks.

“The idea is to tailor the services of these new accounts to the needs of these firms and the risks they present to the Federal Reserve Banks and the payment system,” Waller explained during his speech.

Waller also emphasized that every legally eligible entity could qualify for a payment account under existing legal frameworks, with no changes to eligibility requirements.

“Payments innovation moves fast, and the Federal Reserve needs to keep up,” Waller told conference attendees.

Ripple and Anchorage Digital, both of which filed master account applications in 2025, could see accelerated decisions under the proposed framework.

Industry Leaders Gather as Fed Shifts Stance on Digital Assets

The announcement drew immediate attention at a conference bringing together crypto executives, including Chainlink CEO Sergey Nazarov, Coinbase CFO Alesia Haas, and Circle President Heath Tarbert, alongside Fed officials.

“The defi industry is not viewed with suspicion or scorn,” Waller told the approximately 100 private-sector innovators assembled at the Federal Reserve Board in Washington.

“Rather, today, you are welcomed to the conversation on the future of payments in the United States and on our home field—something that would have been unimaginable a few years ago,” he added.

During panel discussions, Sergey Nazarov pointed out major interoperability challenges during the conference’s opening panel on bridging traditional finance with digital assets.

“Nazarov expressed appreciation for regulators’ active role, noting the significance of having these important conversations at the Federal Reserve itself,” according to live conference coverage.

Meanwhile, Michael Shaulov, CEO of Fireblocks, emphasized the advantages of blockchain custody during panel discussions on resilience and DeFi integration.

“Improving regulations in the US are facilitating these discussions,” Shaulov stated, referencing difficulties traditional bank IT teams face in adopting blockchain infrastructure.

Similarly, Jennifer Barker of BNY Mellon emphasized the need for collaboration between traditional finance and DeFi to allow seamless integration.

“DeFi enables 24/7 dollar movements previously impossible for many banks,” Barker noted during the conference panels.

While the Fed has not specified an implementation timeline for the payment account proposal, Gov. Waller indicated that Fed staff would engage with stakeholders to gather feedback on the benefits and drawbacks before finalizing the framework.