A fresh battle over the future of money is brewing after gold advocate and longtime Bitcoin critic Peter Schiff publicly challenged Binance co-founder Changpeng “CZ” Zhao to a live debate comparing Bitcoin and tokenized gold.

In an X post earlier this week, Schiff invited CZ to discuss “which best satisfies the conditions of money,” referring to the traditional economic functions of a medium of exchange, a unit of account, and a store of value.

CZ, who earlier today received a presidential pardon from Donald Trump, replied to him, saying he is in the mood for it.

He further added that “As much as you voice against Bitcoin, you are always professional and non-personal. I appreciate that. Can have a debate about it.“

The proposed debate comes at a time when both gold and Bitcoin are commanding global attention.

Gold recently hit a record high above $4,035 per ounce amid ongoing U.S. government gridlock and concerns over fiscal stability, while Bitcoin crossed the $126,000 mark earlier this month, its highest level ever.

Schiff Pushes Tokenized Gold as the ‘Ideal Blockchain Asset,’ CZ Disagrees

Schiff, a well-known economist and CEO of Euro Pacific Asset Management, has spent years criticizing Bitcoin’s value proposition.

He argues that the cryptocurrency’s volatility, speculative nature, and lack of intrinsic value make it unsuitable as money or a long-term store of value.

By contrast, he views gold, particularly tokenized gold, as the superior asset, combining the tangible backing of precious metal with blockchain efficiency.

“Ideally, the one thing that makes sense to put on a blockchain is gold,” Schiff said in a recent interview, explaining that his upcoming tokenized gold platform will allow users to buy, store, and redeem gold through blockchain-based tokens issued by his company, Shift Gold.

“You can use tokenized gold as a medium of exchange, a unit of account, and a store of value.”

CZ responded sharply to Schiff’s claims, arguing that tokenized gold, while technologically interesting, is not truly “on-chain” since it depends on third-party custodians.

“Tokenizing gold is NOT ‘on-chain’ gold,” CZ wrote on X. “It’s tokenizing that you trust some third party will give you gold at some later date—maybe decades later, during a war, after management changes, etc. It’s a ‘trust me bro’ token.”

He added that trust-based systems are precisely why “no gold coins have really taken off,” reaffirming his view that Bitcoin’s decentralized structure makes it a more reliable form of digital money.

The exchange reignited one of finance’s oldest debates: whether digital or physical scarcity will define the next era of monetary value.

Schiff vs. CZ: Gold’s 5,000-Year Reign Meets Bitcoin’s Modern Challenge

Schiff maintains that gold’s history as a stable store of value over 5,000 years proves its reliability.

He also points out that gold has outperformed Bitcoin so far in 2025 in terms of stability and price growth.

Data shows that while Bitcoin surged 150% since the start of 2024, gold rose by about 100% during the same period, though its recent rally has outpaced Bitcoin’s consolidation phase.

Still, Bitcoin’s long-term performance has dwarfed that of gold. Since its creation in 2009, Bitcoin has risen from fractions of a cent to over $126,000, gaining millions of percent in value.

CZ has previously predicted that Bitcoin could eventually “flip” gold in market capitalization, though he admits it may take time. Gold’s current market cap stands near $30 trillion, compared with Bitcoin’s roughly $2 trillion.

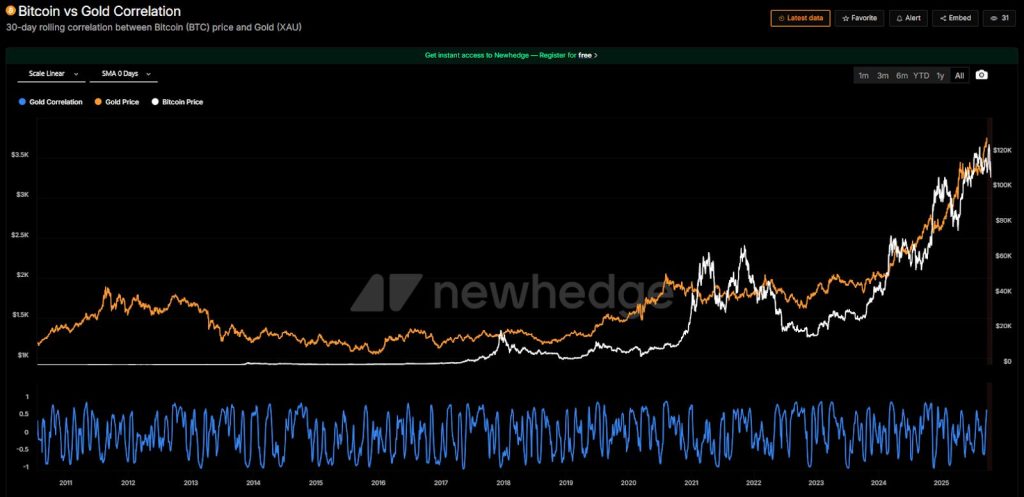

In recent months, Bitcoin’s correlation with gold has also weakened. Data shows that while both assets were nearly perfectly correlated at the beginning of 2024, their correlation has since dropped to 0.19, indicating that the two now move mostly independently.

As Tokenized Gold Booms, Analysts Say Bitcoin May Be Entering Its Next Phase

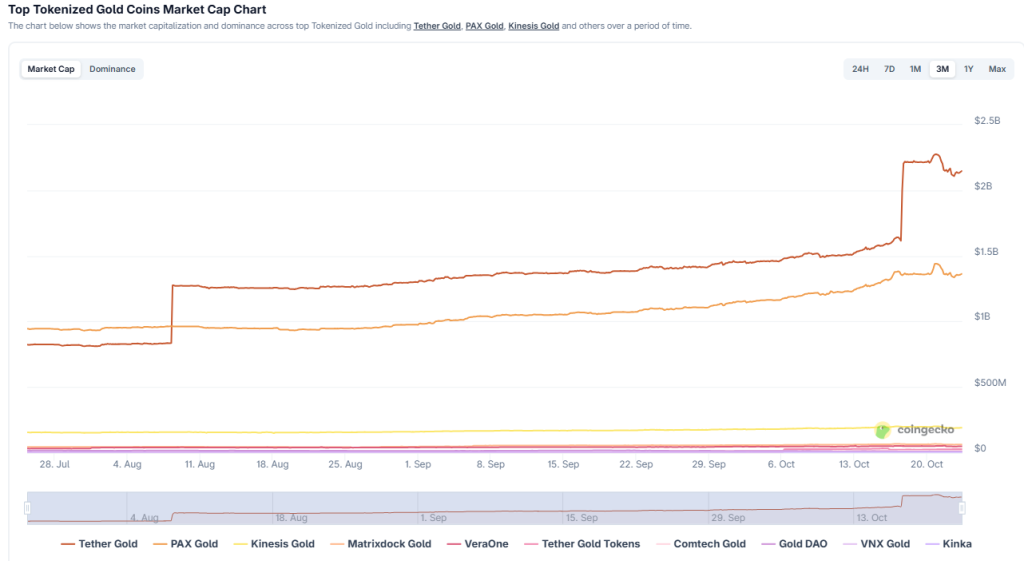

The debate also comes amid a surge in the tokenized gold market. According to CoinGecko, the combined market capitalization of gold-backed tokens such as Tether Gold (XAUT), PAX Gold (PAXG), and Kinesis Gold (KAU) recently crossed $3.75 billion, up from $3 billion earlier this month.

Daily trading volumes for these assets topped $640 million, driven by investors seeking stability amid political and economic uncertainty.

Tokenized commodities, led by gold, account for more than $3.5 billion of real-world asset (RWA) tokenization, which has seen a 36% increase in the past month.

More than 150,000 holders and 20,000 active addresses interacted with gold-backed tokens over the same period, while monthly transfer volumes have climbed above $8.6 billion.

While gold-backed assets gain traction, some analysts argue that the Bitcoin market may be entering a new phase of maturity.

Lightspark CEO David Marcus recently said Bitcoin remains “severely undervalued” compared to gold and could reach $1.3 million per coin if it matched gold’s total market capitalization.

He called Bitcoin the “internet of money,” emphasizing its role as a global settlement layer for cross-border payments.

Bitwise CIO Matt Hougan also noted that gold’s sharp gains in 2025 could offer clues to Bitcoin’s next move.

He attributed gold’s rally largely to central bank accumulation since 2022 and suggested Bitcoin could see similar momentum once large-scale institutional accumulation begins.