Most Japanese say they would buy more Bitcoin (BTC), Ethereum (ETH), and altcoins if the government agrees to reform the nation’s strict crypto tax rules.

This was the main takeaway from a survey of 1,500 adults conducted in April and commissioned by the Japan Blockchain Association (JBA).

Japanese Crypto Tax Reforms Would Drive Volumes Up, Says JBA

In response to the question: “Do you own BTC or other cryptoassets?” 13% of respondents responded in the affirmative.

However, their response to the follow-up question was telling. The question was: “Would you buy crypto/more crypto if the government were to set a flat 20% tax rate on crypto profits?”

To this, 84% of the 191 respondents who said they hold crypto answered “yes.”

And 12% of the 1,309 non-crypto holders also agreed that they would start buying coins if Tokyo green-lights tax reforms.

Capital Gains Tax Request

The JBA suggested that the survey shows that tax reforms would have a very noticeable effect on the trading volumes of domestic exchanges.

At present, Japanese investors must declare their crypto-related profits on income tax returns, in the “other income” category.

That means that depending on their tax brackets, crypto investors may have to pay taxes of up to 55% on their profits.

In many other nations, crypto is instead subject to capital gains tax. That means that, after a certain threshold, traders are taxed at a flat rate of (typically) 10-20%.

Reform advocates want Tokyo to approve a plan to scrap crypto income tax laws. In their place, they want a flat 20% capital gains levy.

The JBA supports this proposal, as do many key members of the ruling Liberal Democratic Party, in addition to opposition lawmakers.

However, the regulatory Financial Services Agency (FSA) effectively has the final say on all Japanese crypto policy.

Thus far, all of the FSA recommendations to the Cabinet have been enshrined into law.

The association said: “Cryptoassets are changing from a means of payment for the public to a means of asset accumulation.”

This is in line with the FSA’s own plans to reclassify crypto as a payment tool to an investment vehicle.

The industry body says it is “stepping up its efforts” to convince Tokyo to approve tax reform starting next year.

The JBA is an industry group that comprises some of the nation’s biggest crypto exchanges and blockchain firms.

JBA Submits Petition

The association also announced on July 18 that it has submitted a petition to the FSA calling for it to approve tax reform for crypto profits.

The survey was conducted on April 24 and April 25 this year. Respondents were all Japanese residents aged 20 to 69. Respondents were 60% male and 40% female, with an average age of 38.

The JBA also asked further questions. And 75% of respondents said they would prefer tax bodies to withdraw their payable taxes at source, rather than make separate tax declarations.

The JBA has also asked Tokyo to let crypto traders choose how they want to pay taxes: at source when they sell coins, or after filing declarations.

The survey’s authors also asked the respondents who do not currently hold any coins why they have not invested yet.

To this, 8% of respondents said that they thought that tax levels were too high. But 61% said they thought they lacked sufficient understanding of crypto.

The Japanese media outlet CoinPost reported that the FSA is now “deliberating a proposal to transition cryptoassets to the framework of the Financial Instruments and Exchange Act.”

“If the transition is approved, cryptoassets will be officially classified as financial products,” the media outlet explained.

Most of the respondents said they work in the private sector. Students made up 5.3% of the respondent pool. And 213 unemployed individuals also submitted responses.

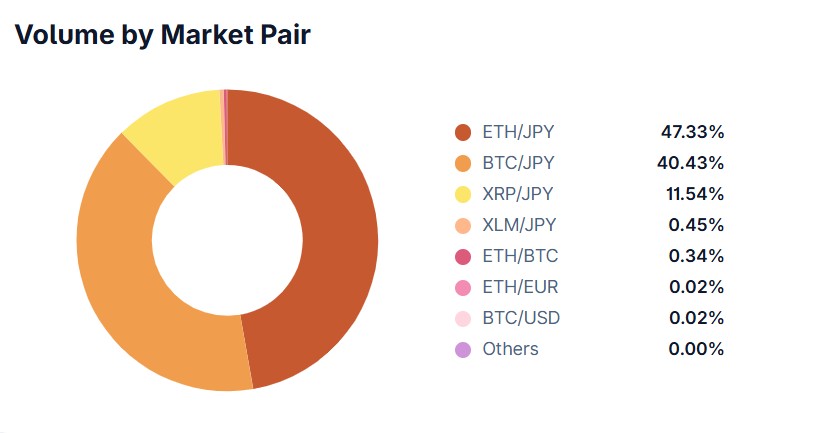

At the time of writing, ETH trading accounts for almost half of the trading volume on bitFlyer, one of the nation’s biggest crypto exchanges.