Tokyo-listed Metaplanet has approved a 75 billion yen share repurchase program, backed by a $500 million credit facility, aiming to close the gap between its stock price and its 30,823 Bitcoin holdings, valued at $3.5 billion.

The Japanese firm, now Asia’s largest listed Bitcoin treasury and the fourth-largest globally, has become the first major digital asset treasury company to consistently trade below its crypto reserves, with its market-to-net-asset-value ratio dropping to 0.99 this month.

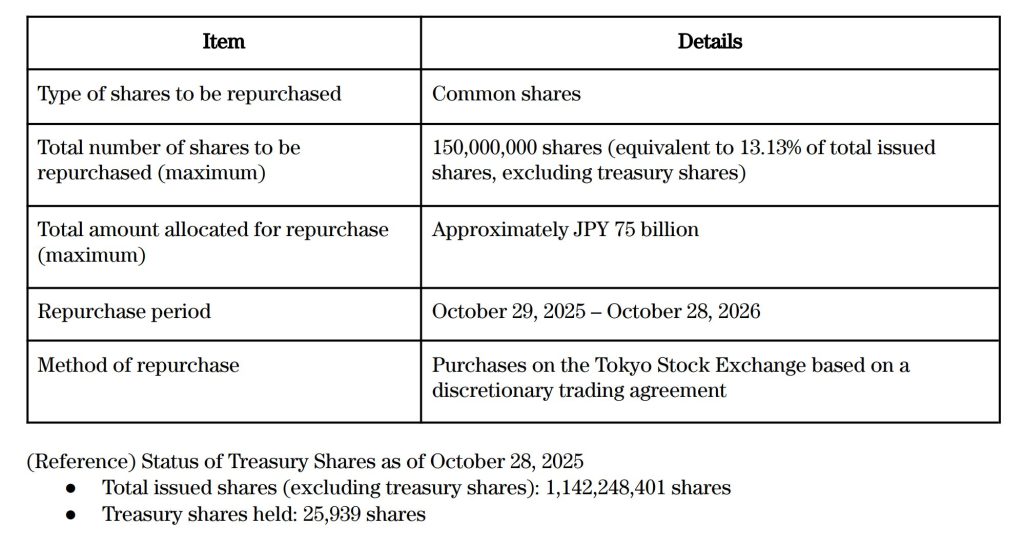

The Board of Directors authorized the repurchase of up to 150 million common shares, representing 13.13% of the total issued shares, over the next 12 months through discretionary trading on the Tokyo Stock Exchange.

Representative Director Simon Gerovich confirmed the initiative is designed to “enhance capital efficiency and maximize BTC Yield”, defined as the rate of increase in Bitcoin held per share, particularly when the company’s valuation multiple falls below 1.0x.

Quarter of Bitcoin Treasuries Now Trade at Discount

Metaplanet’s challenges are part of a broader crisis affecting digital asset treasury companies worldwide, with K33 Research reporting that 26 of 168 Bitcoin-holding firms now trade below their net asset values from last month.

Industry-wide premiums compressed from an average of 3.76x in April to 2.8x currently, while daily Bitcoin accumulation by treasury companies slowed to just 1,428 tokens in September, the weakest pace since May.

NAKA, the merger vehicle of KindlyMD and Nakamoto Holdings, plummeted 96% from its peak and now trades at just 0.7x net asset value after previously commanding a 75x premium.

Other prominent firms, including Twenty One, Semler Scientific, and The Smarter Web Company, have also fallen short of their Bitcoin holdings.

Metaplanet shares reached all-time highs in mid-June but have declined approximately 70%, currently trading at 499 yen, up 2.2% today.

Mark Chadwick, a Japan equity analyst publishing on Smartkarma, characterized the downturn as “a popping of a bubble,” noting that the “general euphoria” surrounding Bitcoin stockpiling has cooled significantly.

However, he believed “long-term Bitcoin bulls” may view the discount as a buying opportunity.

Credit Facility for Capital Deployment

The newly established credit facility provides a maximum borrowing capacity of $500 million, collateralized by Bitcoin, enabling share repurchases while maintaining flexibility for additional Bitcoin acquisitions and investments in its BTC Income business.

The facility serves as bridge financing for a planned future issuance of preferred shares as part of Metaplanet’s broader capital allocation strategy aimed at reaching its long-term objective of acquiring 210,000 Bitcoin by the end of 2027.

Management acknowledged that rising market volatility and declining valuations have caused the stock price to inadequately reflect intrinsic economic value despite advancing its Bitcoin Treasury Strategy since April.

The repurchase program targets periods when the enterprise value-to-Bitcoin holdings ratio falls below 1.0x, allowing the company to reduce share count and increase Bitcoin ownership per remaining share.

The downturn coincided with severe market turmoil that saw crypto traders face record $19 billion in liquidations on October 10 after President Trump announced harsher tariffs on China, triggering volatility that sent Bitcoin to a six-month low near $101,000.

Treasuries Entering a Competitive Phase

The corporate crypto treasury movement has reached a critical inflection point, transitioning from guaranteed premiums to what Coinbase Research describes as a “player-versus-player” competitive phase where companies must differentiate through strategic positioning rather than simply accumulating digital assets.

Short-selling firm Kerrisdale Capital has aggressively targeted overvalued treasury companies, calling business models that issue shares to buy tokens “a relic on the verge of extinction.“

Kerrisdale estimated that Strategy’s $100 billion market capitalization, trading above its $60 billion in Bitcoin holdings, creates an “unjustifiable” premium that sophisticated investors are beginning to arbitrage.

However, Strategy shares have gained over 3,000% since initiating Bitcoin purchases in mid-2020.

Despite widespread caution, some firms continue aggressive accumulation, with American Bitcoin and Strategy collectively purchasing over $205 million in Bitcoin during the past 48 hours.

Strategy acquired 390 tokens between October 20 and October 26 at an average price of $111,117, bringing total holdings to 640,808 Bitcoin.

David Duong, Coinbase’s Global Head of Investment Research, warned that concentration risks persist as “the biggest discretionary balance sheets are sidelined,” making the market “more fragile” in the short term.