Tokyo-listed Metaplanet executed a $100 million Bitcoin-backed borrowing on October 31, drawing from a $500 million credit facility established days earlier to fund additional crypto acquisitions, expand its options trading business, and potentially repurchase shares.

The conservative borrowing represents just 3% of Metaplanet’s $3.5 billion Bitcoin reserve, maintaining substantial collateral buffers even during potential market crashes.

Management confirmed the loan carries no fixed maturity date and allows repayment at any time, while proceeds will primarily support the company’s long-term objective of accumulating 210,000 Bitcoin by the end of 2027.

Strategic Capital Deployment Amid Market Volatility

Metaplanet’s borrowing strategy emerged during a period of massive pressure across the digital asset treasury sector, where a quarter of all Bitcoin-holding companies were trading below their crypto reserves in September.

The firm recently approved a 75 billion yen share repurchase program specifically targeting periods when its enterprise value-to-Bitcoin holdings ratio falls below 1.0x, aiming to reduce share count and increase token ownership per remaining share.

The company’s market-to-net-asset-value ratio dropped to 0.99 earlier last month, making Metaplanet the first major Bitcoin treasury to consistently trade at a discount despite pursuing an aggressive accumulation strategy since April.

Representative Director Simon Gerovich characterized the repurchase initiative as designed to “enhance capital efficiency and maximize BTC Yield” when valuation multiples compress.

Meanwhile, broader industry dynamics indicate that corporate Bitcoin adoption has declined by 95% since July, with only one company initiating treasury strategies in September, compared to 21 in July, according to CryptoQuant data.

Industry-wide premiums compressed from an average of 3.76x in April to 2.8x currently, while daily Bitcoin accumulation by treasury companies slowed to just 1,428 tokens in September.

Income Business Expansion Targets Stable Returns

A portion of the borrowed capital will fund Metaplanet’s Income Business, which creates and sells cash-secured Bitcoin options to generate premium income while maintaining exposure to cryptocurrency.

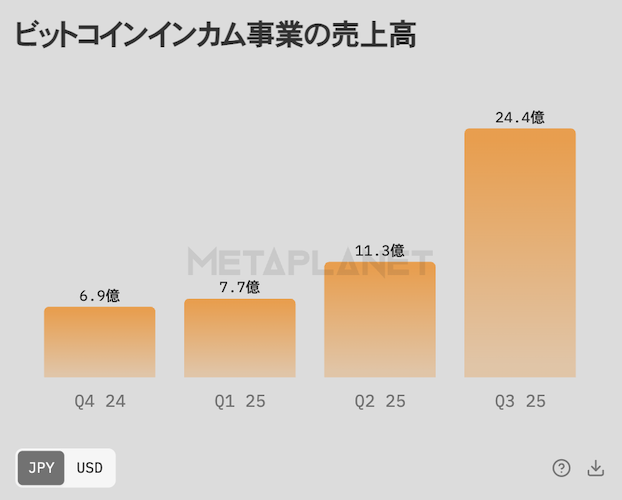

According to Coinpost, sales for this division are projected to reach 2.44 billion yen in the third quarter of 2025, representing a 3.5-fold increase from the prior year’s 690 million yen.

The options strategy allows the company to earn a stable income during market volatility while providing downside protection through collected premiums.

Funds allocated to this business will serve as margin for operations aimed at capturing option premiums, according to company disclosures.

Metaplanet maintains conservative financial management by executing borrowings only within ranges where collateral capacity remains sufficient even during significant Bitcoin price declines.

The firm expects minimal impact on fiscal year 2025 financial results from the current borrowing. However, management has pledged to announce promptly if any material effects emerge.

Corporate Bitcoin Strategies Enter High-Stakes Competitive Phase

The corporate crypto treasury movement has reached what Coinbase Research describes as a “player-versus-player” competitive phase, transitioning from guaranteed premiums to an environment where companies must differentiate through strategic positioning.

Aside from Coinbase even stating that they’re now ghosting, Columbia Business School professor Omid Malekan recently declared that digital asset treasuries have transformed into a “mass extraction and exit event,” which aided the ongoing market crash.

Bitcoin recently slipped below $100,000 for the first time since June, entering bear market territory with a 20% decline from its October record high and wiping over $1 trillion from total crypto market capitalization.

The downturn coincided with a record $19 billion in liquidations on October 10, after President Trump announced harsher tariffs on China, triggering volatility that sent Bitcoin to a six-month low of nearly $101,000.

Despite market turbulence, some firms maintain aggressive accumulation. Strategy purchased 397 BTC between October 27 and November 2 for $45.6 million, bringing total holdings to 641,205 BTC.

Speaking with Cryptonews, Shawn Young, Chief Analyst at MEXC Research, noted that “accumulation of coins by major market participants, the trade agreement between Washington and Beijing, and moderately positive stock market performance are paving the way for a possible recovery in November.“