Two MIT-educated brothers accused of orchestrating the largest MEV bot exploitation in cryptocurrency history will face trial after a federal judge rejected their attempts to dismiss fraud and money laundering charges.

Anton Peraire-Bueno, 24, and James Peraire-Bueno, 28, allegedly stole $25 million in cryptocurrency within 12 seconds by manipulating Ethereum’s MEV-Boost protocol in April 2023.

Technical Error or Deliberate Exploit?

The brothers meticulously planned their operation over several months, studying trading patterns of Ethereum bots and establishing shell companies.

They created 16 Ethereum validators using approximately $880,000 in cryptocurrency, then executed what prosecutors called a “bait, block, search, and propagation” scheme targeting three victim traders operating MEV bots.

Their exploit involved proposing “lure transactions” to induce victim traders’ bots to purchase illiquid cryptocurrencies worth $25 million.

The brothers then sent a false signature to the relay system, gaining premature access to private transaction data.

They replaced the lure transactions with their own trades, selling the illiquid tokens and rendering the victims’ holdings worthless.

Following the theft, the brothers laundered the stolen funds through complex transactions across multiple addresses and foreign exchanges with limited KYC requirements.

They converted the cryptocurrency to DAI stablecoin, then to USDC, before transferring $20 million to U.S. dollar accounts. Foreign law enforcement froze $3 million of the stolen funds.

The case comes amid rising concerns about MEV exploitation across blockchain networks.

Recent incidents include a $2 million insider attack on Bedrock’s UniBTC protocol by a former Fuzzland employee and a notorious Solana MEV bot named “arsc” that accumulated $30 million in two months through sandwich attacks.

Brothers’ Legal Battle Reaches Critical Juncture

Federal prosecutors arrested the Peraire-Bueno brothers on May 15, 2024, with Anton taken into custody in Boston and James in New York.

U.S. Attorney Damian Williams described the scheme as meticulously planned, noting how the brothers “used their specialized skills and education to tamper with and manipulate the protocols relied upon by millions of Ethereum users.“

The brothers face charges of conspiracy to commit wire fraud, wire fraud, and conspiracy to commit money laundering.

Each charge carries a potential 20-year prison sentence. A federal judge scheduled their trial for October 14, 2025, after denying their motions to dismiss the indictment.

The court found the wire fraud charges legally sufficient, determining that the brothers’ lure transactions and false signatures constituted material misrepresentations.

The judge ruled that the $25 million in stolen cryptocurrency represented a traditionally recognized property interest, not merely contingent profits.

IRS Criminal Investigation’s New York Cyber Unit traced the stolen funds back to the brothers despite their sophisticated laundering efforts.

Special Agent Thomas Fattorusso noted that investigators “simply followed the money” using cutting-edge technology and traditional investigative methods.

Growing MEV Threat Challenges Blockchain Scalability

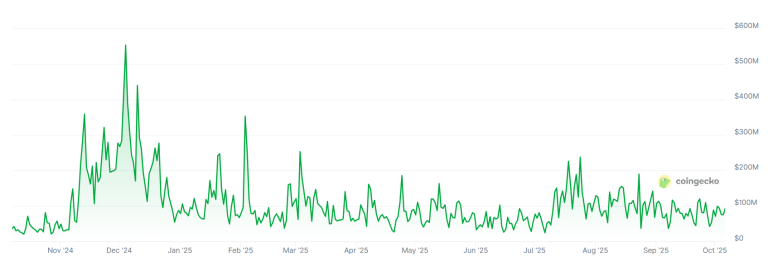

MEV exploitation has emerged as a dominant threat to blockchain scalability, according to recent research from Flashbots.

According to a report covered by Cryptonews in June, MEV bots now consume 40% of all blockspace on Solana and over half of the gas usage on Ethereum rollups, such as Base and OP Mainnet.

The Peraire-Bueno case represents the first criminal prosecution of MEV manipulation; however, similar exploits continue to occur across various networks.

A Ronin Network breach in August 2024 initially appeared malicious but was later revealed to be a white-hat operation, with the hacker returning $9.8 million after discovering a vulnerability in the bridge.

Recent data from EigenPhi shows more than 81,000 users fell victim to sandwich attacks in the last 30 days alone.

These attacks now account for nearly $1 billion in weekly trading volume on Ethereum-based decentralized exchanges.

Flashbots has proposed new frameworks to address MEV abuse, including explicit MEV auctions and programmable privacy using Trusted Execution Environments.

The organization argues that current spam from MEV bots creates artificial fee floors, undermining the promise of near-zero transaction costs on scaled networks.

The brothers’ trial, scheduled for October, is likely to set precedents for future MEV-related prosecutions, as it isn’t technically precise whether it can be attributed to an exploit of a technical oversight.