YouTube superstar Jimmy Donaldson, better known as MrBeast, is taking a bold step beyond online entertainment and into the world of digital finance.

Key Takeaways:

- MrBeast has filed a trademark, aiming to launch a platform offering banking, investment, and crypto services.

- The filing describes a SaaS-based ecosystem featuring crypto payments and decentralized exchanges.

- The move signals MrBeast’s expansion beyond content creation into fintech.

According to a recent US Patent and Trademark Office (USPTO) filing dated October 13, the 27-year-old creator has applied to trademark “MrBeast Financial,” a new venture that would offer online banking and crypto-related services.

MrBeast Financial Trademark Reveals Plans for Crypto and Banking Platform

The application, filed under Beast Holdings LLC, describes MrBeast Financial as a software-as-a-service (SaaS) platform designed to provide banking, investment, and crypto exchange services.

The filing lists capabilities such as crypto payment processing, decentralized exchange (DEX) operations, and other blockchain-based financial services.

The submission explicitly identifies “James Donaldson, a living individual whose consent is made of record,” confirming his personal involvement.

If approved, MrBeast Financial could become the first major influencer-led banking brand in the United States.

Based on USPTO timelines, the trademark will likely undergo its first examination in mid-2026, with final approval or rejection expected by late 2026.

MrBeast, who commands over 445 million subscribers, has built a billion-dollar empire through attention-grabbing stunts, giveaways, and large-scale philanthropy.

However, his business portfolio extends far beyond YouTube. He founded Feastables, a snack brand, and MrBeast Burger, a virtual restaurant chain that ran through delivery apps.

He has also experimented with tech platforms like ViewStats, a YouTube analytics tool that briefly included an AI thumbnail generator before being pulled after community backlash.

The move into finance follows reports from Business Insider that MrBeast’s company, Beast Industries, had previously pitched investors on products like credit cards, personal loans, and cryptocurrency services.

The new trademark suggests those plans are moving forward under a unified financial brand.

This isn’t the only expansion on Donaldson’s radar. In September, reports surfaced that MrBeast is also planning to launch a mobile phone service, signaling broader ambitions across technology and fintech.

MrBeast Accused of Earning $10M From Low-Cap Crypto “Pump and Dumps”

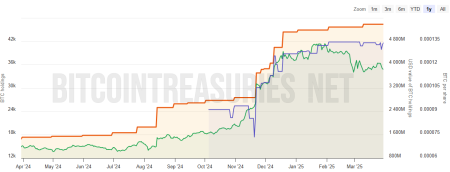

As reported, MrBeast has faced allegations of profiting over $10 million from promoting and dumping several low-cap cryptocurrency projects, according to an investigation by on-chain analyst SomaXBT.

The sleuth claims MrBeast used his influence to boost token prices through promotional campaigns before cashing out at the top, leaving retail investors with heavy losses.

Projects named in the report include SuperFarm ($SUPER), Polychain Monsters ($PMON), SPLYT ($SHOPX), STAK, and Virtue Poker ($VPP).

The investigation alleges that MrBeast turned a $100,000 investment in SuperFarm into $9 million, and another $25,000 in Polychain Monsters into $1.7 million, by selling tokens during public trading surges.

Similar profits were reported across smaller allocations, with most tokens crashing between 75% and 90% after his exits.

SomaXBT’s findings suggest a pattern typical of pump-and-dump schemes, where influencers inflate prices before offloading their holdings.

The report compares MrBeast’s alleged conduct to other recent scandals involving celebrities like Andrew Tate and Iggy Azalea, both accused of manipulating token prices earlier this year.