Mill City Ventures III, a Nasdaq-listed non-bank lender, has raised $450 million in a private placement to overhaul its business model and establish a cryptocurrency treasury centered on Sui, the native token of the Sui blockchain.

Key Takeaways:

- Mill City Ventures raised $450M to build the first public Sui token treasury.

- 98% of the funds will be used to acquire SUI, with Galaxy managing the treasury.

- Despite the move, SUI’s price fell 11% amid broader altcoin market weakness.

The Minneapolis-based firm disclosed Monday that it sold 83 million shares to institutional investors, with capital commitments from prominent crypto backers including Pantera Capital, Electric Capital, ParaFi Capital, Arrington Capital, and FalconX.

Galaxy Asset Management has been tapped to manage the new treasury.

Mill City Allocates 98% of $450M Raise to Build First Public Sui Treasury

Roughly 98% of the funds will be used to purchase SUI tokens, marking what Mill City describes as the first public company Sui treasury.

The remaining 2% will support its legacy short-term lending operations.

Stephen Mackintosh, the firm’s incoming chief investment officer, framed the move as a bet on the convergence of crypto and artificial intelligence.

“We believe that Sui is well-positioned for mass adoption with the speed and efficiency institutions require for crypto at scale, plus the technical architecture capable of supporting AI workloads,” he said.

Mysten Labs co-founder Adeniyi Abiodun echoed that sentiment, calling Sui the infrastructure of choice for crypto, AI, and stablecoins at scale.

The Sui ecosystem has experienced rapid growth in recent months, particularly in DeFi.

Total value locked (TVL) across its protocols reached an all-time high of $2.22 billion over the weekend, up nearly 400% since July 2024, according to DefiLlama.

Leading protocols like Suilend, NAVI, and Haedal currently account for $1.7 billion of that TVL.

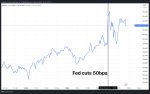

Despite the strategic shift and institutional support, the market response has been muted.

SUI dropped 11% over the past 24 hours amid a broader altcoin selloff. The token, which reached an all-time high of $5.35 in January, is now down 27% from its peak.

Crypto Treasuries Aren’t Really Buying Crypto

A growing number of publicly traded companies are raising hundreds of millions of dollars to build crypto treasuries, but one analyst says many aren’t actually buying digital assets from the open market.

As reported, crypto analyst Ran Neuner claimed that crypto treasury firms are acting less like buyers and more like exit vehicles for crypto insiders.

Instead of purchasing assets directly from exchanges, these companies often receive crypto contributions from existing holders, in exchange for shares that later trade at massive premiums on public markets.

Skepticism around the sustainability of the crypto treasury trend is also growing.

Last month, Glassnode lead analyst James Check raised concerns over the longevity of the corporate Bitcoin treasury strategy, arguing the easy gains might already be gone for new entrants as the market matures.

The warning echoes recent comments from Matthew Sigel, head of digital asset research at VanEck, who has voiced concerns over the Bitcoin treasury strategies adopted by some publicly traded firms.