Stablecoin issuer Paxos revealed that it erroneously minted $300 trillion worth of PayPal’s PYUSD stablecoin on Wednesday, only to reverse the mistake minutes later by burning the excess tokens.

Blockchain records visible on Etherscan confirmed the flurry of minting and burning transactions, exposing a rare but dramatic “fat-finger” error in the reportedly tightly controlled world of stablecoin issuance.

The transactions revealed that the firm had accidentally added six extra zeros during minting. Within minutes, Paxos destroyed the incorrectly issued $300 trillion PYUSD and re-minted the correct amount of $300m instead.

Stablecoin Issuers Have Faced Similar Minting Mishaps Before

Such mistakes are not rare in crypto. Often, token transfers sent to the wrong address cannot be reversed. However, stablecoin issuers have more control. They can step in to correct errors, such as by returning or burning tokens created by mistake.

Paxos’s blunder echoes past industry slipups. In 2019, Tether mistakenly issued about $5b in USDT and later burned the overage.

In May 2021, BlockFi accidentally credited users with vast amounts of Bitcoin instead of a promotional stablecoin, forcing complicated reversals. And in Dec. 2022, a DeversiFi upgrade glitch triggered a $23.7m Ethereum gas payout, which developers mostly recovered with community support.

Stablecoins Tighten Grip On Crypto Ecosystem

These incidents show how fragile crypto’s plumbing can be, especially when automated systems handle large-scale transactions.

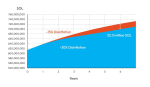

As of mid-October 2025, the stablecoin sector’s market cap stood near $306.18b, up about 47% year to date. The growth leans heavily on major players like Tether’s USDT (holding around 59% market share) and Circle’s USDC.

PayPal USD (PYUSD), though smaller, commands attention. As of Oct. 2025, its market cap is about $2.32b, matching its token supply of 2.32b, with trading prices tightly anchored near $0.9997.