Pump.fun’s pseudonymous co-founder Sapijiju has pushed back against allegations that the Solana-based memecoin platform cashed out more than $436 million in USDC, calling the claims “complete misinformation” circulated by blockchain analytics firm Lookonchain.

Key Takeaways:

- Pump.fun’s co-founder denied claims of a $436M cash-out, saying the USDC transfers were routine treasury movements.

- On-chain data shows Pump.fun still holds over $855M in stablecoins and $211M in SOL.

- Analysts and community members remain divided.

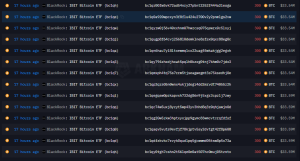

The dispute erupted this week after Lookonchain reported that wallets linked to Pump.fun had sent hundreds of millions of dollars in stablecoins to crypto exchange Kraken since mid-October, activity widely interpreted as a large liquidation.

Pump.fun Says $436M Transfers Were Treasury Moves, Not Sales

In a detailed post on X, Sapijiju rejected the characterization, arguing that the transfers were not sales but routine treasury movements.

He said the USDC in question came from the PUMP token’s initial coin offering (ICO) and was redistributed across internal wallets to manage the company’s runway and operating needs.

“What’s happening is part of Pump’s treasury management,” he wrote.

“USDC from the $PUMP ICO has been transferred into different wallets so the company’s runway can be reinvested into the business. Pump has never directly worked with Circle.”

Treasury management typically involves repositioning funds used for operations, reserves, or development, an activity that does not necessarily signal selling pressure.

According to DefiLlama, Pump.fun’s monthly revenue fell to $27.3 million in November, dropping below $40 million for the first time since July.

Still, on-chain data from DefiLlama, Arkham, and Lookonchain shows Pump.fun-tagged wallets continue to hold more than $855 million in stablecoins and roughly $211 million in Solana (SOL), suggesting that the project retains a sizable treasury.

Analysts and community members were split over the explanation. Nansen’s Nicolai Søndergaard argued the transfers could be a precursor to further selling, while blockchain researcher EmberCN countered that the funds originated from institutional private placements of the PUMP token rather than active dumping.

The debate quickly spilled into the community. Some users said Sapijiju’s statement lacked clarity, pointing to contradictions in his wording.

X user Voss argued the co-founder could not claim Pump.fun had no involvement in the transfers while simultaneously describing them as treasury management.

Others dismissed the explanation entirely, with one user, EthSheepwhale, accusing the project of poor token execution and “price manipulation via airdrops,” noting that PUMP is trading 32% below its ICO price at $0.002714, and nearly 70% below its September peak.

Pump.fun Acquires Kolscan

In July, Pump.fun announced its acquisition of the wallet tracking tool Kolscan, aiming to revolutionize on-chain trading.

The integration will merge Kolscan’s analytics with Pump.fun’s social trading features, enhancing transparency, wallet tracking, and copy-trading capabilities.

Co-founder Alon Cohen emphasized that trading is a “social sport,” highlighting the importance of community and shared insights in driving success within the ecosystem.

As part of the deal, all Kolscan services will be made free to users.

Pump.fun has already attracted tens of thousands of users and intends to build a scalable crypto social media platform, leveraging Kolscan’s tools to grow its community and influence.