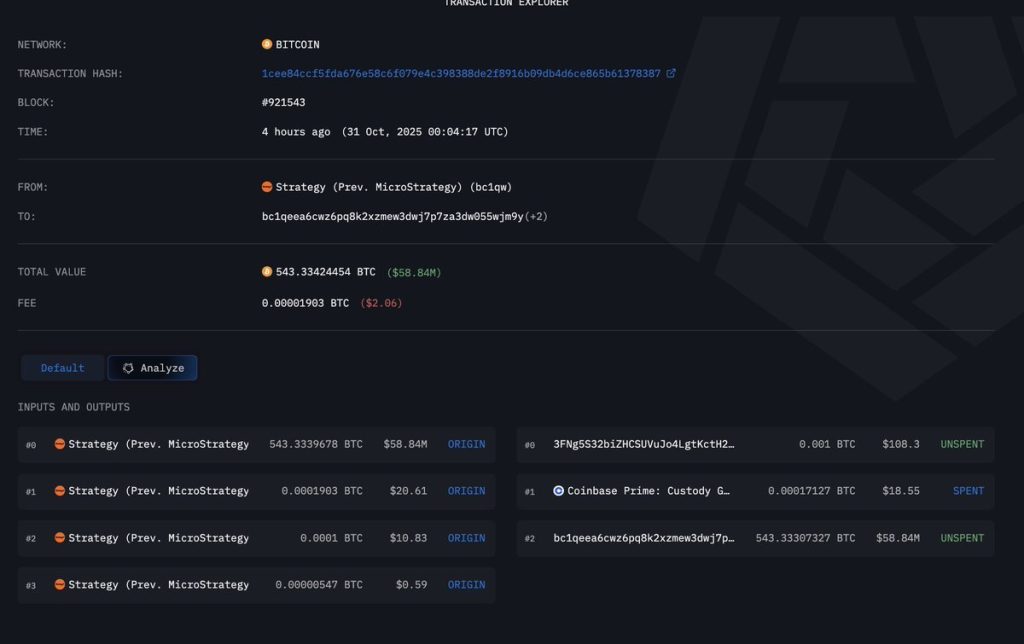

Michael Saylor’s Strategy has transferred 22,704 BTC, about $2.45 billion, to multiple new wallets in the past 9 hours, Arkham data revealed.

The large-scale Bitcoin movement has drawn attention, given its size and potential implications for market dynamics.

The move arrives hours after Strategy reported a net income of $2.8 billion for its third quarter, exceeding Wall Street expectations. It reported diluted earnings per share of $8.42 for Q3, exceeding Street estimates of $8.15.

The company, being the largest corporate Bitcoin holder, holds 640,808 Bitcoins valued at $70.28 billion. The holdings are up from 597,325 at the start of the third quarter.

During the Strategy earnings call, Saylor noted that the company will remain focused on purchasing Bitcoin rather than pursuing any deal, even if it is accretive.

Strategy BTC Transfers Trigger Market Speculation: Is Liquidation Likely?

The recent consecutive mass Bitcoin transfers from the Strategy wallet to various new addresses have triggered market speculation. Crypto analyst Emmett Gallic said that the transactions could be related to a “custody switch.”

Mass transfers by large holders often align with custody restructuring or internal security upgrades, and not liquidation. The clue lies in the movement patterns – if assets stay offline, it’s probably housekeeping.

Besides, Saylor is betting big on Bitcoin, predicting that the asset will reach $150,000. Speaking with CNBC at the Money 20/20 fintech conference in Las Vegas, he said that the Bitcoin bull run seems optimistic for a clear market structure.

“I think Bitcoin is going to continue to grind up,” Saylor noted. “Our expectation right now is [at the] end of the year it should be about $150,000.”

Further, the Strategy frontman reiterated that regardless of price, the company will be “buying the top forever.”

That said, the transfers confirm an internal restructuring rather than a massive selloff, at a time when the Strategy has achieved a 26.0% BTC yield in 2025 YTD and $12.9 billion BTC $ gain.

“We generated BTC yield of 26% and BTC $ gain of $13 billion, year-to-date, and we are reaffirming our full-year guidance for operating income of $34 billion, net income of $24 billion, and diluted EPS of $80 per share, based on a BTC price outlook of $150,000 at the end of the year,” said Andrew Kang, Strategy’s Chief Financial Officer.