A critical breakout level at $297 is now back in focus, opening the doors for a bullish Solana price outlook going into the final quarter of the year.

Fundamentals are warming for a move as the macro backdrop is starting to shift in favor of risk assets like altcoins.

Speculators now expect up to three rate cuts before year-end, starting as soon as September.

Lower borrowing costs could stimulate new inflows into risk assets like cryptocurrencies, reviving altcoin season sentiment.

And Solana stands as a prime beneficiary with the approaching October 10 deadline for a potential spot SOL ETF, which could open the gates to previously untapped TradFi demand.

Solana Price Analysis: Does the SOL Bull Run Hinge on $297?

Solana could be on track to fulfill the $297 breakout target set by a previous falling wedge, as it now nears the breakout of a 4-month ascending channel.

This 4-month consolidation phase has allowed the wedge pattern to gradually play out—and with market sentiment warming, its full upside potential may finally come into view.

With a potential double bottom reversal pattern forming around $157, Solana could reverse to retest resistance at $207, the level that capped its most recent bull run.

This comes as momentum indicators still reflect weakness. The RSI hovers just below the neutral line, suggesting sellers maintain short-term control.

More so, the MACD teeters on a death cross, with the line moving in close parallel to the signal, pointing to a fragile uptrend.

A second bounce off $157 could provide the strength needed to flip the outlook fully bullish.

Crucially, $207 marks the final threshold to a breakout of the ascending channel, opening the door for a retest of the $297 resistance.

If flipped to support, this level becomes a launchpad for Solana to enter price discovery.

With interest rate cuts and a spot ETF approval likely to boost demand going into the final quarter of the year, a 205% rally to $500 could be in play.

The Solana Ecosystem Holds Higher Gain Opportunities

When it comes to large-cap coins like SOL, gains tend to move slowly. Explosive breakouts can take months to develop, only to play out in a matter of days.

That means holders spend most of their time waiting.

Meanwhile, the low-cap meme coins in its ecosystem, like TROLL, are posting 2x gains in a single day.

That’s where Snorter ($SNORT) steps in. Its purpose-built trading bot is engineered to spot early momentum, helping investors get in before the crowd, where the real gains are made.

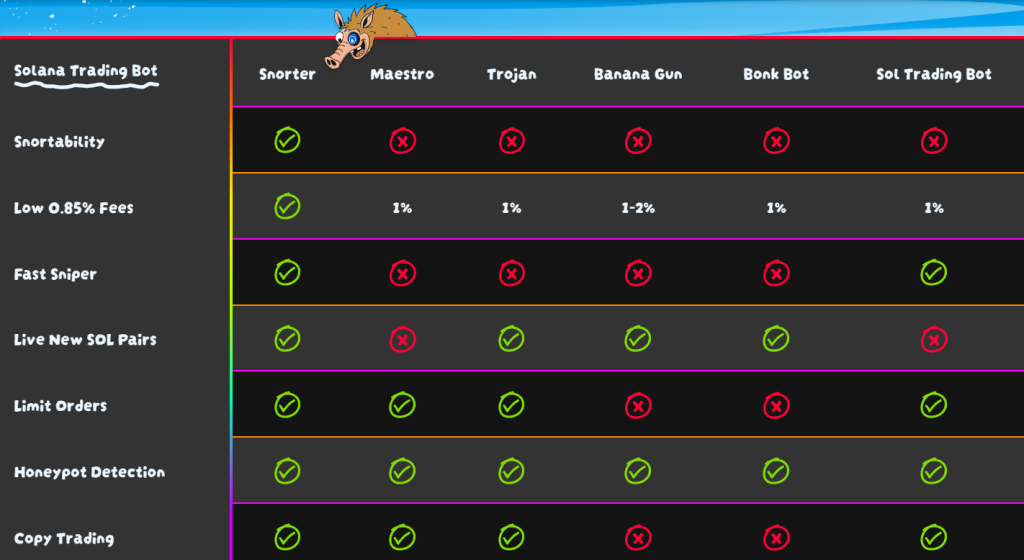

While trading bots have been around for a while, Snorter is built for a new generation of crypto traders focused on speed, precision, and safety.

It offers sniper-friendly limit orders, MEV-resistant swaps, real-time copy trading, and even rug-pull protection to help avoid bad exits.

Getting in early is only half the game, Snorter also helps you time your exit like a pro.

The project is off to a strong start—$SNORT has already raised over $2.4 million in its initial presale weeks, likely driven by its high 155% APY on staking to rewards early investors.

You can keep up with Snorter on X, Instagram, or join the presale on the Snorter website.

Click Here to Participate in the Presale